- United States

- /

- Personal Products

- /

- NYSE:ELF

A Fresh Look at e.l.f. Beauty’s (ELF) Valuation After Its Groundbreaking Shoppable Twitch Feature Launch

Reviewed by Kshitija Bhandaru

e.l.f. Beauty (ELF) has rolled out an industry-first shoppable feature that lets Twitch viewers buy cosmetics while watching streams, thanks to a new collaboration with Amazon Ads. By merging digital commerce with live entertainment, the brand is aiming to capture even more attention from Gen Z and Alpha consumers.

See our latest analysis for e.l.f. Beauty.

This innovation follows a year packed with bold moves for e.l.f. Beauty, including the high-profile $1 billion acquisition of Rhode and the global rollout of Naturium. While the new Twitch feature cements its digital-first strategy, the stock has maintained strong momentum. A 90-day share price return of nearly 18% and a robust 1-year total shareholder return of 21.7% signal that investors still see significant growth potential.

If e.l.f.’s approach to digital engagement has you curious about where the next breakout could come from, why not discover fast growing stocks with high insider ownership

That leads to the critical question: Is e.l.f. Beauty still trading below its true value, or has the recent surge and digital innovation already been factored into the share price, leaving little room for further upside?

Most Popular Narrative: 9.2% Undervalued

Compared to the recent closing price of $136.92, the most widely followed narrative estimates e.l.f. Beauty's fair value at $150.79. The difference has investors asking what is fueling this valuation gap and whether that premium can be realized in the years ahead.

The expansion into new international markets and rapid growth in existing ones (e.g., 30% international net sales growth, top rankings in new geographies, global Sephora rollout) provides significant runway for future revenue growth and increased diversification, which is likely under-appreciated by the market.

Want to see what’s behind this bullish estimate? Discover the bold revenue jumps, margin transformation, and profit outlook at the heart of this narrative, but only inside the full story. See which future growth levers could be driving e.l.f. Beauty’s standout valuation.

Result: Fair Value of $150.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff risks related to significant China production and increasing competition in affordable beauty could quickly put pressure on margins and future growth.

Find out about the key risks to this e.l.f. Beauty narrative.

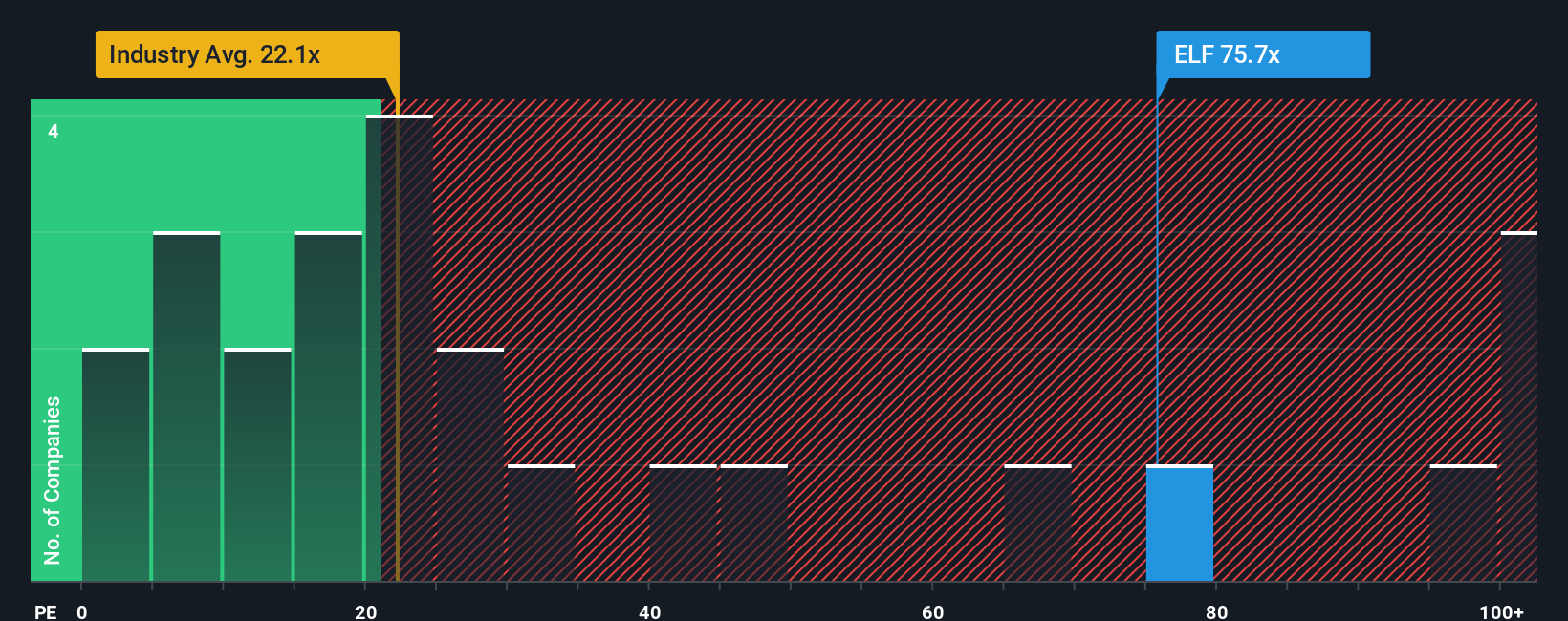

Another View: Market Multiples Tell a Cautious Story

Taking a step back from growth narratives and fair value projections, market ratios paint a more conservative picture. e.l.f. Beauty's price-to-earnings ratio sits at 83x, far above peers (21.3x) and the broader industry (19.6x), and well above its fair ratio of 31.1x. That kind of premium often comes with higher risk. Will future growth really be enough to close the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own e.l.f. Beauty Narrative

If you think there’s another angle to this story, dive into the numbers and assemble your own view in just a few minutes. Do it your way

A great starting point for your e.l.f. Beauty research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Let your search for standout stocks go beyond the beauty industry. Simply Wall Street’s screeners spotlight hidden gems and untapped potential waiting for you today.

- Uncover companies pioneering the rise of artificial intelligence and get ahead of the curve by visiting these 24 AI penny stocks.

- Capture market inefficiencies with these 871 undervalued stocks based on cash flows, which could offer upside others might overlook.

- Start building reliable cash flow by targeting these 18 dividend stocks with yields > 3%, offering yields above 3% plus strong financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives