- United States

- /

- Personal Products

- /

- NYSE:EL

A Look at Estée Lauder (EL) Valuation After Its New AI-Powered Jo Malone Scent Advisor Launch

Reviewed by Simply Wall St

Estée Lauder Companies (EL) just turned online perfume shopping into more of a conversation than a guess, debuting Jo Malone London’s AI powered Scent Advisor and nudging the stock higher as investors reassess its fragrance strategy.

See our latest analysis for Estée Lauder Companies.

The launch of Scent Advisor caps a strong rebound in sentiment, with a roughly 42 percent year to date share price return at a 105.13 dollars close, even as the five year total shareholder return remains sharply negative, suggesting momentum is rebuilding from a low base.

If this kind of digital reinvention catches your eye, it could be worth scanning for other beauty and consumer names using fast growing stocks with high insider ownership.

Yet with shares now trading close to intrinsic estimates and slightly above the average analyst target, investors have to ask whether this fragrance fueled AI push still leaves upside on the table, or if future growth is already priced in.

Most Popular Narrative Narrative: 3.2% Overvalued

With Estée Lauder Companies last closing at 105.13 dollars against a narrative fair value of about 101.87 dollars, the story leans toward a mildly stretched valuation built on a detailed long term rebuild in profitability and growth.

Operational restructuring (PRGP) is driving a multi-year program of cost savings through SG&A reduction, outsourcing, localized production, and improved procurement, with these savings being reinvested into consumer-facing activities and innovation; this should support sustainable operating margin improvement and stronger earnings growth.

Curious how modest revenue growth expectations can still underpin a premium profit multiple and a sharp swing from losses to strong returns on equity? The narrative hinges on a powerful mix of margin repair, disciplined reinvestment, and a future earnings profile more often associated with faster growing sectors. Want to see which specific profitability and valuation assumptions are doing the heavy lifting here? Read on to unpack the full playbook behind this fair value view.

Result: Fair Value of $101.87 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering travel retail weakness and exposure to a softer China recovery could derail margin repair and keep earnings volatility higher than bulls expect.

Find out about the key risks to this Estée Lauder Companies narrative.

Another View on Value

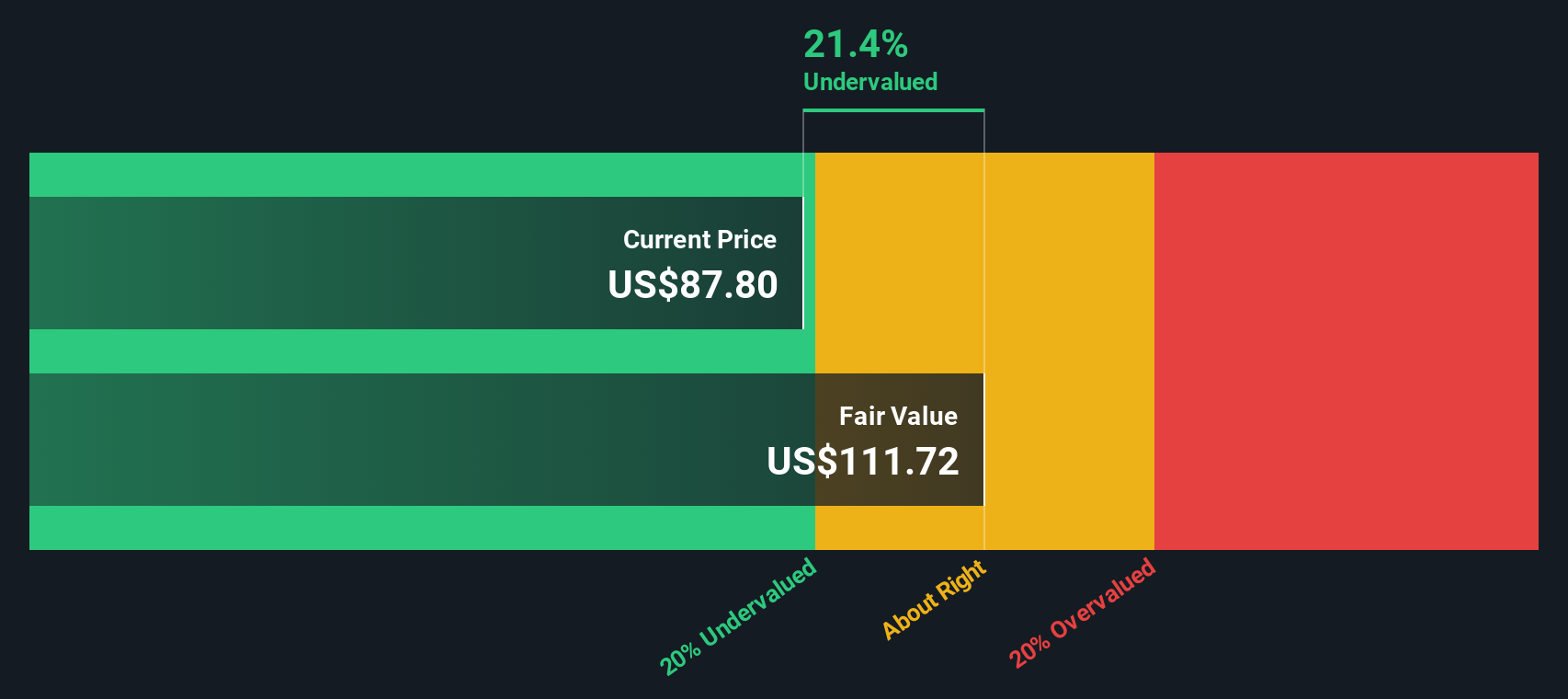

While the narrative framework suggests Estée Lauder Companies is about 3.2 percent overvalued, our DCF model actually pegs the shares at roughly 106.32 dollars, a touch above today’s 105.13 dollars. That tiny discount hints at limited margin of safety, but also limited downside. What kind of investor does this setup really suit?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Estée Lauder Companies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Estée Lauder Companies Narrative

If you interpret the numbers differently or want to stress test your own assumptions, you can build a personalized Estée Lauder view in just minutes using Do it your way.

A great starting point for your Estée Lauder Companies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop at one compelling story. Use the Simply Wall St Screener to uncover fresh, high conviction opportunities before the crowd catches on.

- Capture early stage momentum by targeting these 3576 penny stocks with strong financials that pair smaller market caps with improving fundamentals and room for re rating.

- Position your portfolio for the next productivity boom by scanning these 26 AI penny stocks that link real revenue traction to transformative AI solutions.

- Lock in potential mispricings by focusing on these 906 undervalued stocks based on cash flows that trade below their cash flow driven fair values, before sentiment catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Estée Lauder Companies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EL

Estée Lauder Companies

Manufactures, markets, and sells skin care, makeup, fragrance, and hair care products worldwide.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026