- United States

- /

- Personal Products

- /

- NYSE:COTY

With EPS Growth And More, Coty (NYSE:COTY) Makes An Interesting Case

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

In contrast to all that, many investors prefer to focus on companies like Coty (NYSE:COTY), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Coty

Coty's Improving Profits

Coty has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. As a result, we'll zoom in on growth over the last year, instead. In impressive fashion, Coty's EPS grew from US$0.15 to US$0.35, over the previous 12 months. It's not often a company can achieve year-on-year growth of 136%.

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Coty shareholders can take confidence from the fact that EBIT margins are up from 7.9% to 11%, and revenue is growing. That's great to see, on both counts.

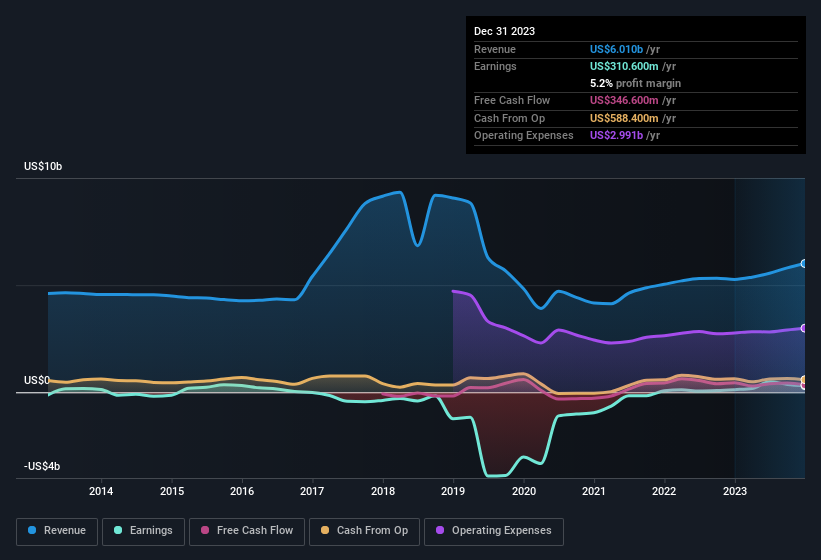

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Coty?

Are Coty Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Although we did see some insider selling (worth US$2.0m) this was overshadowed by a mountain of buying, totalling US$5.7m in just one year. This adds to the interest in Coty because it suggests that those who understand the company best, are optimistic. Zooming in, we can see that the biggest insider purchase was by Independent Director Mariasun Aramburuzabala Larregui for US$5.4m worth of shares, at about US$10.80 per share.

Along with the insider buying, another encouraging sign for Coty is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth US$615m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Is Coty Worth Keeping An Eye On?

Coty's earnings per share growth have been climbing higher at an appreciable rate. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Coty deserves timely attention. You should always think about risks though. Case in point, we've spotted 3 warning signs for Coty you should be aware of, and 1 of them is a bit unpleasant.

The good news is that Coty is not the only growth stock with insider buying. Here's a list of growth-focused companies in the US with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:COTY

Coty

Manufactures, markets, distributes, and sells branded beauty products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives