- United States

- /

- Personal Products

- /

- NYSE:COTY

The Bull Case For Coty (COTY) Could Change Following Securities Law Probe on Operational Weaknesses

Reviewed by Sasha Jovanovic

- In September 2025, Bleichmar Fonti & Auld LLP announced an investigation into Coty Inc. for potential federal securities law violations after Coty reported disappointing financial results tied to U.S. operational challenges and increased retailer inventory.

- This raised concerns among investors about Coty’s business practices and the impact of operational weaknesses on its longer-term outlook.

- We'll explore how the law firm's investigation and recent financial pressures could impact Coty's investment outlook and risk profile.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Coty Investment Narrative Recap

Owning shares in Coty often comes down to believing in a recovery of core U.S. operations, normalization of retailer inventories, and renewed momentum from new product launches. The law firm investigation following recent disappointing results puts a spotlight on the company's operational execution, a key short-term catalyst for stabilization, while also amplifying the risk that inventory challenges could linger and further impact revenues in fiscal 2026. If the situation escalates, delays in inventory normalization and top-line growth may remain the biggest concern for shareholders.

Among recent announcements, Coty's August 2025 quarterly results stand out: the company reported further sales declines and extended its cautious outlook, expecting negative net revenues for the first half of fiscal 2026 but banking on a turnaround as new launches gain traction in the second half. This guidance is particularly relevant in light of the class action investigation, since near-term financial performance and U.S. operational pressures are central to both the legal inquiry and the company's path to recovery.

Yet behind the headline risk, investors should also be aware of the persistent volatility tied to...

Read the full narrative on Coty (it's free!)

Coty's narrative projects $6.1 billion revenue and $302.1 million earnings by 2028. This requires 1.3% yearly revenue growth and a $683.2 million earnings increase from -$381.1 million.

Uncover how Coty's forecasts yield a $5.04 fair value, a 26% upside to its current price.

Exploring Other Perspectives

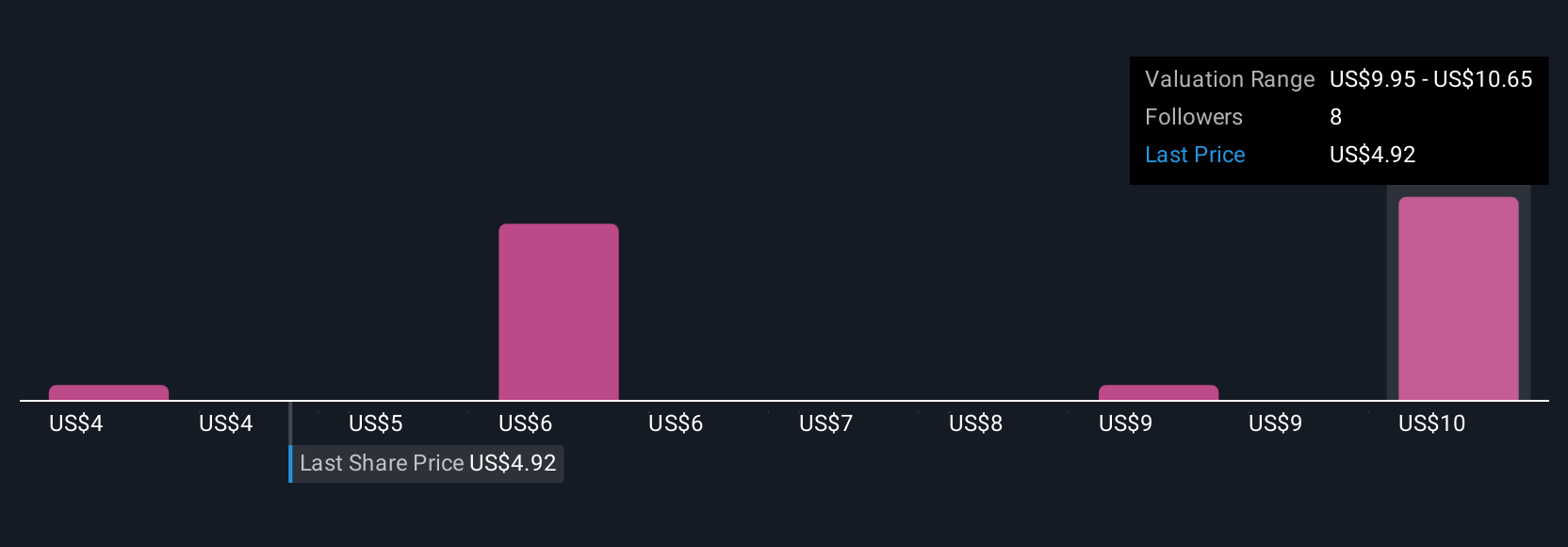

Five retail investors in the Simply Wall St Community assigned Coty a fair value ranging from US$3.69 to US$10.50 per share. While the company is counting on ending retailer destocking to spark a rebound, the diversity of community estimates shows just how varied expectations for its turnaround prospects can be.

Explore 5 other fair value estimates on Coty - why the stock might be worth over 2x more than the current price!

Build Your Own Coty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Coty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coty's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COTY

Coty

Manufactures, markets, distributes, and sells branded beauty products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion