- United States

- /

- Personal Products

- /

- NYSE:COTY

Gucci License Dispute Could Be a Game Changer for Coty (COTY)

Reviewed by Sasha Jovanovic

- Earlier this month, Coty Inc. filed a lawsuit in the UK against Kering and Gucci over the planned transfer of the Gucci beauty and fragrance license to L'Oréal, with all parties confirming the current license will remain in effect until expiration in 2028.

- This legal dispute brings fresh uncertainty to Coty's operations and future licensed brand revenues, as it unfolds alongside recent earnings pressures and leadership changes.

- We'll explore how the pending Gucci license litigation could affect Coty's investment thesis, especially its reliance on key licensing relationships.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Coty Investment Narrative Recap

For Coty shareholders, the core investment thesis rests on the company’s turnaround potential, its ability to maintain high-profile brand licenses, and capitalize on shifts in consumer preferences toward prestige beauty. The recent Gucci license litigation introduces uncertainty around one of Coty’s most critical licensing partnerships, and could impact near-term and future licensed revenue streams, making this a potentially material development for Coty’s short-term outlook and its largest risk, overreliance on key licenses.

Coty’s November 5, 2025, quarterly earnings announcement, showing both sales and net income declines year-over-year, arrived just as the Gucci dispute surfaced, underscoring continued pressures on top-line and profitability at a time when reliable licensing relationships are especially important for restoring growth momentum.

By contrast, the risk of losing major licensed brands like Gucci remains a key area investors should be aware of, especially as...

Read the full narrative on Coty (it's free!)

Coty's narrative projects $6.1 billion in revenue and $302.1 million in earnings by 2028. This requires 1.3% yearly revenue growth and a $683.2 million increase in earnings from -$381.1 million currently.

Uncover how Coty's forecasts yield a $5.04 fair value, a 34% upside to its current price.

Exploring Other Perspectives

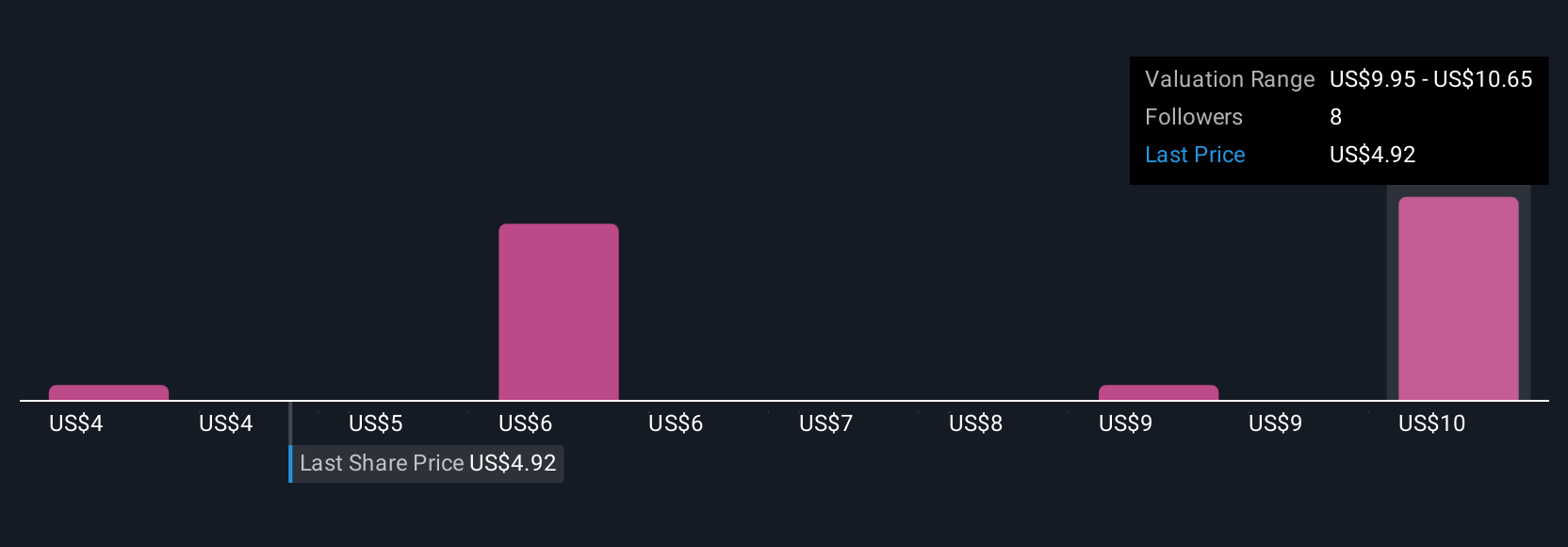

Fair value estimates from five Simply Wall St Community members span from US$3.69 to US$11.25, reflecting strong differences of opinion. Against this wide spectrum, overreliance on blockbuster licenses emerges as a central theme influencing Coty’s forward performance, reminding you to review a variety of perspectives before making any decisions.

Explore 5 other fair value estimates on Coty - why the stock might be worth over 2x more than the current price!

Build Your Own Coty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Coty research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Coty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Coty's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COTY

Coty

Manufactures, markets, distributes, and sells branded beauty products worldwide.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives