- United States

- /

- Household Products

- /

- NYSE:CLX

Why Clorox (CLX) Is Down 5.5% After ERP Disruptions Sap Sales and Earnings Outlook

Reviewed by Sasha Jovanovic

- The Clorox Company recently reported first quarter fiscal 2026 results, revealing US$1.43 billion in sales and US$80 million in net income, both lower than the previous year, while confirming a continued full-year guidance that anticipates further sales and earnings declines.

- The implementation of a new US ERP system led to temporary disruptions and market share losses, but Clorox expects these operational investments to support future productivity and long-term growth initiatives.

- We'll explore how the ERP-driven disruptions and margin pressures weigh on Clorox's investment narrative and fiscal 2026 outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Clorox Investment Narrative Recap

To be a Clorox shareholder today, you need confidence that the company’s digital transformation and brand strength will pay off beyond temporary hurdles from its new US ERP system. Recent Q1 results confirmed a guidance for lower sales and earnings, so the pace and effectiveness of Clorox’s post-ERP recovery is the main near-term catalyst, with competition from private label brands posing the biggest risk. If you believe Clorox can turn operational investments into sustainable gains, the case remains largely intact.

Among recent events, Clorox’s maintenance of its fiscal 2026 guidance, despite double-digit year-over-year sales declines and operational disruptions, stands out. This signals management’s continued focus on stabilizing operations and pursuing efficiency, even with acknowledged headwinds from cost inflation and competitive pressure. But, for investors it's important to weigh whether these initiatives are enough if category demand stays weak and private label gains traction...

Read the full narrative on Clorox (it's free!)

Clorox's narrative projects $7.0 billion revenue and $881.8 million earnings by 2028. This requires a 0.4% yearly revenue decline and a $71.8 million earnings increase from the current $810.0 million.

Uncover how Clorox's forecasts yield a $124.76 fair value, a 17% upside to its current price.

Exploring Other Perspectives

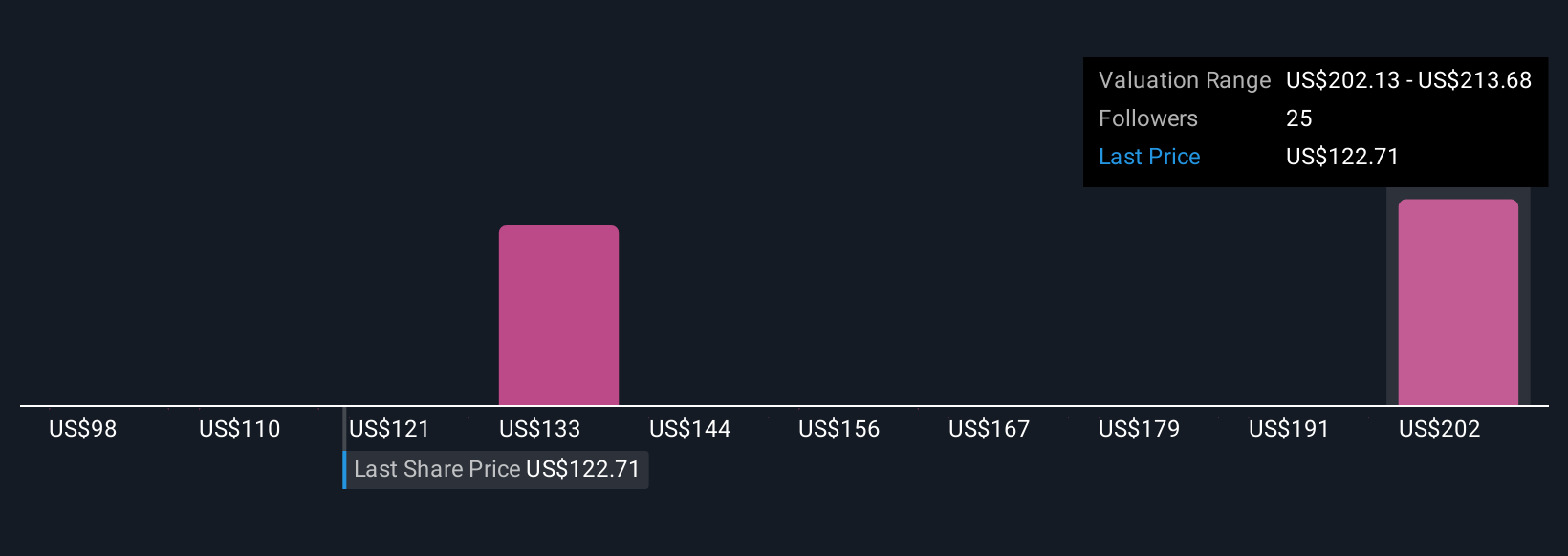

Six Simply Wall St Community members estimate Clorox’s fair value between US$98 and US$213 per share, spanning a broad range of views. Many anticipate ERP-enabled efficiencies will take time to offset near-term margin pressures, so stay open to contrasting outlooks from other investors.

Explore 6 other fair value estimates on Clorox - why the stock might be worth 8% less than the current price!

Build Your Own Clorox Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Clorox research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Clorox research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Clorox's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CLX

Clorox

Manufactures and markets consumer and professional products worldwide.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives