- United States

- /

- Household Products

- /

- NYSE:CL

Is Now the Time to Reassess Colgate After Its 15% Drop This Year?

Reviewed by Simply Wall St

If you are wondering what to do with your Colgate-Palmolive stock, you are definitely not alone. Household names like Colgate-Palmolive can be easy to overlook simply because they feel so dependable, but recent price movements may make you think twice about taking that stability for granted. Over the past year, the stock has dipped about 15.7%, which is not a small number, even for a company with Colgate’s track record. At the same time, the past three and five years show returns of 16.5% and 21.7% respectively. This hints at the brand’s longer-term staying power, even with short-term wobbles.

Despite the recent declines, investors seem to be reassessing risk, with analyst price targets still roughly 10% above current levels. What is driving all this? In part, it is broader market developments and concerns over consumer staples stocks, but also company-specific factors including steady, if unspectacular, annual growth. Colgate’s revenues and net income are both rising in the high single digits, signaling the core business is still intact.

Now, if you are a value-minded investor, here is where things get interesting. Using a set of six major valuation checks to analyze the stock, Colgate-Palmolive scores 4 out of 6, suggesting it meets most of the criteria for being undervalued. That gives us a solid baseline for a deeper dive. Next, we will break down those valuation approaches and see exactly where Colgate-Palmolive shines and which signals might still be missing. If you are looking for the most insightful way to judge the stock’s true worth, make sure to keep reading until the end.

Colgate-Palmolive delivered -15.7% returns over the last year. See how this stacks up to the rest of the Household Products industry.Approach 1: Colgate-Palmolive Cash Flows

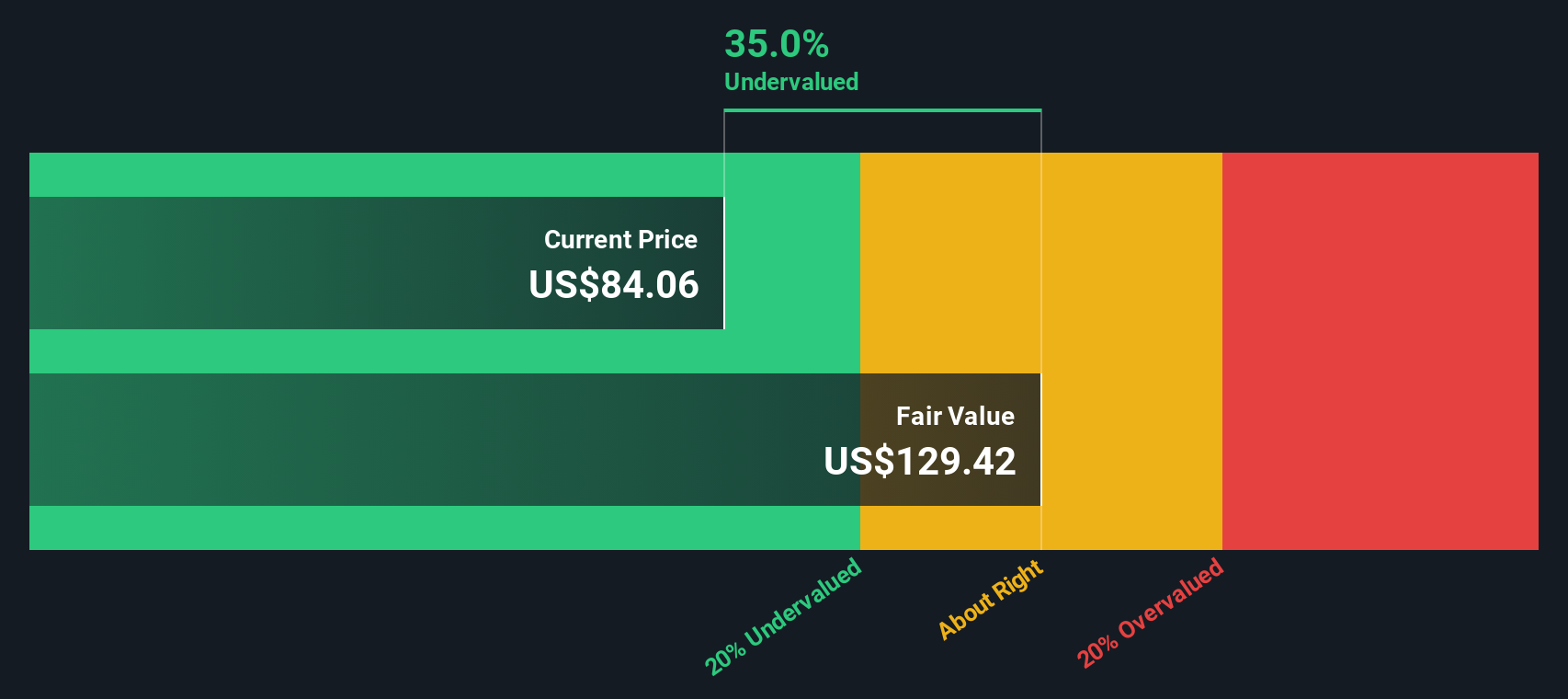

A Discounted Cash Flow (DCF) model attempts to estimate a company’s true worth by projecting its future free cash flows and discounting them back to today’s dollars. This approach focuses on the actual cash the business is expected to generate, rather than short-term price swings.

For Colgate-Palmolive, the most recent annual free cash flow is $3.27 billion. Analysts expect this figure to steadily climb, reaching $4.19 billion by 2029. The ten-year outlook shows modest but consistent growth, which reflects the reliable nature of Colgate’s business model.

After analyzing the numbers using a two-stage DCF model, the estimated intrinsic or fair value of the company is $129.42 per share. When compared to the current market price, this suggests that Colgate-Palmolive is about 33.6% undervalued at the moment. This indicates that the stock is trading below what the business’s future cash generation might justify.

Result: UNDERVALUED

Approach 2: Colgate-Palmolive Price vs Earnings

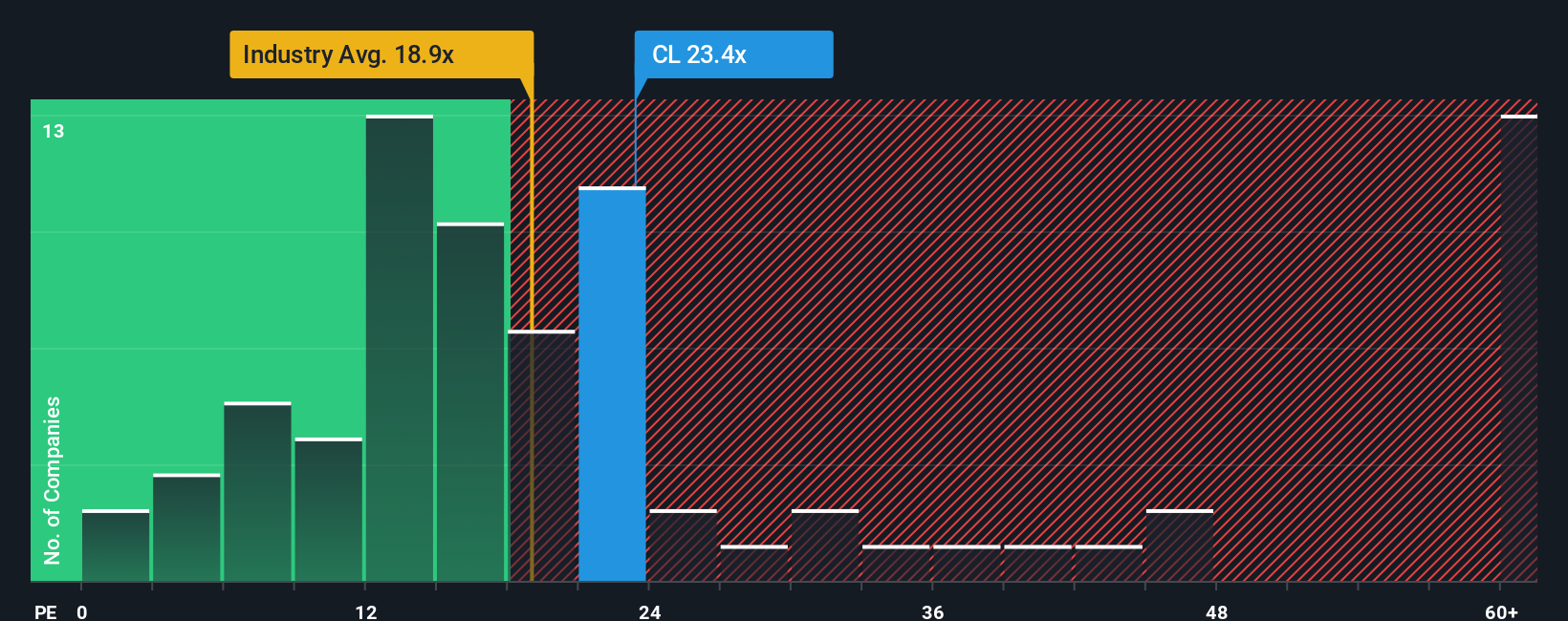

For established, consistently profitable companies like Colgate-Palmolive, the price-to-earnings (PE) ratio is especially useful to judge valuation. This metric shows how much investors are willing to pay today for a dollar of the company’s earnings. It helps to filter out short-term noise and focus on long-term profitability.

The appropriate PE ratio depends on several factors, including how fast the company is expected to grow its earnings and the level of risk compared to its industry. A higher growth outlook or a more stable business can justify a higher PE, while more uncertainty might call for a lower one.

Colgate-Palmolive’s current PE ratio is 23.9x. This is higher than the industry average of 18.2x, but below the average for its closest peers, which is 26.0x. For even more precision, Simply Wall St calculates a Fair Ratio of 24.8x for Colgate, considering specifics like its steady growth, industry standing, and risk profile. Since the actual PE and Fair Ratio are within a fraction of a point, this suggests the market is pricing Colgate-Palmolive almost exactly as the fundamentals would warrant.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Colgate-Palmolive Narrative

While numbers like fair value and PE ratios are useful, the most powerful way to make investment decisions is by building a Narrative—a simple, story-driven perspective that connects your view of Colgate-Palmolive’s future to its forecasted revenues, profits, and ultimate fair value.

Narratives translate your understanding of a company’s strengths, risks, and opportunities into concrete financial outcomes, letting you see how your scenario would play out in hard numbers. On Simply Wall St, Narratives are an easy, interactive tool used by millions of investors to quickly combine company news, updates, and personal opinion with up-to-date models to calculate what the company could truly be worth.

By comparing your Narrative’s fair value with the current share price, you can make clearer decisions about when to buy or sell, moving beyond headlines to a perspective that evolves as new information (like news or earnings) arrives. For example, some Colgate-Palmolive Narratives currently project a fair value over $106, while others are more cautious at $83. This shows how different stories can lead to very different investment views, all based on the same company details. This puts you, and your unique view, at the center of the investment conversation.

Do you think there's more to the story for Colgate-Palmolive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CL

Colgate-Palmolive

Manufactures and sells consumer products in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives