- United States

- /

- Household Products

- /

- NYSE:CL

Does the Recent Dip in Colgate-Palmolive Signal a New Opportunity for Investors in 2025?

Reviewed by Bailey Pemberton

If you’ve been debating what to do with your Colgate-Palmolive shares, you’re definitely not alone. This legacy consumer goods company is at the center of fresh conversations lately, and for good reason. After all, everyone needs toothpaste and soap, but that steady demand doesn’t always mean smooth sailing for the stock price. Over the past week, Colgate-Palmolive showed a slight gain of 0.3%. However, the broader picture is more complex, as the stock is down 3.1% over the last 30 days and has slipped by 13.2% year-to-date. In fact, it has lost nearly 19.2% across the last twelve months, even though its three- and five-year returns tell a gentler story, up 16% and 12.2%, respectively.

What’s behind these moves? Recent market chatter has circled around supply chain pressures and global cost inflation, which have prompted the company to intensify its focus on operational efficiency and product innovation. While other headlines may not have dented the share price dramatically, sentiment appears to have shifted as investors adjust to the evolving risk-reward balance for household staples like Colgate-Palmolive.

Is the company undervalued at these levels? Using six common valuation checks, Colgate-Palmolive scores a 4. This is not bad, but not extremely cheap either. Let’s look at exactly what goes into that number and see how these different valuation methods compare. If you’re looking for a smarter way to size up value, there will be additional insights below.

Why Colgate-Palmolive is lagging behind its peers

Approach 1: Colgate-Palmolive Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to today's dollars. In Colgate-Palmolive's case, the latest model uses the 2 Stage Free Cash Flow to Equity method. This method combines analyst forecasts and long-term growth assumptions to capture a realistic picture of value over time.

Currently, Colgate-Palmolive reports a Last Twelve Months Free Cash Flow (FCF) of $3.27 billion. Analyst projections estimate FCF will grow steadily, reaching $4.19 billion by 2029. These five-year projections are directly provided by analysts. Subsequent years rely on gradual growth extrapolated by Simply Wall St. This approach provides a comprehensive picture, factoring in both near-term expert views and long-term trends.

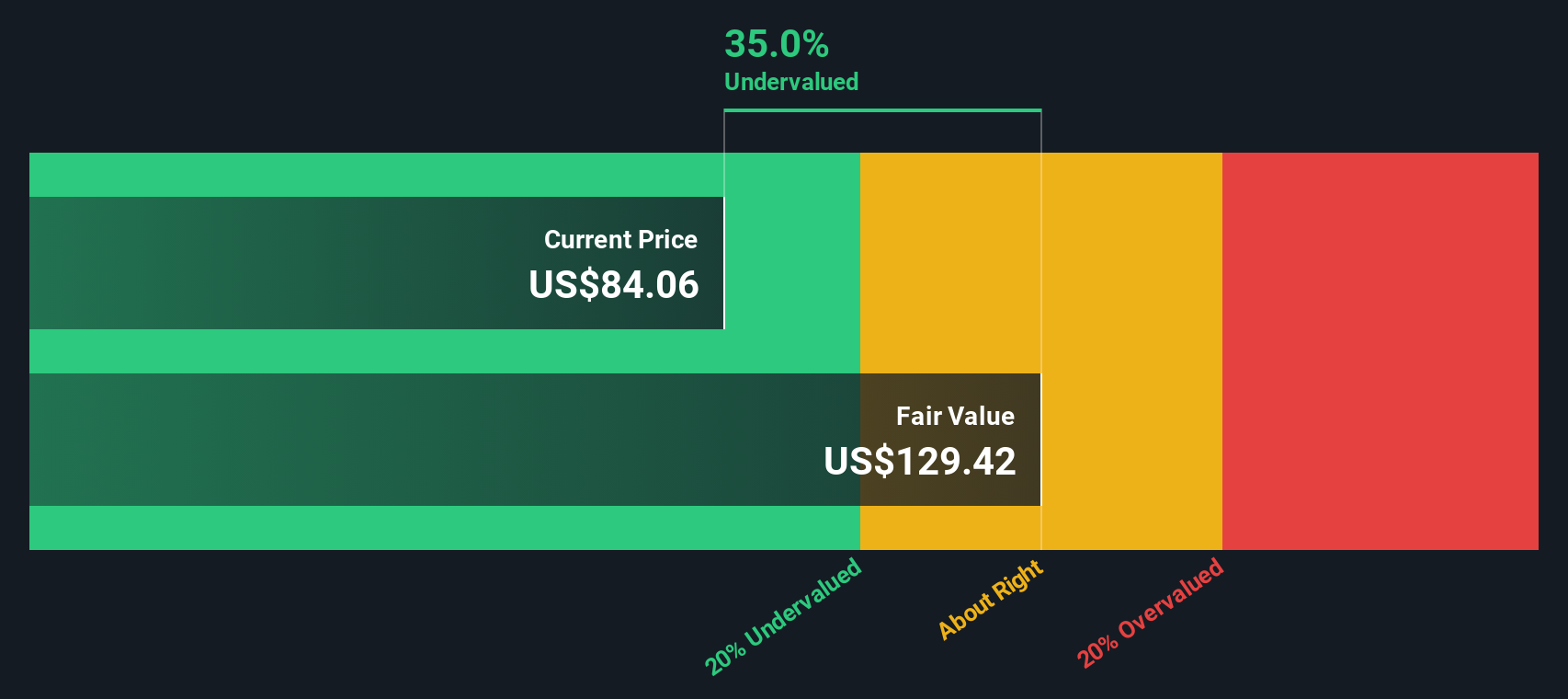

When all projected cash flows are summed and discounted, the DCF model estimates Colgate-Palmolive’s intrinsic value to be $129.35 per share. With the current share price trading at a 39.2% discount to this calculation, the DCF approach suggests the stock is significantly undervalued at present.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Colgate-Palmolive is undervalued by 39.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Colgate-Palmolive Price vs Earnings

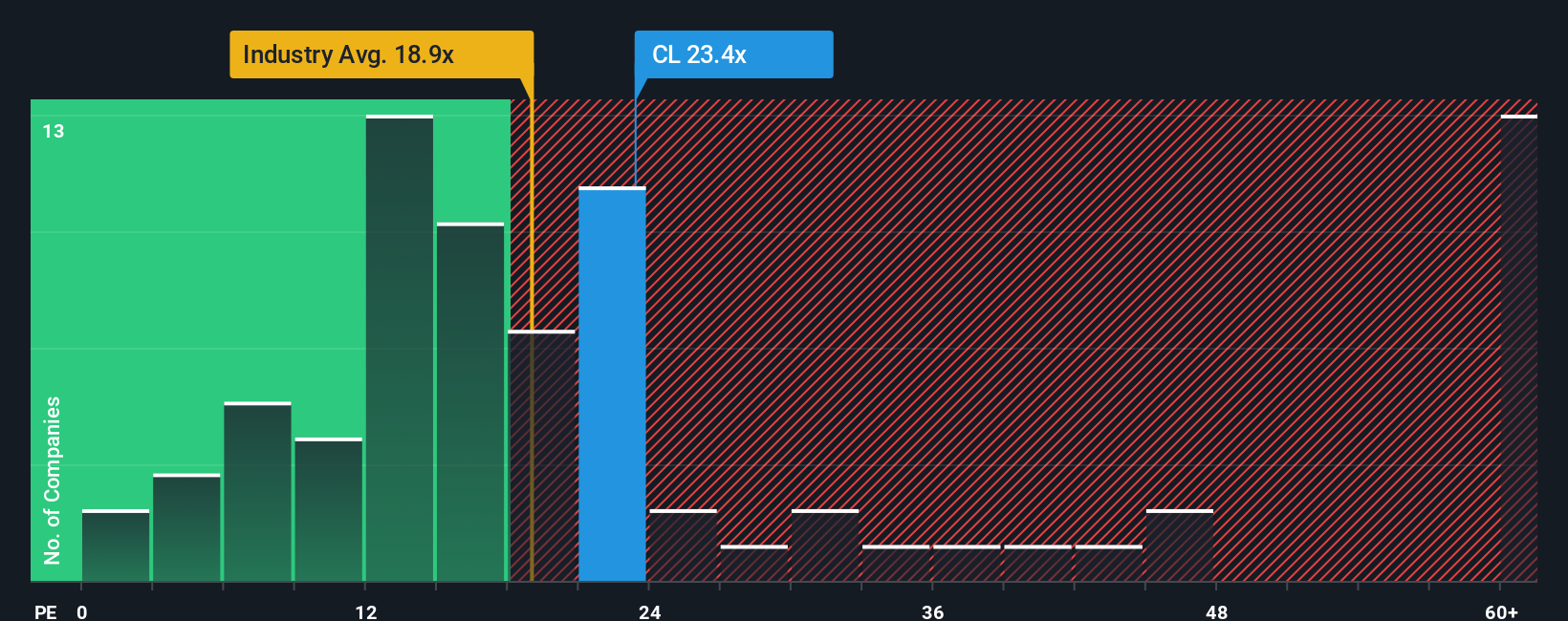

The price-to-earnings (PE) ratio is a popular valuation metric for profitable companies like Colgate-Palmolive because it directly relates a company's stock price to its earnings. For stable, established businesses in the consumer goods space, PE is often used as a benchmark for how much investors are willing to pay for each dollar of profit.

The "right" PE ratio depends on several factors, including expectations for future earnings growth, perceived risk, and the overall quality of the business. Companies with higher growth prospects or lower risk profiles often command higher PE ratios. Slower-growth or riskier firms tend to trade at lower multiples.

Currently, Colgate-Palmolive trades at a PE of 21.9x. This is slightly above the Household Products industry average of 19.9x but lower than the average among its listed peers, which sits at 24.5x. Simply Wall St’s proprietary Fair Ratio for Colgate-Palmolive is 23.6x, which takes into account not just generic industry comparisons but also factors like its specific earnings growth, profit margins, business risks, and overall market cap.

Unlike blunt comparisons to industry or peers, the Fair Ratio customizes what is “fair” for Colgate-Palmolive by adjusting for its actual performance and outlook. This provides a more accurate sense of whether the shares are fairly valued in the current market context.

Comparing the current PE of 21.9x to the Fair Ratio of 23.6x, the stock appears slightly undervalued based on earnings, but the difference is not significant.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Colgate-Palmolive Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are simply stories investors build around a company, explaining what they believe will drive its future. They connect their perspective to key numbers like revenue, margins, and ultimately, a fair value estimate. With Narratives, you make sense of Colgate-Palmolive not just by the latest figures, but by connecting the company’s business story to a clear financial forecast and a justified fair price.

Narratives are an easy, accessible tool used by millions of investors on Simply Wall St’s Community page. They help you decide when to buy or sell by comparing your Fair Value to the current Price, and they update automatically as new news or earnings come in. This way, your perspective stays current and actionable. For example, some Colgate-Palmolive Narratives reflect real optimism, focusing on emerging markets and digital transformation to project a fair value up to $106 per share, while a more cautious Narrative, concerned about cost pressures and subdued growth, lands as low as $83 per share. With Narratives, you can weigh the numbers, the story, and decide on a path that fits your own conviction.

Do you think there's more to the story for Colgate-Palmolive? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CL

Colgate-Palmolive

Manufactures and sells consumer products in the United States and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives