- United States

- /

- Household Products

- /

- NYSE:CL

Colgate-Palmolive (CL): Revisiting Valuation After This Year’s 14% Share Price Slide

Reviewed by Simply Wall St

Colgate-Palmolive (CL) has quietly slipped about 14 % this year, even as its underlying business keeps grinding forward with steady revenue and profit growth. That disconnect is exactly what makes the stock interesting now.

See our latest analysis for Colgate-Palmolive.

Despite the recent pullback, including a roughly 9% 90 day share price return and a 14% year to date share price decline to about $77.60, Colgate Palmolive still shows a positive three year total shareholder return. This suggests that long term momentum has cooled rather than disappeared.

If Colgate Palmolive’s reset has you reassessing the staples space, it could be a good moment to broaden your watchlist and explore fast growing stocks with high insider ownership

So with earnings still growing, shares trading below analyst targets and a sizeable intrinsic value gap implied, is Colgate Palmolive quietly slipping into undervalued territory, or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 11% Undervalued

With Colgate Palmolive last closing at $77.60 against a narrative fair value of $87.21, the current setup leans toward a discounted price, but the story hinges on how its long term earnings path is modeled.

Productivity and restructuring initiatives ($200 to $300 million over three years) are designed to free up resources for innovation, digital, and R&D investments, enabling incremental margin expansion and additional reinvestment for growth.

Want to see the full playbook behind that margin boost, the earnings climb it implies, and the richer multiple it relies on? Read the complete narrative to uncover the specific growth, profitability, and valuation assumptions that power this fair value call.

Result: Fair Value of $87.21 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent raw material cost pressures and prolonged consumer caution in key markets could squeeze margins and derail the gradual earnings recovery implied in this narrative.

Find out about the key risks to this Colgate-Palmolive narrative.

Another Take On Valuation

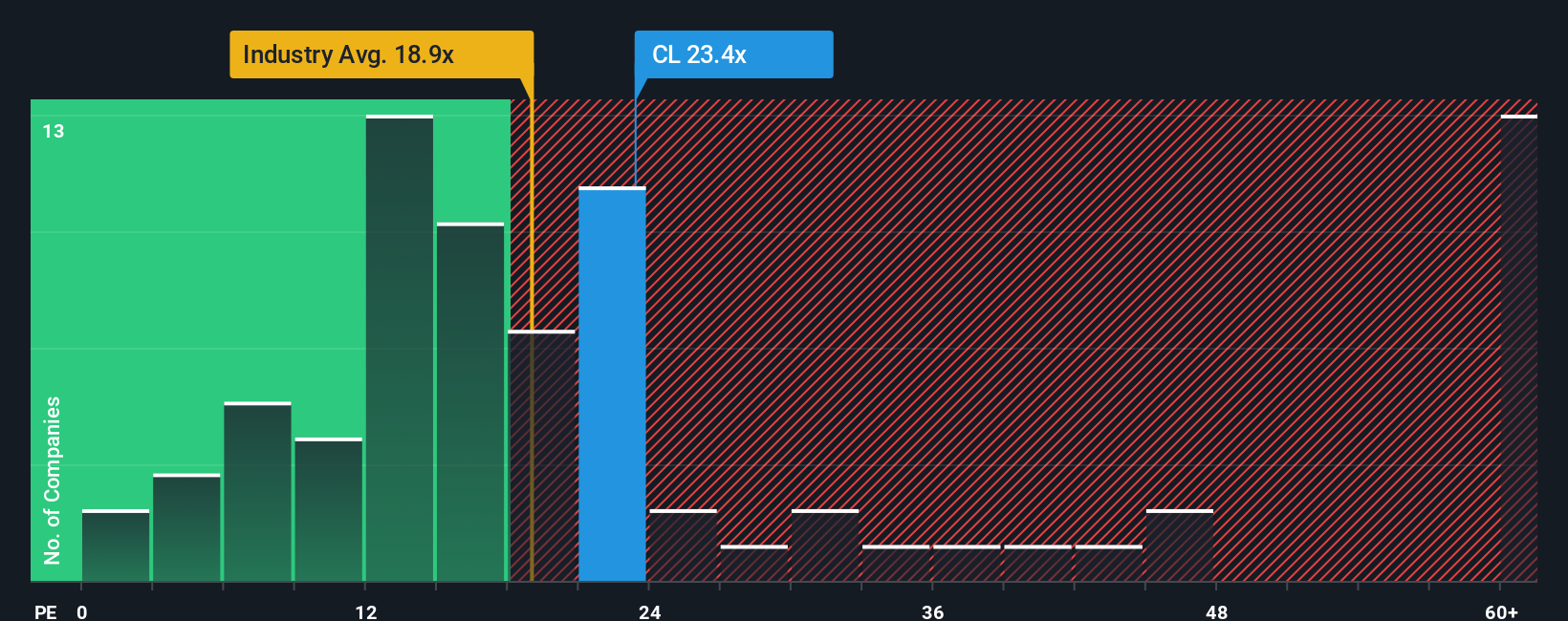

Looked at through a simple earnings lens, Colgate Palmolive screens quite differently. Its current price to earnings ratio of 21.5 times sits above the global household products average of 17.5 times and above a fair ratio of 19.5 times, suggesting less obvious bargain and more valuation risk if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Colgate-Palmolive Narrative

If this perspective does not quite align with your own or you prefer to dive into the numbers yourself, you can craft a personalized thesis in minutes: Do it your way

A great starting point for your Colgate-Palmolive research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more high conviction investment ideas?

Before you move on, lock in a few fresh opportunities by using the Simply Wall Street Screener to uncover compelling stocks that match your strategy and risk profile.

- Capture early stage potential by targeting these 3572 penny stocks with strong financials that pair low share prices with improving fundamentals and room for meaningful upside.

- Position yourself at the forefront of innovation by screening these 26 AI penny stocks shaping the next wave of intelligent automation and data driven products.

- Strengthen your portfolio’s income engine with these 15 dividend stocks with yields > 3% that combine reliable cash payouts with the prospect of long term capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CL

Colgate-Palmolive

Manufactures and sells consumer products in the United States and internationally.

Established dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026