- United States

- /

- Personal Products

- /

- NYSE:BRBR

We Ran A Stock Scan For Earnings Growth And BellRing Brands (NYSE:BRBR) Passed With Ease

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like BellRing Brands (NYSE:BRBR), which has not only revenues, but also profits. While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

Check out our latest analysis for BellRing Brands

BellRing Brands' Earnings Per Share Are Growing

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. To the delight of shareholders, BellRing Brands has achieved impressive annual EPS growth of 39%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

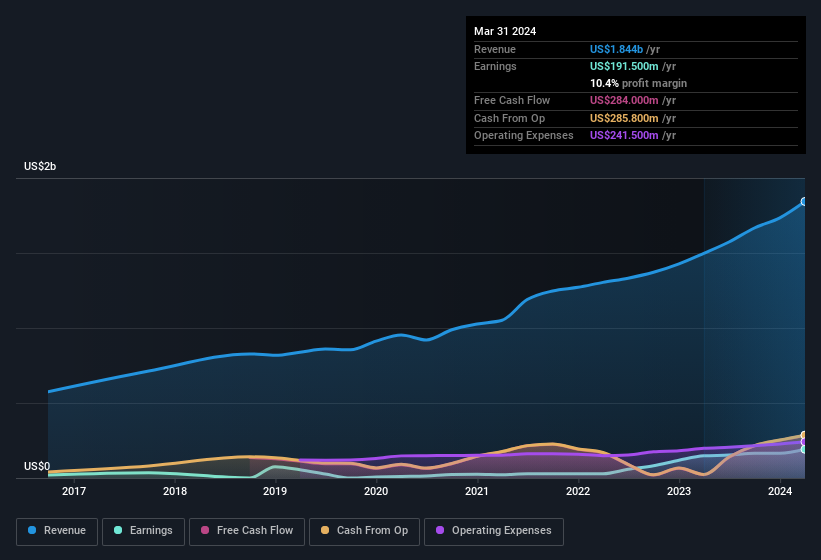

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. BellRing Brands maintained stable EBIT margins over the last year, all while growing revenue 23% to US$1.8b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of BellRing Brands' forecast profits?

Are BellRing Brands Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$7.4b company like BellRing Brands. But we are reassured by the fact they have invested in the company. Given insiders own a significant chunk of shares, currently valued at US$63m, they have plenty of motivation to push the business to succeed. That's certainly enough to let shareholders know that management will be very focussed on long term growth.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are. Our analysis has discovered that the median total compensation for the CEOs of companies like BellRing Brands with market caps between US$4.0b and US$12b is about US$8.5m.

The BellRing Brands CEO received US$6.8m in compensation for the year ending September 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Should You Add BellRing Brands To Your Watchlist?

BellRing Brands' earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Big growth can make big winners, so the writing on the wall tells us that BellRing Brands is worth considering carefully. We don't want to rain on the parade too much, but we did also find 3 warning signs for BellRing Brands (1 is concerning!) that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if BellRing Brands might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:BRBR

BellRing Brands

Provides various nutrition products in the United States.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives