- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

Is Now the Right Moment to Reassess WD-40 Shares After Latest 23% Drop?

Reviewed by Bailey Pemberton

If you are looking at WD-40 stock and wondering whether now could be the right time to buy, sell, or simply hold tight, you are not alone. Lately, WD-40 has been on a bit of a rollercoaster. The price at last close was $194.2, and over the last week, the stock slipped by 2.4%. Zooming out to the past month, we see a 9.3% drop, and if you have been watching all year, you have likely noticed the stock is down 19.1% year to date. In fact, over the past year, it has declined 23.2%. These numbers are sure to get investors thinking about what is really happening beneath the surface.

It is worth noting though that if you had held on for a few years, the three-year return is still a healthy 15.4%, and the five-year return sits at 5.6%. This longer-term performance suggests that the company has fundamentals that can endure the bumps along the way, even if the recent drop has investors reassessing risk and opportunity. While sector trends and shifting investor sentiment have played roles, the most important question now is: is WD-40 undervalued at this price?

Looking at common valuation checks, WD-40 currently scores a 0 out of 6 for being undervalued. That is not what most bargain hunters want to see, but numbers alone never tell the whole story. Let’s dig into how valuation is measured, and why a better way to weigh up WD-40’s true worth might surprise you at the end of this article.

WD-40 scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: WD-40 Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the current true value of a company by forecasting its future cash flow and discounting those amounts back to today's dollars. For WD-40, this process involves projecting the company's expected Free Cash Flow (FCF) over the coming years and then calculating what those future dollars are truly worth in present terms.

WD-40 recently reported a last twelve months (LTM) Free Cash Flow of $79.7 million. Projections indicate a FCF of $33.3 million in 2026, with further declines expected in subsequent years, based on a combination of analyst and Simply Wall St extrapolated estimates. By 2035, the estimated FCF is $14.27 million, reflecting a downward trend over a ten-year horizon. All these figures are referenced in US dollars.

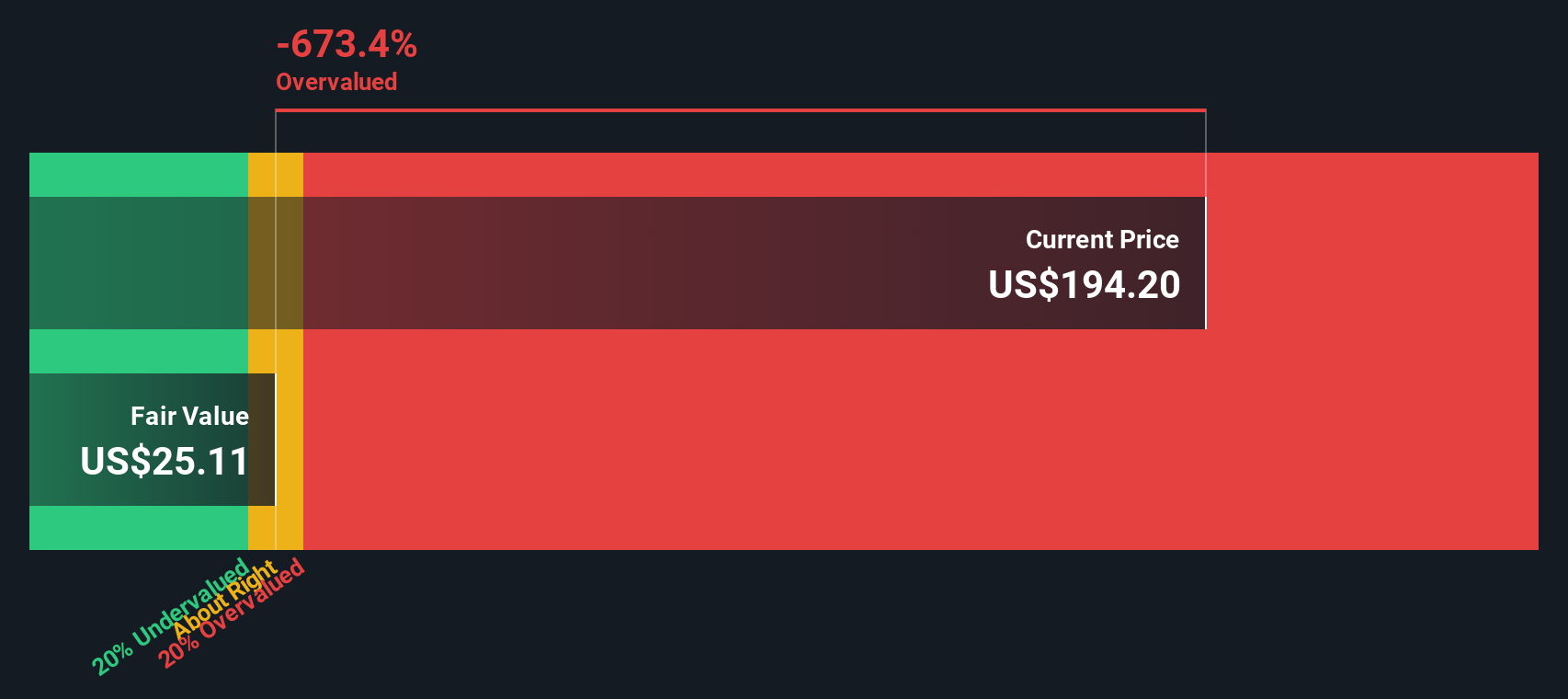

After discounting these cash flows to the present, the DCF model generates an intrinsic value for WD-40 of $25.11 per share. When compared with the recent trading price of $194.20, the DCF analysis implies the stock is overvalued by 673.4%.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests WD-40 may be overvalued by 673.4%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: WD-40 Price vs Earnings

For profitable companies like WD-40, the Price-to-Earnings (PE) ratio is a widely used valuation metric because it relates a company’s share price to its actual earnings. It offers investors a quick way to gauge how much they are paying for current profits, which is especially useful when assessing mature, earnings-generating businesses.

The “right” or fair PE ratio depends on several factors. Companies with strong growth prospects, high profitability, and lower perceived risk typically command higher PE ratios. Conversely, slower-growing or riskier businesses usually see lower multiples, as investors are less willing to pay a premium for uncertain future earnings.

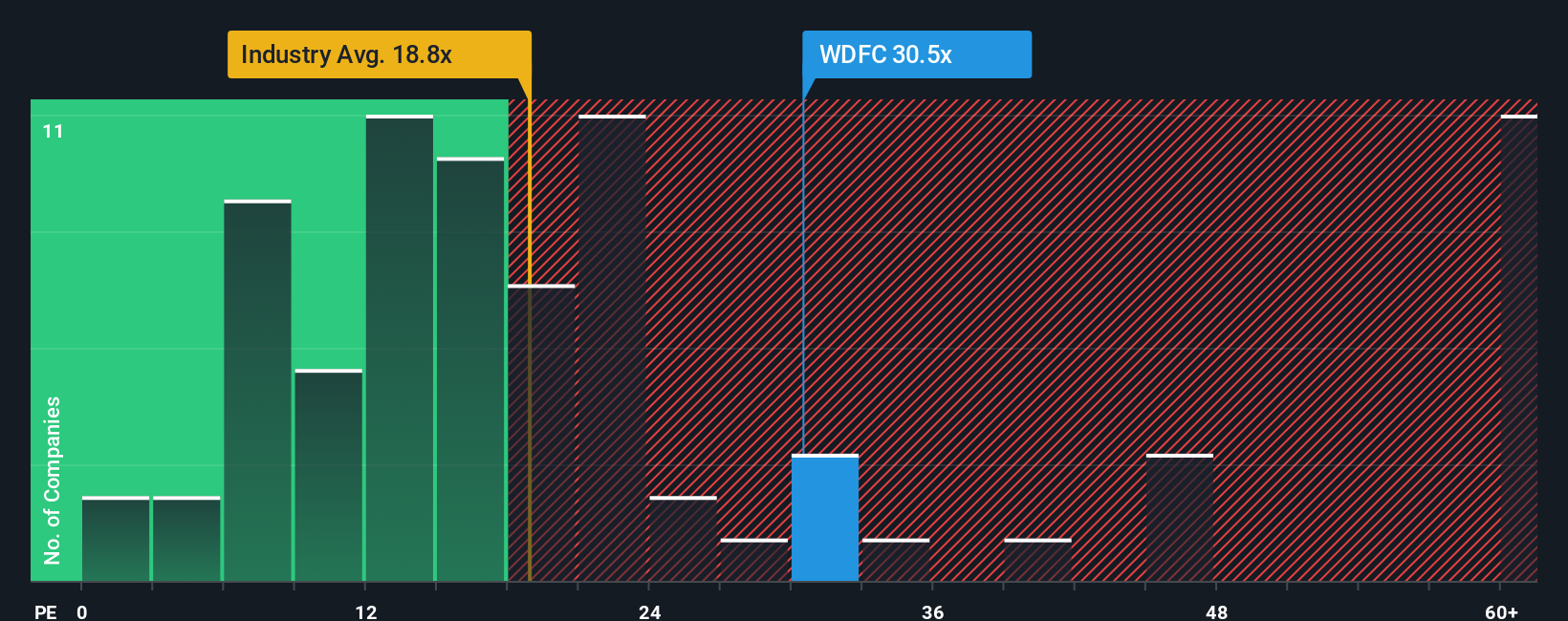

At the moment, WD-40’s PE ratio stands at 30.46x. To put that in context, its peers in the Household Products industry are trading at an average of 15.11x, while the broader industry itself is at 18.85x. Simply Wall St’s proprietary “Fair Ratio” for WD-40 is calculated at 16.32x, taking into account the company’s earnings growth, profit margin, market cap and risk profile, as well as sector nuances.

The benefit of the Fair Ratio is that it goes a step beyond simple peer or industry comparisons. By incorporating factors like expected growth, profitability, risk, and company size, it provides a more tailored benchmark for WD-40’s valuation. This gives a more accurate sense of what the market should reasonably pay.

Given that the actual PE ratio of 30.46x is well above the Fair Ratio of 16.32x, this approach suggests WD-40 stock is trading at a significant premium relative to its fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your WD-40 Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives, an approach that brings the story behind the numbers into your investing process. Narratives let you connect your perspective on a company, such as what you believe about their future revenue, profit margins, and growth, directly to a tailored financial forecast and fair value estimate.

Unlike static models, Narratives give you a platform to craft your own take on WD-40 by blending industry trends, company updates, and your assumptions in a simple, accessible tool on Simply Wall St’s Community page, which is used by millions of investors worldwide. With Narratives, you can see in real time how your story translates to an updated fair value compared to today’s market price, helping you act confidently when deciding whether to buy, sell, or hold.

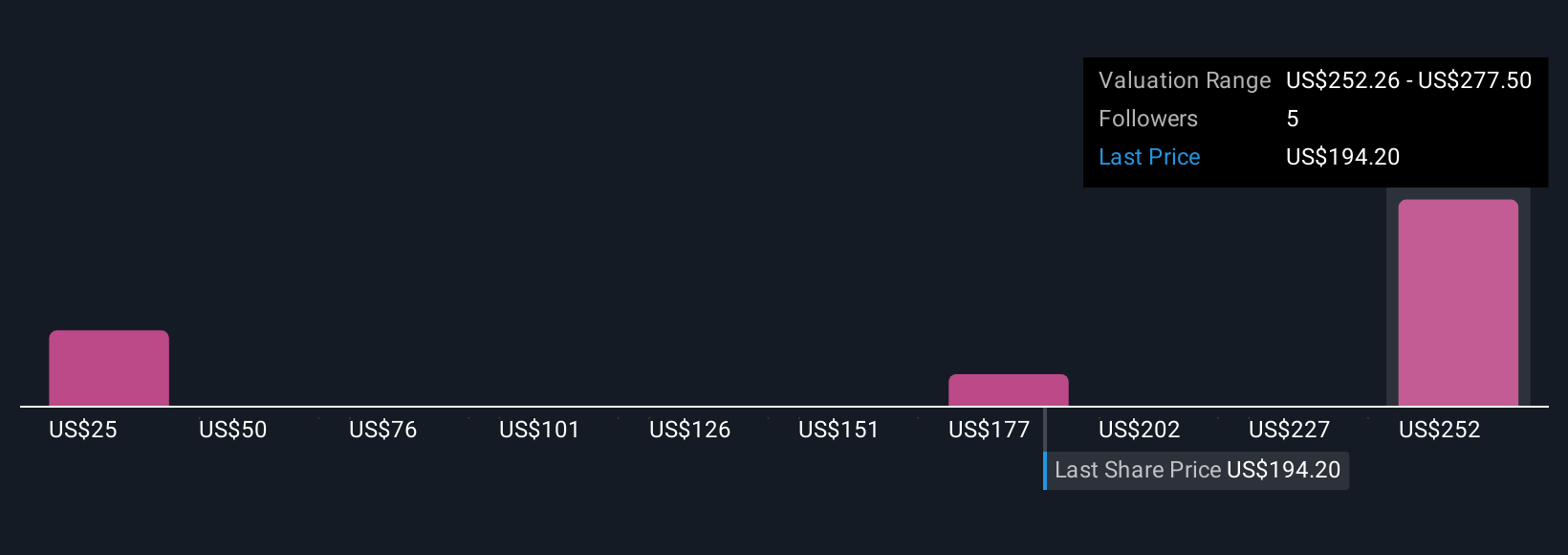

Because Narratives continuously update with new information like earnings releases or major news, your analysis stays timely and relevant. For example, some investors believe WD-40’s global expansion and premium focus could justify a fair value of $277.50 per share, while others take a more cautious view based on tighter margins and assign a lower estimate. This shows that Narratives empower you to invest in line with your beliefs, not just the consensus.

Do you think there's more to the story for WD-40? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDFC

WD-40

Develops and sells maintenance products, and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives