- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

How Should Investors React To WD-40's (NASDAQ:WDFC) CEO Pay?

Garry Ridge has been the CEO of WD-40 Company (NASDAQ:WDFC) since 1997, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for WD-40.

View our latest analysis for WD-40

How Does Total Compensation For Garry Ridge Compare With Other Companies In The Industry?

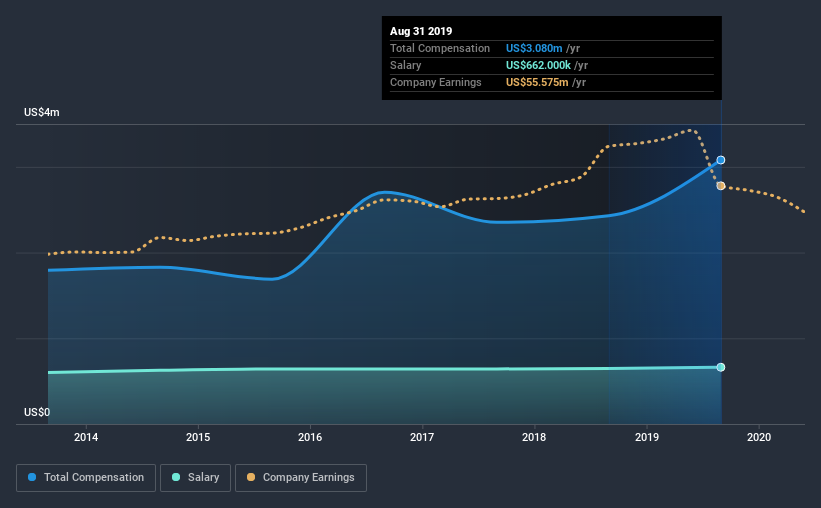

According to our data, WD-40 Company has a market capitalization of US$2.5b, and paid its CEO total annual compensation worth US$3.1m over the year to August 2019. Notably, that's an increase of 27% over the year before. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$662k.

On comparing similar companies from the same industry with market caps ranging from US$2.0b to US$6.4b, we found that the median CEO total compensation was US$4.9m. This suggests that Garry Ridge is paid below the industry median. Moreover, Garry Ridge also holds US$17m worth of WD-40 stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$662k | US$649k | 21% |

| Other | US$2.4m | US$1.8m | 79% |

| Total Compensation | US$3.1m | US$2.4m | 100% |

On an industry level, around 12% of total compensation represents salary and 88% is other remuneration. WD-40 is paying a higher share of its remuneration through a salary in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at WD-40 Company's Growth Numbers

Over the last three years, WD-40 Company has not seen its earnings per share change much, though they have deteriorated slightly. Its revenue is down 3.7% over the previous year.

Its a bit disappointing to see that the company has failed to grow its earnings. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has WD-40 Company Been A Good Investment?

We think that the total shareholder return of 82%, over three years, would leave most WD-40 Company shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

As we noted earlier, WD-40 pays its CEO lower than the norm for similar-sized companies belonging to the same industry. And although the company is suffering from declining earnings growth over the past three years, shareholder returns remain strong. Although we'd like to see positive earnings growth, we'd argue the remuneration is modest, based on our observations.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 1 warning sign for WD-40 that investors should think about before committing capital to this stock.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading WD-40 or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade WD-40, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:WDFC

WD-40

Develops and sells maintenance products, and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives