- United States

- /

- Household Products

- /

- NasdaqGS:WDFC

A Look at WD-40 (WDFC) Valuation After Its 8%+ Quarterly Dividend Increase

Reviewed by Simply Wall St

WD-40 (WDFC) just gave income-focused investors something to chew on, lifting its quarterly dividend to 1.02 dollars per share, more than an 8% bump that underscores management’s confidence and shareholder friendly posture.

See our latest analysis for WD-40.

The higher payout comes as WD-40’s share price has started to stabilize, with a 1 month share price return of 6.24% helping to offset a weaker year to date share price return and a negative 1 year total shareholder return, so near term momentum is tentatively rebuilding after a tougher stretch.

If this dividend move has you rethinking your income and quality mix, it could be worth exploring fast growing stocks with high insider ownership as a fresh source of ideas beyond the usual names.

With WD-40’s shares still down double digits year to date despite steady revenue growth and a healthy dividend hike, are investors being handed a quietly attractive entry point, or is the market already pricing in every turn of the wrench?

Most Popular Narrative Narrative: 21.5% Undervalued

With WD-40’s last close at $207.63 against a narrative fair value of $264.50, the story points to meaningful upside if its assumptions hold.

The company's focus on premiumization of products, with targets for a compound annual growth rate for premium products exceeding 10%, is poised to improve net margins by shifting the product mix towards higher-margin offerings.

WD-40’s strategy to divest its less profitable home care and cleaning brands is expected to position the company as a higher growth and higher gross margin enterprise, ultimately boosting operational margins and net margins once complete.

Want to see what kind of growth, margin mix shift, and future earnings multiple are being baked into that upside case? The full narrative reveals the playbook.

Result: Fair Value of $264.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering uncertainty around divesting home care brands and ongoing currency headwinds could pressure margins and undermine that optimistic upside narrative.

Find out about the key risks to this WD-40 narrative.

Another Lens on Valuation

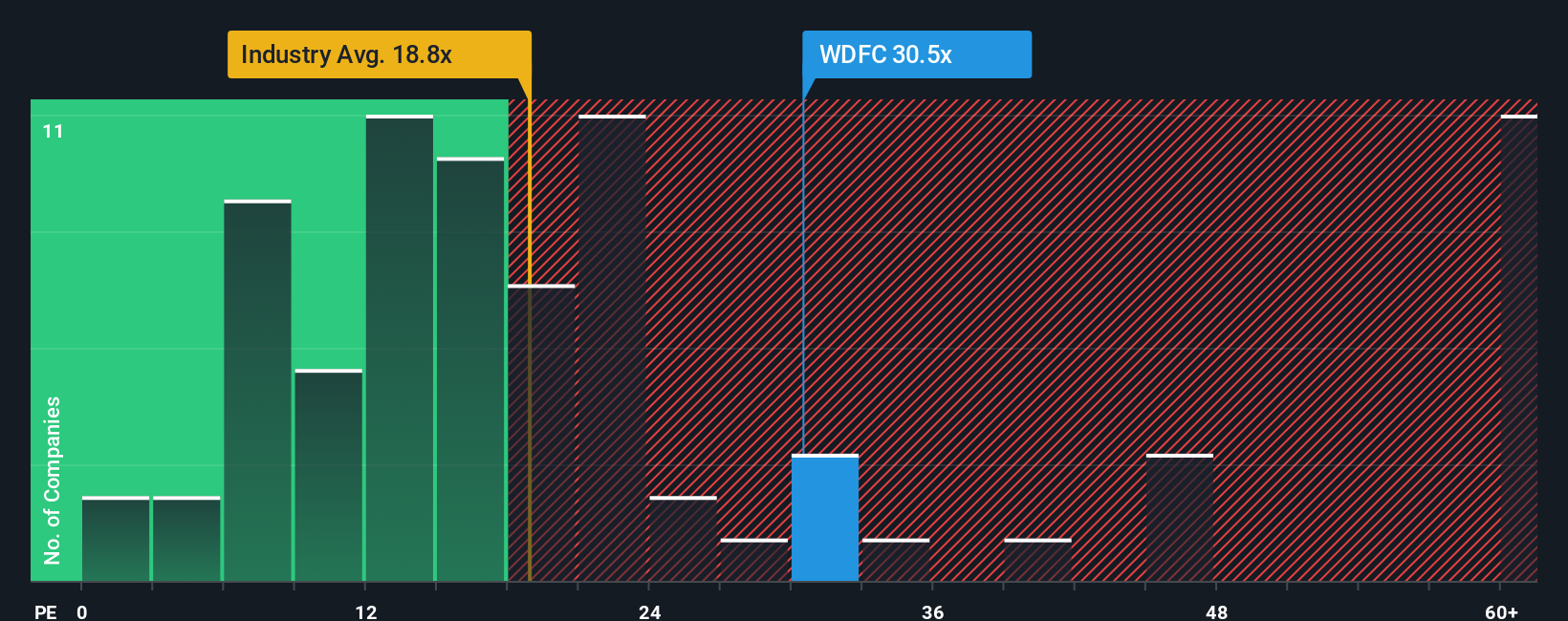

Step away from the narrative fair value and WD-40 suddenly looks pricey. On a price to earnings basis of about 31 times, it trades well above the 17.3 times industry average, its 12.5 times peer average and even our 12.6 times fair ratio, raising real downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own WD-40 Narrative

If you see the story differently or want to stress test the numbers yourself, you can quickly build a custom view in minutes: Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding WD-40.

Looking for your next investing edge?

Before you move on, lock in your advantage by using the Simply Wall St Screener to uncover focused, data-backed opportunities that most investors are overlooking.

- Target reliable cash generators by reviewing these 13 dividend stocks with yields > 3% that could strengthen your portfolio’s income stream while rates and inflation shift.

- Capitalize on structural growth by scanning these 29 healthcare AI stocks transforming diagnostics, treatment efficiency, and long-term healthcare economics.

- Position ahead of the next speculative wave by evaluating these 80 cryptocurrency and blockchain stocks that are building real businesses around blockchain infrastructure and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if WD-40 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDFC

WD-40

Engages in the provision of maintenance products and homecare and cleaning products in North America, Central and South America, Asia, Australia, Europe, India, the Middle East, and Africa.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion