- United States

- /

- Leisure

- /

- NasdaqGS:CLAR

3 US Penny Stocks With Market Caps Under $300M To Consider

Reviewed by Simply Wall St

The U.S. stock market recently experienced a sharp decline after two days of record highs for the S&P 500, with major indices like the Dow Jones and Nasdaq also seeing significant drops. For investors interested in smaller or newer companies, penny stocks remain a relevant area of investment despite their vintage name. These stocks, often representing firms with solid financial foundations, can offer unique opportunities for growth and value that larger companies might overlook.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $130.85M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.82 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.45 | $47.85M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2601 | $9.93M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.18 | $153.67M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.40 | $25.9M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.889 | $80.05M | ★★★★★☆ |

| BAB (OTCPK:BABB) | $0.86825 | $6.26M | ★★★★★☆ |

| Lifetime Brands (NasdaqGS:LCUT) | $5.00 | $114.11M | ★★★★★☆ |

Click here to see the full list of 708 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Ispire Technology (NasdaqCM:ISPR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ispire Technology Inc. is involved in the research, development, design, commercialization, sales, marketing, and distribution of e-cigarettes and cannabis vaping products globally, with a market cap of $248.35 million.

Operations: The company generates revenue from its cigarette manufacturers segment, totaling $148.52 million.

Market Cap: $248.35M

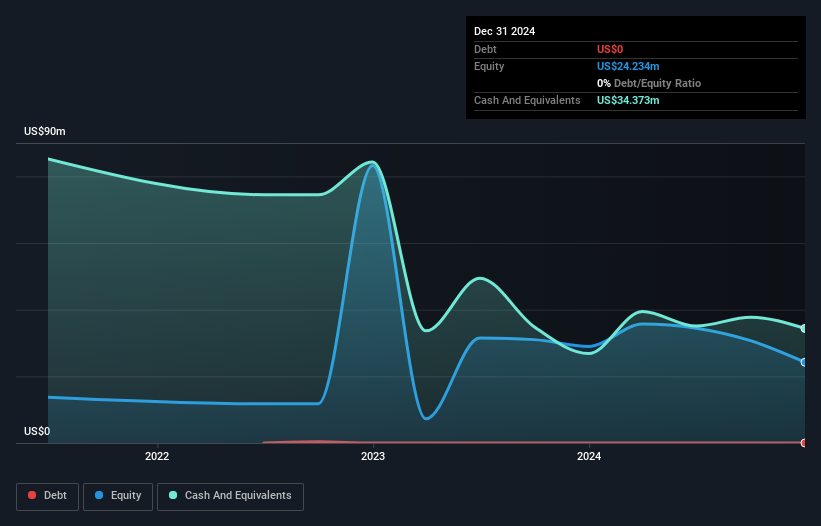

Ispire Technology Inc. is navigating the volatile penny stock landscape with a market cap of US$248.35 million and revenues from its cigarette manufacturers segment totaling US$148.52 million. Despite being unprofitable, with a negative return on equity of -95.02%, it has no debt and maintains a stable cash runway for over three years, indicating financial resilience amidst challenges. Recent initiatives include a secured promissory note for US$20 million to support growth and a share repurchase program worth up to US$10 million, signaling confidence in its long-term strategy despite ongoing losses and management changes.

- Click here to discover the nuances of Ispire Technology with our detailed analytical financial health report.

- Explore Ispire Technology's analyst forecasts in our growth report.

Veru (NasdaqCM:VERU)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Veru Inc. is a late clinical stage biopharmaceutical company that develops medicines for metabolic diseases, oncology, and viral-induced acute respiratory distress syndrome (ARDS), with a market cap of $80.64 million.

Operations: Veru Inc. has not reported any specific revenue segments.

Market Cap: $80.64M

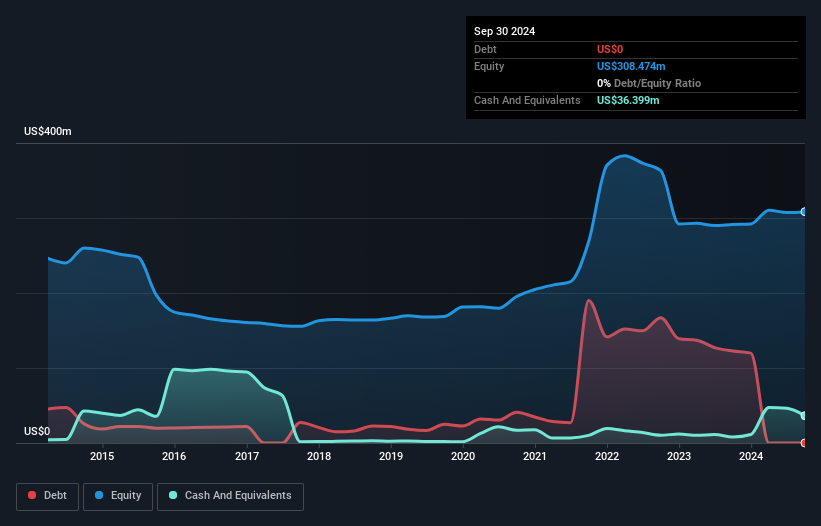

Veru Inc., with a market cap of US$80.64 million, is navigating the challenges typical of penny stocks as it remains pre-revenue and unprofitable. Despite this, Veru has achieved positive topline results in its Phase 2b QUALITY clinical study for enobosarm, showing promise in preserving lean body mass in patients using semaglutide for weight reduction. The company is debt-free and has experienced management but faces financial strain with less than a year of cash runway. Recent earnings reported a net loss of US$8.95 million for Q1 2025, raising concerns about its ability to continue as a going concern according to its auditor's report.

- Dive into the specifics of Veru here with our thorough balance sheet health report.

- Assess Veru's future earnings estimates with our detailed growth reports.

Clarus (NasdaqGS:CLAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Clarus Corporation designs, develops, manufactures, and distributes outdoor equipment and lifestyle products both in the United States and internationally, with a market cap of $187.97 million.

Operations: The company's revenue is divided into two segments: Outdoor, generating $182.63 million, and Adventure, contributing $86.78 million.

Market Cap: $187.97M

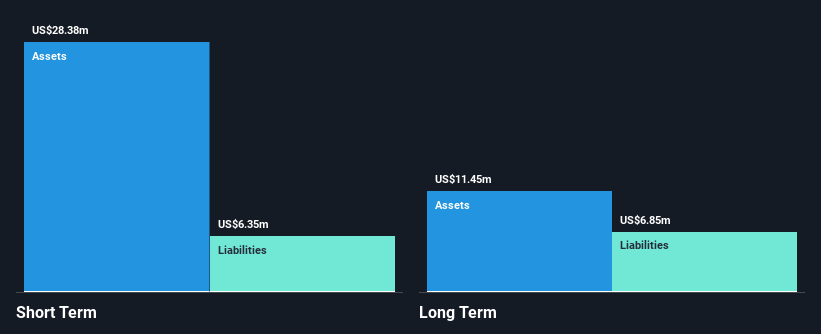

Clarus Corporation, with a market cap of US$187.97 million, operates in the outdoor and lifestyle sectors but is currently unprofitable and not expected to achieve profitability in the near term. The company benefits from being debt-free, providing some financial stability despite its ongoing losses over the past five years. Clarus's short-term assets significantly exceed both its short- and long-term liabilities, indicating good liquidity management. Recent board changes include appointing Mr. Mark Besca, bringing substantial financial expertise to the audit committee. However, challenges remain with an inexperienced management team averaging 1.6 years of tenure and a dividend not well-supported by earnings or cash flow.

- Get an in-depth perspective on Clarus' performance by reading our balance sheet health report here.

- Learn about Clarus' future growth trajectory here.

Summing It All Up

- Get an in-depth perspective on all 708 US Penny Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLAR

Clarus

Designs, develops, manufactures, and distributes outdoor equipment and lifestyle products in the United States, Australia, China, Austria, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives