- United States

- /

- Personal Products

- /

- NasdaqCM:SKIN

The Beauty Health Company (NASDAQ:SKIN) Stock Rockets 31% But Many Are Still Ignoring The Company

Despite an already strong run, The Beauty Health Company (NASDAQ:SKIN) shares have been powering on, with a gain of 31% in the last thirty days. But the last month did very little to improve the 73% share price decline over the last year.

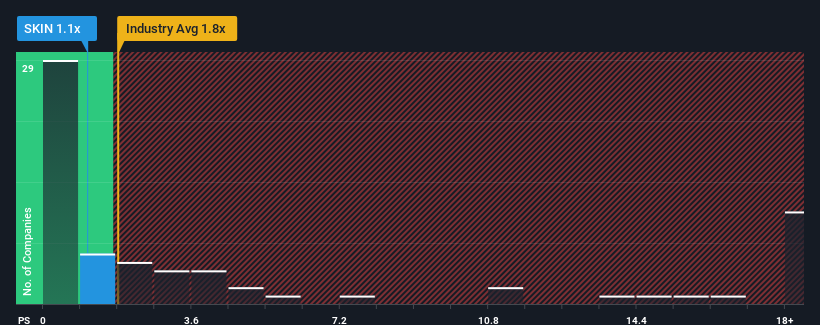

In spite of the firm bounce in price, Beauty Health's price-to-sales (or "P/S") ratio of 1.1x might still make it look like a buy right now compared to the Personal Products industry in the United States, where around half of the companies have P/S ratios above 1.8x and even P/S above 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Beauty Health

What Does Beauty Health's P/S Mean For Shareholders?

Recent times haven't been great for Beauty Health as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Beauty Health will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Beauty Health?

In order to justify its P/S ratio, Beauty Health would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. The latest three year period has also seen an excellent 204% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 7.9% each year over the next three years. That's shaping up to be similar to the 6.3% each year growth forecast for the broader industry.

With this information, we find it odd that Beauty Health is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Beauty Health's P/S

The latest share price surge wasn't enough to lift Beauty Health's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that Beauty Health currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Beauty Health that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beauty Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SKIN

Beauty Health

Designs, develops, manufactures, markets, and sells esthetic technologies and products in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives