- United States

- /

- Personal Products

- /

- NasdaqCM:SISI

Cautious Investors Not Rewarding Shineco, Inc.'s (NASDAQ:SISI) Performance Completely

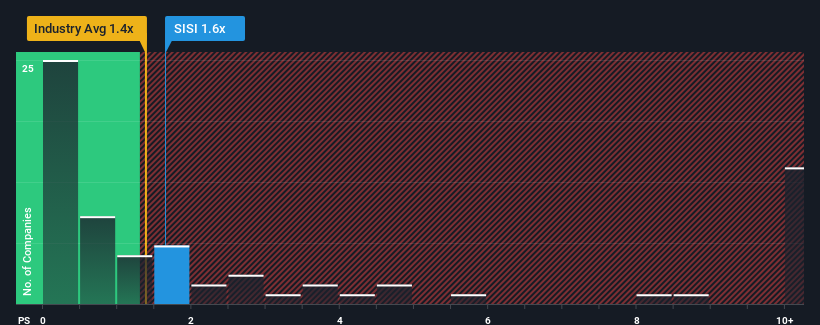

There wouldn't be many who think Shineco, Inc.'s (NASDAQ:SISI) price-to-sales (or "P/S") ratio of 1.6x is worth a mention when the median P/S for the Personal Products industry in the United States is similar at about 1.4x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for Shineco

What Does Shineco's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Shineco has been doing very well. Perhaps the market is expecting future revenue performance to taper off, which has kept the P/S from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Shineco will help you shine a light on its historical performance.Is There Some Revenue Growth Forecasted For Shineco?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shineco's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 146%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 0.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that Shineco is trading at a fairly similar P/S compared to the industry. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Shineco's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Shineco currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

Don't forget that there may be other risks. For instance, we've identified 5 warning signs for Shineco (4 are potentially serious) you should be aware of.

If these risks are making you reconsider your opinion on Shineco, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SISI

Shineco

Through its subsidiaries, plants, processes, and distributes agricultural produce.

Moderate and slightly overvalued.

Market Insights

Community Narratives