- United States

- /

- Household Products

- /

- NasdaqGS:REYN

Reynolds Consumer Products (REYN): Evaluating Valuation After Q3 Earnings Beat and Raised Outlook

Reviewed by Simply Wall St

Reynolds Consumer Products (REYN) just released third quarter results, topping profit and revenue forecasts while updating its estimates for the year. The company also gave an upbeat outlook for the next quarter, which attracted fresh investor attention.

See our latest analysis for Reynolds Consumer Products.

The wave of upbeat news from Reynolds Consumer Products, including a surprise Q3 revenue win, a healthy dividend, and creative new product buzz, has revitalized the stock’s momentum lately. The share price jumped over 10% in the last 90 days, signaling renewed optimism after a sluggish start to the year, even though the 1-year total shareholder return still sits around -6%.

If these results have you rethinking where opportunity might strike next, this could be a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares rebounding but annual revenue growth still modest, the question becomes whether Reynolds Consumer Products remains undervalued after its surprise quarter or if the stock’s recent gains mean markets have already accounted for future growth.

Most Popular Narrative: 5% Undervalued

With the most followed narrative suggesting Reynolds Consumer Products’ fair value sits about 5% above the last close, analysts see potential for modest upside if the company can execute on upcoming growth initiatives. The stage is set for a deeper dive into what is fueling these expectations and what could move the stock next.

Ongoing product innovation, particularly in sustainable and convenience-focused products such as Hefty ECOSAVE compostable cutlery, air fryer liners, and unbleached parchment, is expected to drive future revenue growth as Reynolds captures premium pricing and gains share among environmentally conscious and convenience-seeking consumers.

What is the real math powering this valuation? The underlying narrative leverages forward-looking revenue expansion and a profit margin lift that could reset Reynolds’ earnings runway. Curious to see what future earnings and market multiples are shaping the possible move above today’s price? The full narrative unpacks the quantitative side, revealing just how bold the path to that price target might be.

Result: Fair Value of $26.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, higher raw material costs or weaker consumer demand could quickly reverse expected gains. This reminds investors that the growth story still faces hurdles.

Find out about the key risks to this Reynolds Consumer Products narrative.

Another View: What Do Earnings Multiples Say?

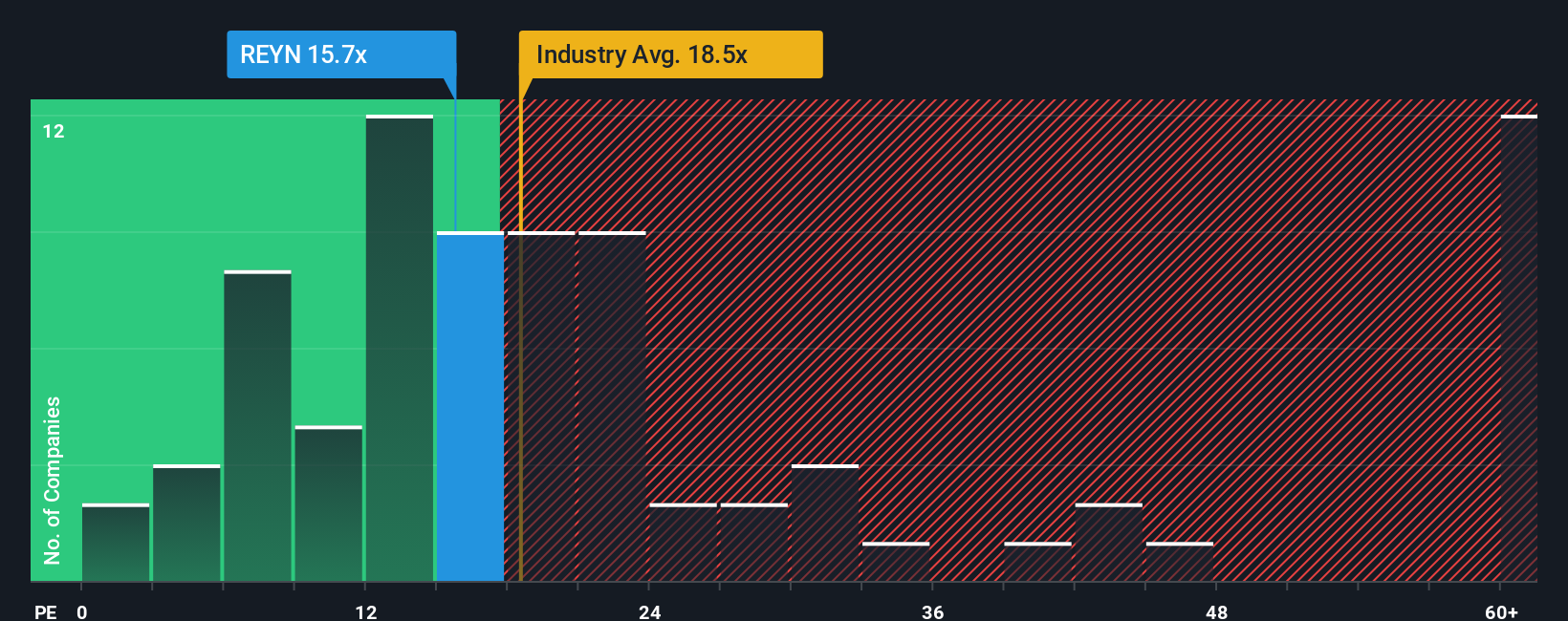

While analysts see Reynolds Consumer Products as modestly undervalued based on expected profit growth, a quick look at the current earnings multiple tells a different story. The stock trades at 16.8x, just above its peer average of 16.4x, and sits comfortably below the global industry’s 18.7x ratio. This suggests the market is only offering a slight discount, and perhaps investors are already cautious about near-term challenges. Is the fair value really as high as the models suggest, or are risk factors already reflected in the price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Reynolds Consumer Products Narrative

If you have a different perspective or want to dig into the numbers yourself, you can shape your own outlook in just a few minutes. Do it your way

A great starting point for your Reynolds Consumer Products research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for the obvious. If you want a real edge, check out these compelling opportunities you simply shouldn’t overlook:

- Find authentic growth potential by uncovering these 855 undervalued stocks based on cash flows that are flying under the radar and priced below their intrinsic value.

- Capitalize on the artificial intelligence surge by seeking out these 26 AI penny stocks at the forefront of high-impact digital transformation.

- Secure steady cash flow by targeting these 21 dividend stocks with yields > 3% offering attractive yields and reliable income potential for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:REYN

Reynolds Consumer Products

Produces and sells products in cooking, waste and storage, and tableware product categories in the United States and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives