- United States

- /

- Household Products

- /

- NasdaqGS:KMB

Is Kimberly-Clark’s 2025 Pullback a Chance After DCF and PE Signal Upside Potential?

Reviewed by Bailey Pemberton

- Wondering if Kimberly-Clark at around $102.89 is a bargain hiding in plain sight or a value trap dressed up as a dividend staple? Let us break down what the current price is really implying about its future.

- The stock has slipped about 3.8% over the last week and is roughly 21.2% down year to date, leaving it about 19.5% lower than a year ago, which naturally raises questions about sentiment and opportunity.

- Much of the recent share price pressure has come as investors reassess defensive consumer staples in light of changing interest rate expectations and shifting demand patterns. At the same time, Kimberly-Clark has been in the headlines for ongoing restructuring initiatives and product innovation efforts that aim to protect margins and support steady cash flow.

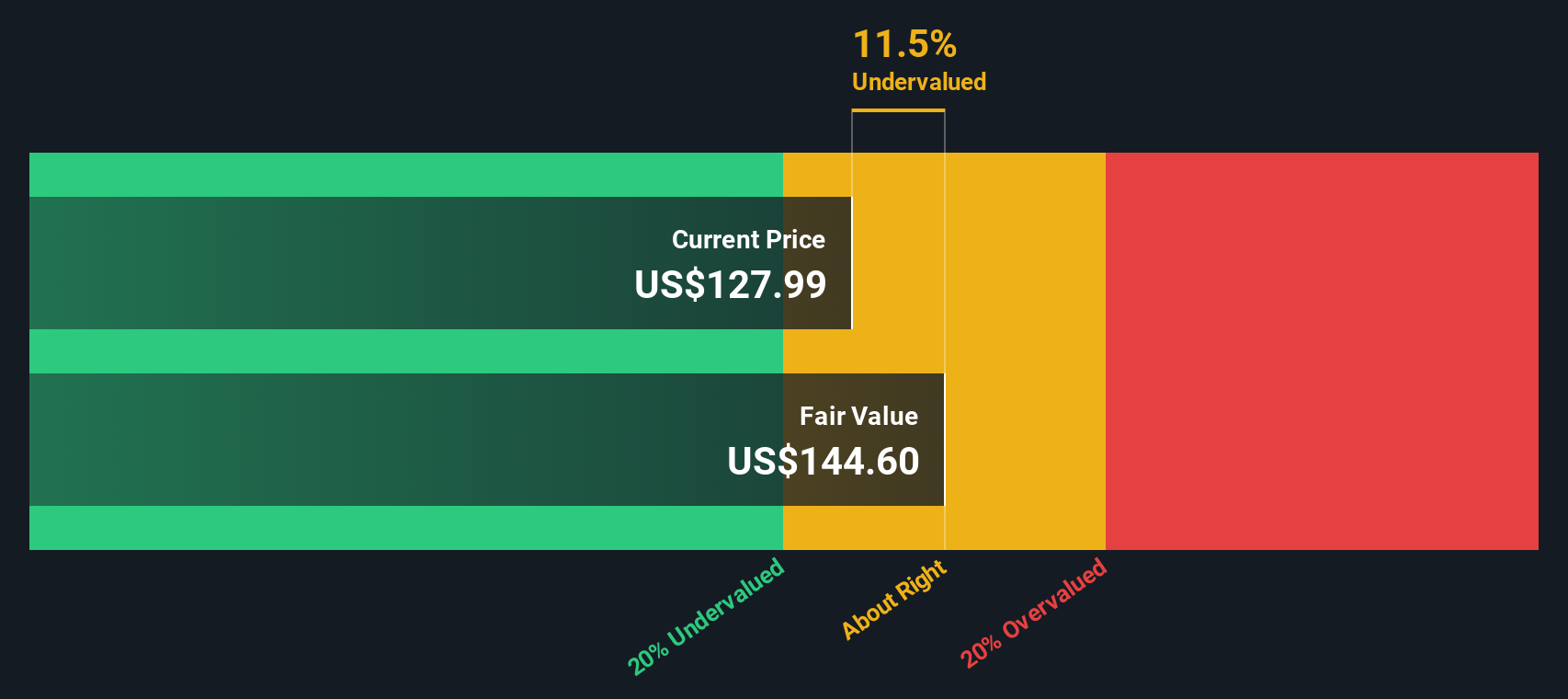

- Despite the weak price performance, Kimberly-Clark currently posts a valuation score of 5/6, suggesting it looks undervalued on most of our checks. Next, we will walk through DCF, multiples, and other approaches, before finishing with an even more practical way to think about what this valuation really means for long term investors.

Find out why Kimberly-Clark's -19.5% return over the last year is lagging behind its peers.

Approach 1: Kimberly-Clark Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today.

For Kimberly-Clark, the model starts with last twelve months free cash flow of about $1.8 billion and builds out two stages of growth. Analyst estimates suggest free cash flow rises to roughly $5.4 billion by 2028, with later years extrapolated by Simply Wall St to reach around $12.3 billion by 2035. These projections reflect steady expansion in cash generation as restructuring benefits, pricing power, and volume growth compound over time.

When all those future cash flows are discounted back using the 2 Stage Free Cash Flow to Equity approach, the model arrives at an intrinsic value of roughly $687 per share. Compared with the current share price near $103, this implies the stock is about 85% undervalued on a DCF basis, indicating a wide gap between price and modeled value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kimberly-Clark is undervalued by 85.0%. Track this in your watchlist or portfolio, or discover 903 more undervalued stocks based on cash flows.

Approach 2: Kimberly-Clark Price vs Earnings

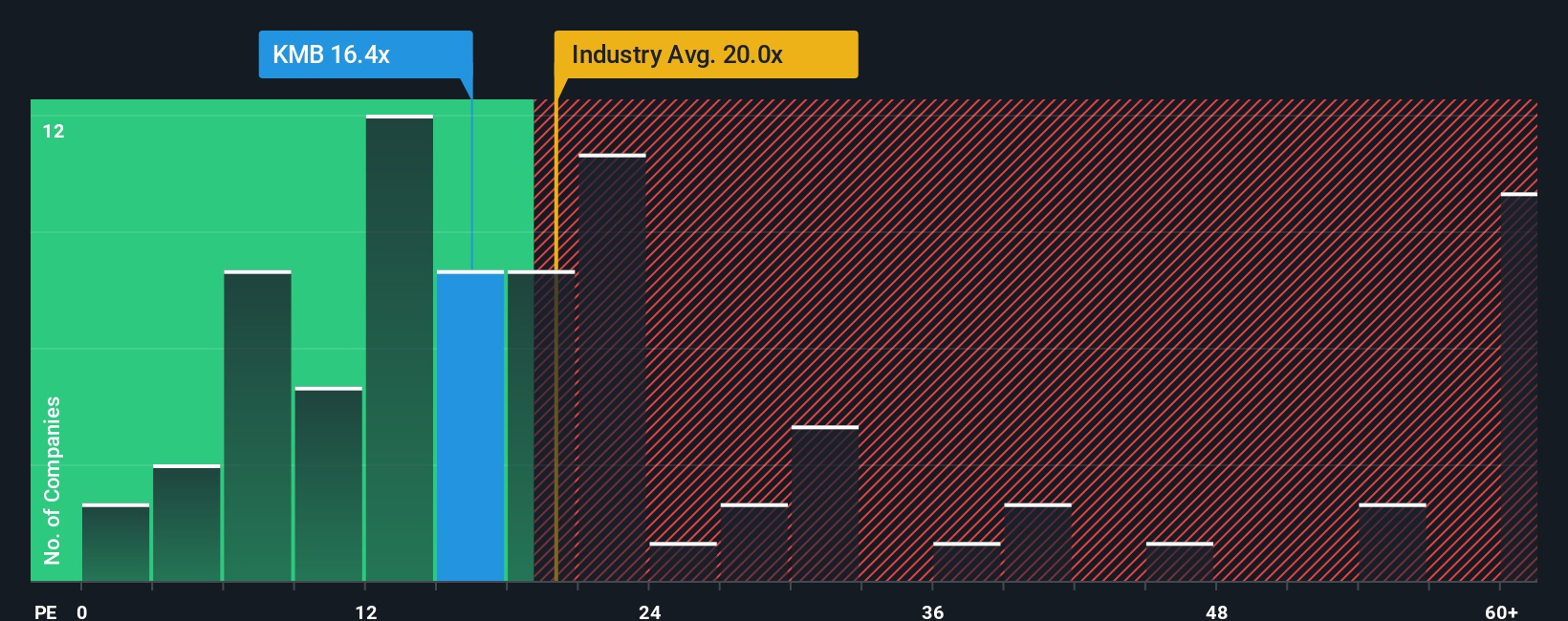

For a mature, consistently profitable business like Kimberly-Clark, the price to earnings, or PE, ratio is a sensible way to judge valuation because it directly compares what investors are paying with what the company is actually earning today.

In general, companies with stronger growth prospects and lower perceived risk can justify a higher “normal” PE, while slower growing or riskier businesses usually deserve a lower one. Kimberly-Clark currently trades on a PE of about 17.3x, which is roughly in line with the Household Products industry average of about 17.1x and a bit below the broader peer group at around 19.7x. On these simple comparisons, the stock looks modestly conservative but not dramatically cheap.

Simply Wall St’s Fair Ratio takes this a step further by estimating what PE multiple Kimberly-Clark should command, given its earnings growth outlook, profitability, risk profile, industry positioning, and market cap. That analysis suggests a Fair Ratio near 28.1x, noticeably above the current 17.3x. On this basis, the market appears to be discounting Kimberly-Clark more than its fundamentals warrant, which may indicate undervaluation rather than a fully priced staple.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1450 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kimberly-Clark Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Kimberly-Clark’s business to a concrete forecast and a fair value, right inside the Simply Wall St Community page that millions of investors use.

A Narrative is essentially your story behind the numbers. It is where you spell out what you expect for Kimberly-Clark’s future revenue, earnings, and margins, and the platform automatically turns that story into a financial forecast and an implied fair value that you can compare with today’s share price to help you decide whether it looks like a buy, hold, or sell.

Because Narratives on Simply Wall St update dynamically as new information comes in, such as earnings, news on the Kenvue acquisition, or shifts in analyst expectations, they help you keep your thesis current rather than locked in a static one off model.

For example, one Kimberly-Clark Narrative might lean bullish with assumptions close to the most optimistic analyst target of about $162 per share. Another more cautious investor could anchor on the lower end near $118, and by seeing both side by side you can judge which story and which fair value feels more realistic to you.

Do you think there's more to the story for Kimberly-Clark? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kimberly-Clark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KMB

Kimberly-Clark

Manufactures and markets personal care products in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026