- United States

- /

- Personal Products

- /

- NasdaqGS:IPAR

Digital Shift to Amazon and TikTok Might Change the Case for Investing in Interparfums (IPAR)

Reviewed by Sasha Jovanovic

- Interparfums recently advanced its e-commerce and digital marketing efforts, focusing on major platforms like Amazon and TikTok to accelerate future growth.

- This operational shift is drawing market attention to the company’s capacity for innovation and improved efficiency amid broader industry pressures on demand and costs.

- We’ll examine how the company’s focus on digital channels could reshape Interparfums’ investment narrative going forward.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Interparfums Investment Narrative Recap

For shareholders in Interparfums, the story rests on believing the company can sustainably grow by deepening its digital presence and expanding its roster of luxury fragrance licenses. The latest push into e-commerce and digital marketing on platforms like Amazon and TikTok is a positive for the main growth catalyst, international sales, but recent pressures on short-term demand and industry-wide cost headwinds remain the key risks, and there is not yet evidence this effort will materially offset the near-term volatility stemming from those factors.

Among recent events, the reaffirmed guidance for FY 2025 stands out: management maintained its outlook for US$1.51 billion in net sales and US$5.35 EPS despite margin pressure, suggesting confidence in core operations. This announcement holds heightened relevance now, as investors judge the near-term impact of destocking trends and cost pressures against longer-term digital channel opportunities.

In contrast, the effect of shifting consumer preferences and channel disruption is information investors should not overlook...

Read the full narrative on Interparfums (it's free!)

Interparfums is projected to reach $1.7 billion in revenue and $206.2 million in earnings by 2028. This forecast assumes annual revenue growth of 5.0% and an earnings increase of $45.2 million from current earnings of $161.0 million.

Uncover how Interparfums' forecasts yield a $163.33 fair value, a 77% upside to its current price.

Exploring Other Perspectives

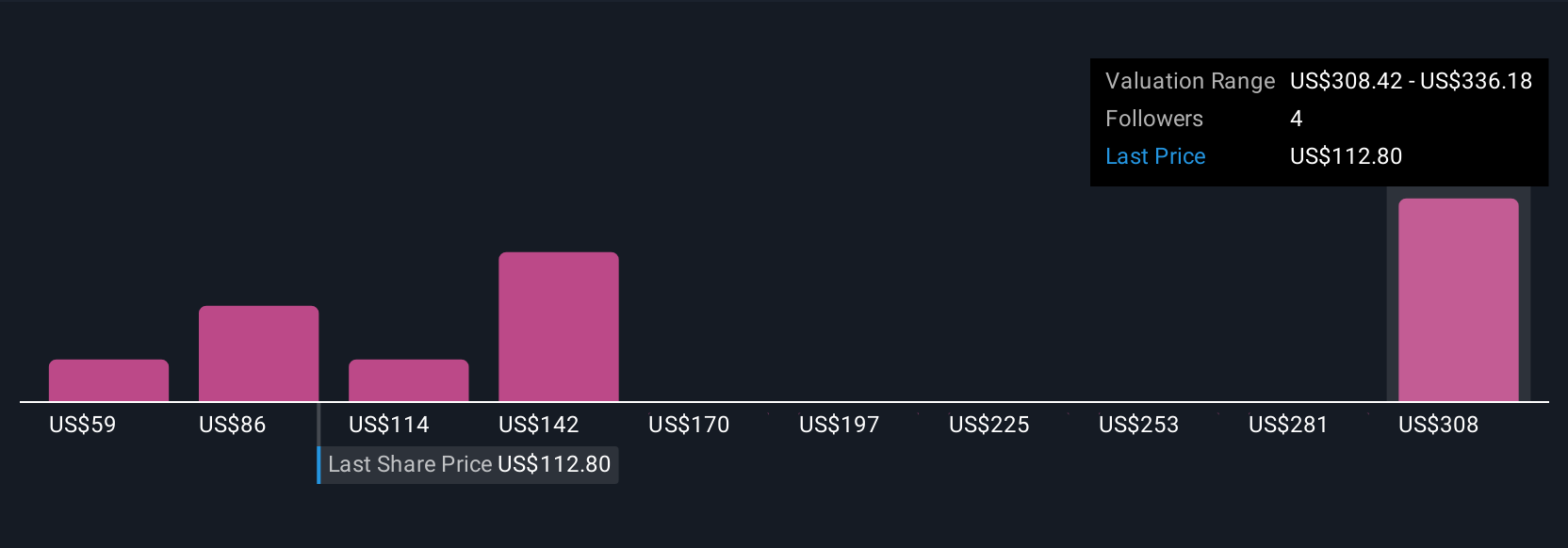

Eight Simply Wall St Community members have published fair value estimates for Interparfums ranging from as low as US$52.71 to as high as US$14,448. While projections diverge, the top catalyst remains the company’s expansion in e-commerce and digital marketing, inviting you to weigh these varied viewpoints and what they could mean for future growth.

Explore 8 other fair value estimates on Interparfums - why the stock might be worth 43% less than the current price!

Build Your Own Interparfums Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interparfums research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interparfums research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interparfums' overall financial health at a glance.

No Opportunity In Interparfums?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IPAR

Interparfums

Manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion