- United States

- /

- Food

- /

- NasdaqGM:LWAY

3 Top Growth Stocks Insiders Are Eager To Hold

Reviewed by Simply Wall St

In the current U.S. market landscape, recent volatility has been marked by sharp declines in stock indexes following geopolitical tensions and trade policy announcements, even as the Nasdaq reached new record highs before retreating. Amidst these fluctuations, growth companies with high insider ownership often draw investor interest due to the perceived alignment of interests between company insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Upstart Holdings (UPST) | 12.6% | 93.2% |

| Niu Technologies (NIU) | 37.2% | 92.8% |

| IREN (IREN) | 11.2% | 67.4% |

| FTC Solar (FTCI) | 23.1% | 63% |

| Credo Technology Group Holding (CRDO) | 11.2% | 29.4% |

| Coastal Financial (CCB) | 13.9% | 45.5% |

| Celsius Holdings (CELH) | 10.8% | 32.1% |

| Atour Lifestyle Holdings (ATAT) | 18.2% | 23.5% |

| Astera Labs (ALAB) | 12.1% | 36.6% |

| Accelerant Holdings (ARX) | 24.9% | 66.5% |

We'll examine a selection from our screener results.

Abeona Therapeutics (ABEO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Abeona Therapeutics Inc. is a clinical-stage biopharmaceutical company focused on developing gene and cell therapies for life-threatening diseases, with a market cap of $284.08 million.

Operations: Abeona Therapeutics Inc. currently does not have any reported revenue segments in its financial disclosures.

Insider Ownership: 11%

Abeona Therapeutics is gaining attention due to its innovative gene therapy, ZEVASKYN, for treating recessive dystrophic epidermolysis bullosa. Recent activation of new treatment centers enhances patient access and supports growth potential. Despite trading below estimated fair value, Abeona has shown significant profit improvement with a net income surge to US$108.83 million in Q2 2025. While insider buying isn't substantial recently, the company's revenue is forecasted to grow rapidly at 50.1% annually.

- Unlock comprehensive insights into our analysis of Abeona Therapeutics stock in this growth report.

- The valuation report we've compiled suggests that Abeona Therapeutics' current price could be quite moderate.

BioHarvest Sciences (BHST)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BioHarvest Sciences Inc. is a biotechnology company operating in Israel and the United States with a market cap of $251.02 million.

Operations: The company generates revenue through its products segment, amounting to $29.43 million, and from CDMO services, contributing $0.77 million.

Insider Ownership: 16.8%

BioHarvest Sciences stands out due to its proprietary Botanical Synthesis platform, notably producing plant-based exosomes with high bioavailability, opening new revenue streams in cosmetics and pharma. Recent private placements raised CAD 5.1 million for growth initiatives. Despite a net loss of US$4.08 million in Q2 2025, revenues increased to US$8.52 million from the previous year, indicating strong growth potential with forecasts suggesting revenue growth at 33.1% annually, surpassing market averages.

- Click to explore a detailed breakdown of our findings in BioHarvest Sciences' earnings growth report.

- According our valuation report, there's an indication that BioHarvest Sciences' share price might be on the expensive side.

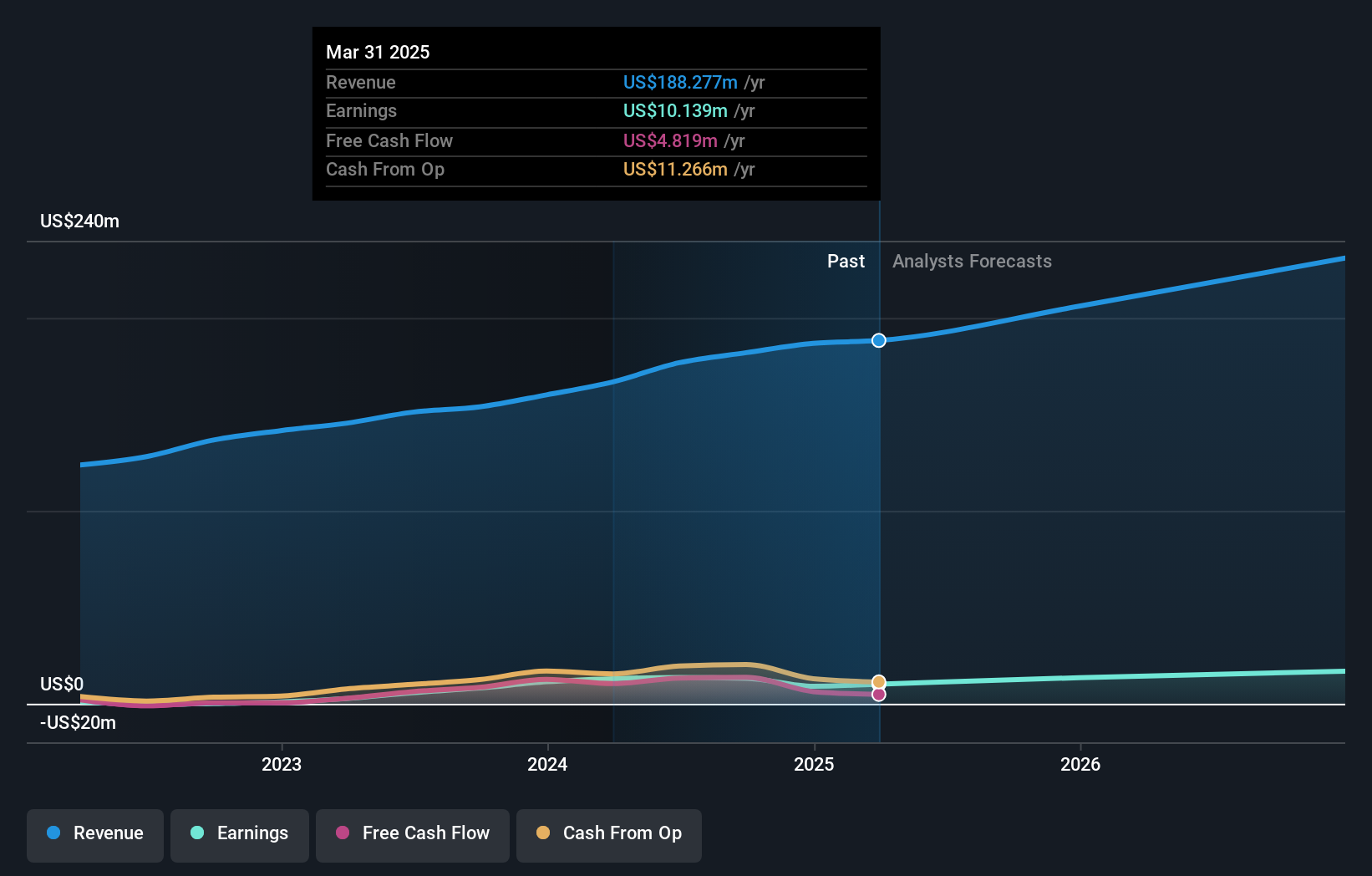

Lifeway Foods (LWAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lifeway Foods, Inc. produces and markets probiotic-based products both in the United States and internationally, with a market cap of $406.85 million.

Operations: The company's revenue is primarily derived from its Cultured Dairy Products segment, which generated $193.02 million.

Insider Ownership: 37.2%

Lifeway Foods, known for its kefir products, is experiencing robust growth with forecasted earnings expansion of 33.6% annually, outpacing the US market. Despite recent insider selling, the company maintains substantial insider ownership and has seen more buying than selling in the last three months. Lifeway's strategic initiatives include a multi-million dollar production expansion and new product launches like Muscle Mates™ and a pumpkin spice smoothie collaboration with Erewhon Market, enhancing its market presence and consumer reach.

- Delve into the full analysis future growth report here for a deeper understanding of Lifeway Foods.

- Our valuation report here indicates Lifeway Foods may be overvalued.

Seize The Opportunity

- Discover the full array of 201 Fast Growing US Companies With High Insider Ownership right here.

- Ready For A Different Approach? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LWAY

Lifeway Foods

Produces and markets probiotic-based products in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives