- United States

- /

- Healthcare Services

- /

- OTCPK:CSDX

October 2025 Penny Stocks With Promising Potential

Reviewed by Simply Wall St

The U.S. stock market has experienced a volatile period, with major indices like the Nasdaq, S&P 500, and Dow Jones Industrial Average showing varied performance amid ongoing trade tensions and impressive bank earnings. In this context, penny stocks—often associated with smaller or newer companies—continue to attract attention for their potential to offer significant growth opportunities. Despite being considered a niche investment area today, these stocks can still provide value when backed by strong financial health. Here we explore three penny stocks that stand out for their financial strength and growth potential in the current market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.81 | $396.46M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.79 | $650.99M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $4.95 | $849.73M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.90 | $55.1M | ✅ 5 ⚠️ 1 View Analysis > |

| Sensus Healthcare (SRTS) | $3.22 | $52.77M | ✅ 4 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $23.75M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.22 | $547.65M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.98 | $6.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.41 | $78.39M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 363 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Anixa Biosciences (ANIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anixa Biosciences, Inc. is a biotechnology company that develops therapies and vaccines targeting critical unmet needs in oncology, with a market cap of $148.78 million.

Operations: Anixa Biosciences, Inc. does not currently report any revenue segments.

Market Cap: $148.78M

Anixa Biosciences is a pre-revenue biotechnology company with a market cap of US$148.78 million, focusing on innovative cancer therapies and vaccines. Recent developments include the completion of patient visits in its breast cancer vaccine trial funded by the U.S. Department of Defense, and ongoing ovarian cancer CAR-T therapy trials in collaboration with Moffitt Cancer Center. Despite being unprofitable and highly volatile, Anixa maintains no debt and has sufficient cash runway for over a year. The company benefits from seasoned management and board members while leveraging partnerships with renowned research institutions to advance its pipeline.

- Click to explore a detailed breakdown of our findings in Anixa Biosciences' financial health report.

- Learn about Anixa Biosciences' future growth trajectory here.

Siebert Financial (SIEB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Siebert Financial Corp. operates in the United States, offering brokerage and financial advisory services, with a market cap of $124.11 million.

Operations: The company generates revenue primarily from its securities brokerage and asset management industry, amounting to $86.04 million.

Market Cap: $124.11M

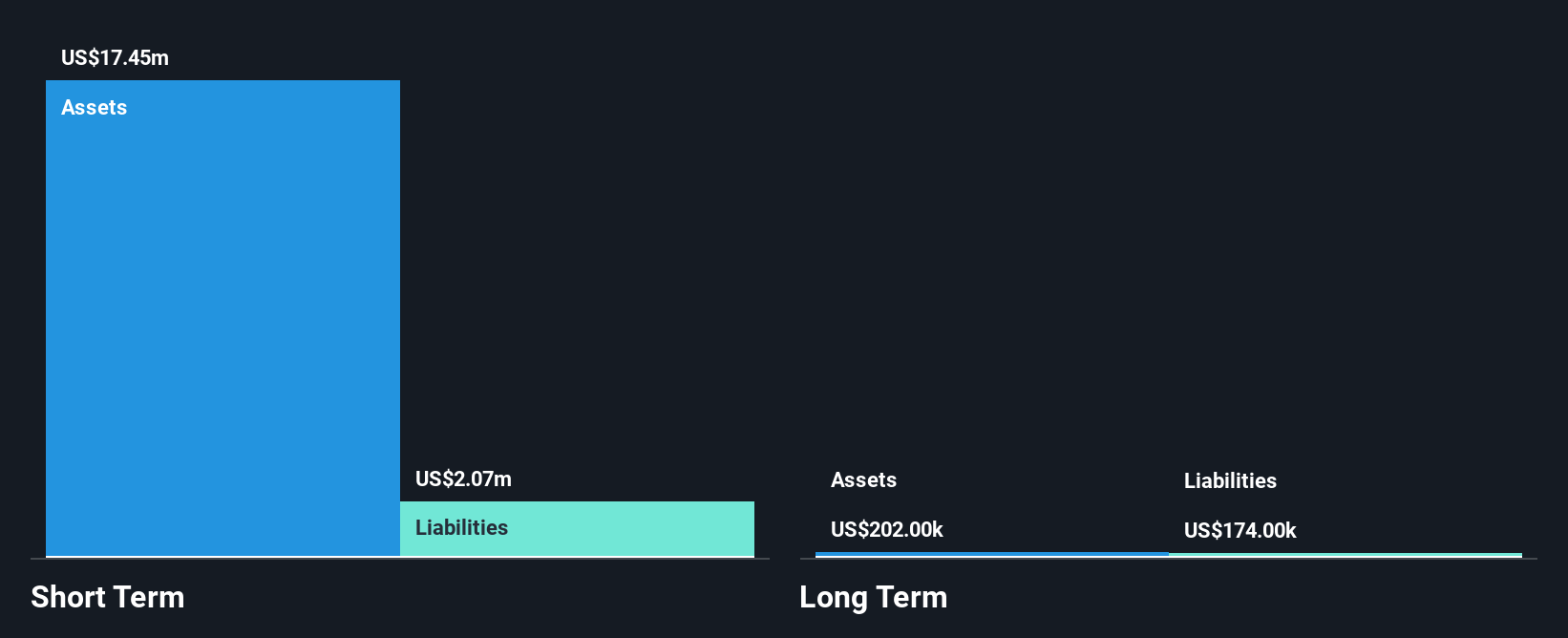

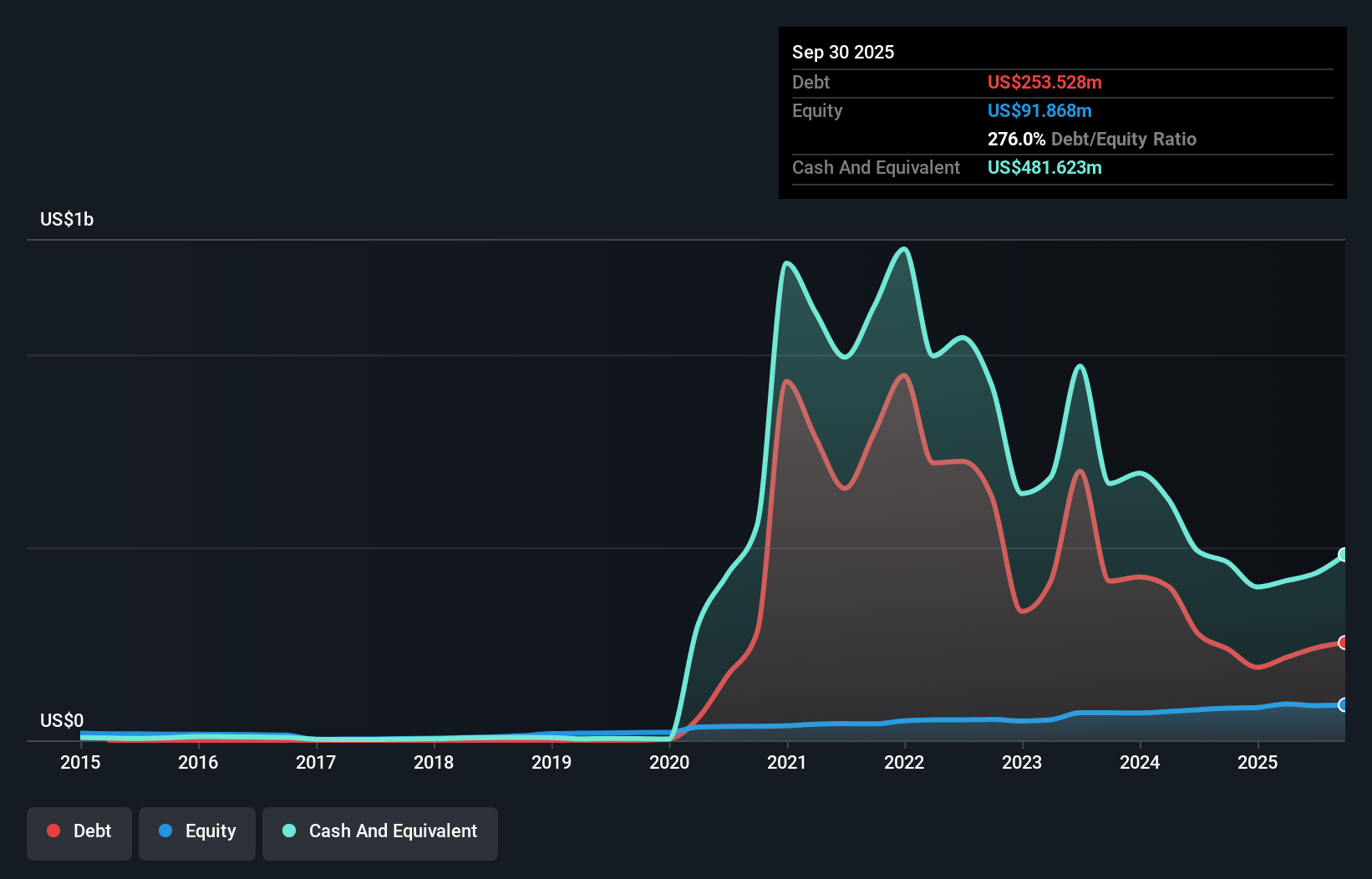

Siebert Financial Corp., with a market cap of US$124.11 million, is navigating the penny stock landscape by leveraging strategic partnerships and financial infrastructure. Recent collaborations with Next Securities aim to enhance trading platforms through AI technology, potentially broadening Siebert's market reach. Despite a recent decline in quarterly revenue to US$14.87 million and a net loss of US$4.72 million, the company maintains strong short-term asset coverage over its liabilities and has reduced its debt-to-equity ratio significantly over five years. However, challenges include negative earnings growth and low return on equity, highlighting areas needing improvement amidst evolving market conditions.

- Click here and access our complete financial health analysis report to understand the dynamics of Siebert Financial.

- Understand Siebert Financial's track record by examining our performance history report.

CS Diagnostics (CSDX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CS Diagnostics Corp. designs, manufactures, and sells wellness and medical products in Germany and internationally, with a market cap of $47.41 million.

Operations: The company generates revenue from its Internet Software & Services segment, amounting to $0.08 million.

Market Cap: $47.41M

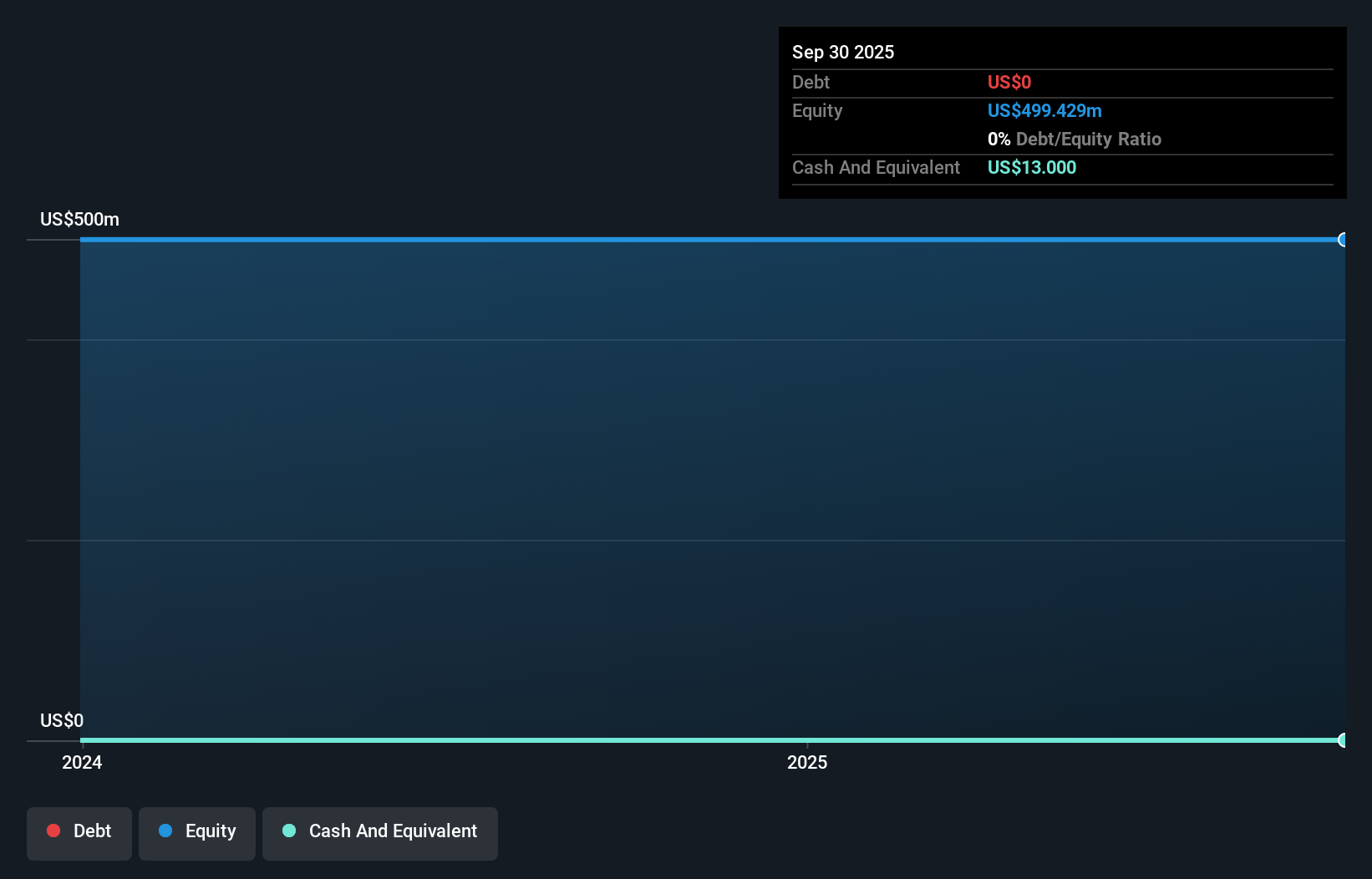

CS Diagnostics Corp., with a market cap of US$47.41 million, operates in the wellness and medical products sector and has recently transitioned to profitability despite being pre-revenue with just US$84K in revenue. The company’s short-term assets significantly exceed its liabilities, and it remains debt-free, reflecting a solid financial position amidst high share price volatility. Recent earnings reports show declining revenue but an increase in net income for the first half of 2025 compared to the previous year, suggesting cost management improvements. However, its low return on equity indicates potential challenges in generating shareholder value efficiently.

- Jump into the full analysis health report here for a deeper understanding of CS Diagnostics.

- Gain insights into CS Diagnostics' past trends and performance with our report on the company's historical track record.

Next Steps

- Explore the 363 names from our US Penny Stocks screener here.

- Contemplating Other Strategies? This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:CSDX

CS Diagnostics

Engages in designing, manufacturing, and selling of wellness and medical products in Germany and internationally.

Flawless balance sheet with medium-low risk.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success