- United States

- /

- Medical Equipment

- /

- NYSEAM:SENS

Senseonics Holdings (SENS): Evaluating Valuation After 91% Revenue Growth and Reverse Split Announcement

Reviewed by Kshitija Bhandaru

Senseonics Holdings (SENS) is getting plenty of attention after reporting preliminary third-quarter revenue of $8.1 million, up 91% from the previous year. The company also announced a 160% jump in new U.S. patient growth.

See our latest analysis for Senseonics Holdings.

These milestones come just after Senseonics’ board approved a 1-for-20 reverse stock split to streamline its share structure and support future growth. The latest moves and an eye-popping 91% quarterly revenue gain have sparked fresh interest, even as the share price slipped 16.9% in the last session. Momentum appears to be building, with the 1-year total shareholder return up nearly 40%. Longer-term total returns are still in recovery mode.

If you’re inspired by Senseonics’ growth story, now is the perfect time to spot other healthcare innovators using our curated list: See the full list for free.

With such headline-grabbing growth and a sharp price split just implemented, investors are left wondering whether today’s depressed share price is a genuine opportunity or if future gains are already reflected in the valuation.

Most Popular Narrative: 67.2% Undervalued

The narrative's fair value estimate stands at $1.43, suggesting major upside from the recent $0.47 close. But what is underpinning such a bullish stance?

Ongoing product innovation, specifically the upcoming Gemini (self-powered, wear-optional sensor) and Freedom (fully invisible CGM) platforms, demonstrates sustained R&D investment. This positions Senseonics to maintain differentiation and increase average selling prices, which can drive future revenue and long-term earnings growth.

What’s the secret behind this narrative’s ambitious target? There are high-growth forecasts, assumptions about margins, and a forward-looking profit multiple that’s rarely seen outside the tech space. Craving the specifics that fuel this audacious valuation? Dive in to uncover the bold projections behind the story.

Result: Fair Value of $1.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing losses and dependence on a single core product mean that even minor setbacks in product rollout or financing could quickly dampen bullish expectations.

Find out about the key risks to this Senseonics Holdings narrative.

Another View: Is the Market Already Pricing in the Growth?

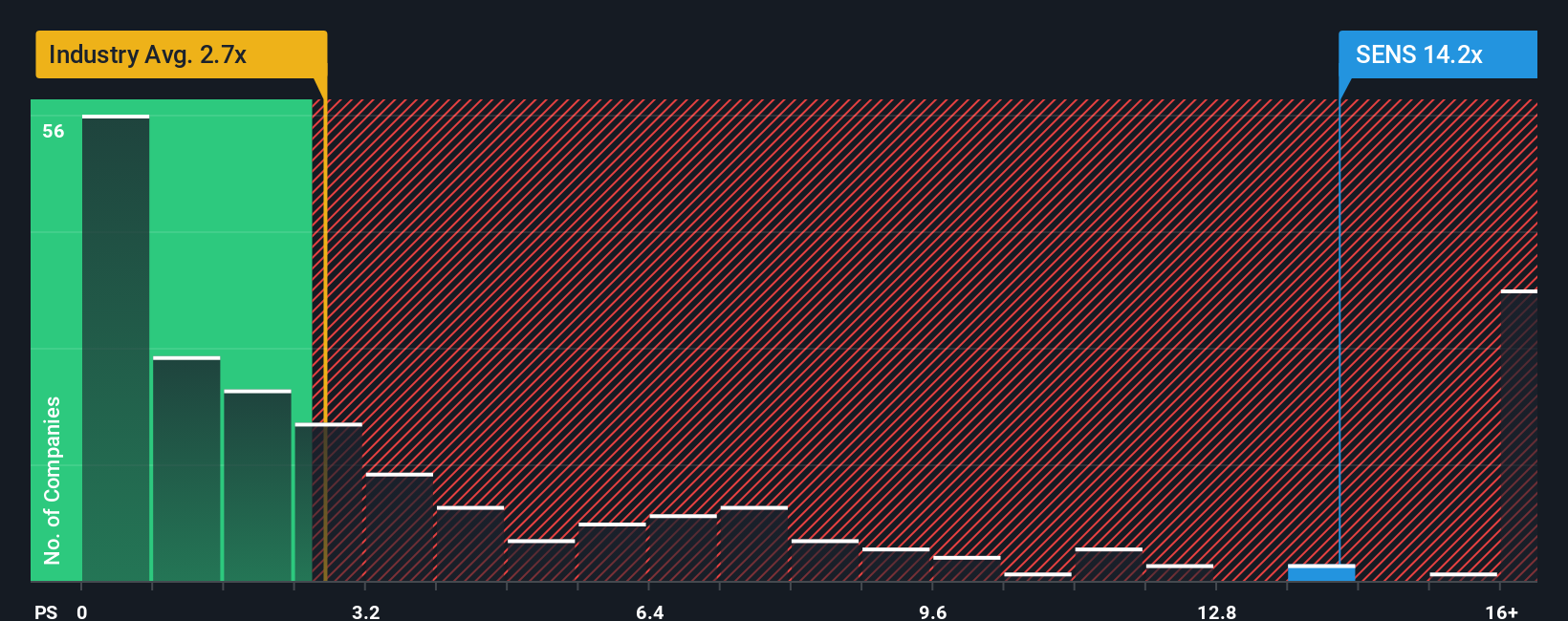

When we take a step back and compare Senseonics’ price-to-sales ratio of 15x to its industry peers, which average just 2.8x, the stock looks significantly more expensive than the sector norm. Even against the fair ratio of 2x, a level the market could eventually revert toward, the current valuation might present higher risk than reward. Can rapid growth alone justify these lofty price tags, or is the stock running ahead of itself?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Senseonics Holdings Narrative

If you want your own take or prefer an independent deep dive, you can easily build a narrative of your own in just minutes. Do it your way

A great starting point for your Senseonics Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t wait for the crowd to catch up. Take the next step by uncovering fresh opportunities tailored to your investing style using Simply Wall Street’s curated stock lists:

- Uncover hidden gems by targeting value with these 894 undervalued stocks based on cash flows that trade well below their intrinsic worth.

- Capitalize on game-changing trends and stay ahead of the curve with these 25 AI penny stocks reshaping industries with artificial intelligence.

- Grow your portfolio’s income stream by homing in on these 19 dividend stocks with yields > 3% offering robust yields above 3%, backed by strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:SENS

Senseonics Holdings

A commercial-stage medical technology company, focuses on development and manufacturing of continuous glucose monitoring (CGM) systems for people with diabetes in the United States and internationally.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives