- United States

- /

- Healthcare Services

- /

- NYSEAM:NHC

How Investors May Respond To National HealthCare (NHC) Lease Default Notice From National Health Investors

Reviewed by Simply Wall St

- In an announcement made before September 13, 2025, National Health Investors reported that an affiliate of National HealthCare Corporation was in default under a master lease due to non-monetary compliance issues that remained unresolved within the required timeframe.

- This default notice puts ongoing lease arrangements under scrutiny and could present new challenges for National HealthCare’s operational stability if unaddressed.

- We’ll consider how the potential remedies available to National Health Investors may influence National HealthCare’s investment narrative going forward.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is National HealthCare's Investment Narrative?

To be a shareholder in National HealthCare, you need to believe in the long-term resilience of its core healthcare operations and its capacity to consistently deliver services in an aging population market. Until recently, the big picture catalysts included reliable revenue growth, solid but modest profit margins, and a rising dividend. But with the affiliate’s lease default now surfacing, there’s cause for vigilance. This situation injects fresh short-term risk around lease compliance and potentially broader impacts on relationships with National Health Investors, a key partner. Short-term catalysts like dividends and operational stability could face headwinds if the lease issues escalate, although the recent uptick in the share price suggests investors may not see immediate material impact just yet. Nevertheless, this incident shifts the focus more sharply onto lease health and partner dynamics as risks to monitor.

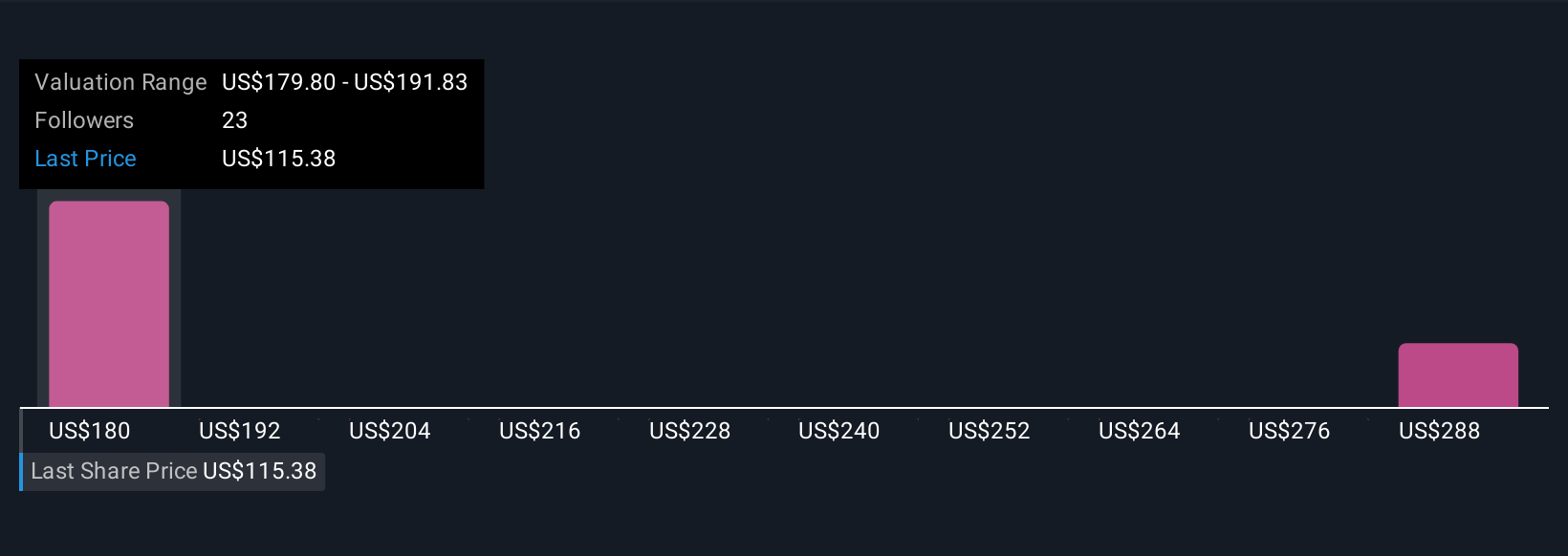

But amid the strong dividend story, lease compliance is now a risk investors shouldn’t overlook. National HealthCare's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on National HealthCare - why the stock might be worth over 2x more than the current price!

Build Your Own National HealthCare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National HealthCare research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free National HealthCare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National HealthCare's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 25 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National HealthCare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:NHC

National HealthCare

Engages in the operation of services to skilled nursing facilities, assisted and independent living facilities, homecare and hospice agencies, and health hospitals.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives