- United States

- /

- Medical Equipment

- /

- NYSEAM:MYO

Here's Why We're Not Too Worried About Myomo's (NYSEMKT:MYO) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, Myomo (NYSEMKT:MYO) shareholders have done very well over the last year, with the share price soaring by 239%. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

So notwithstanding the buoyant share price, we think it's well worth asking whether Myomo's cash burn is too risky. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Myomo

Does Myomo Have A Long Cash Runway?

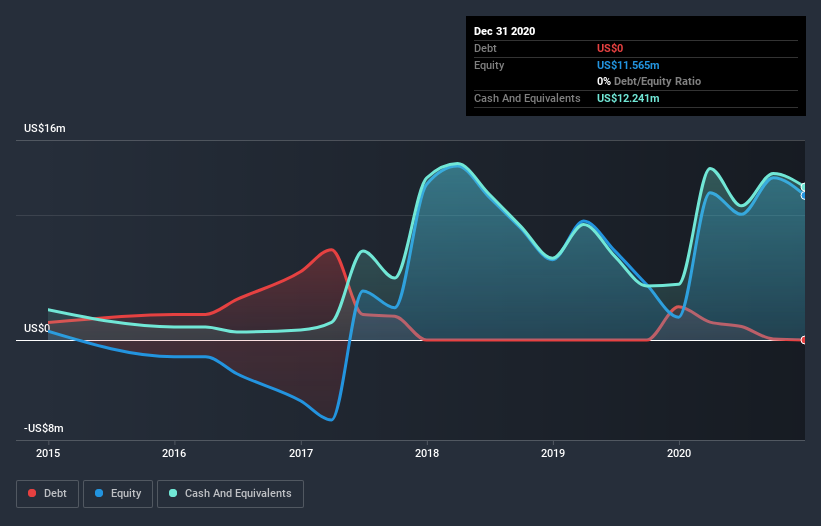

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at December 2020, Myomo had cash of US$12m and no debt. In the last year, its cash burn was US$9.1m. That means it had a cash runway of around 16 months as of December 2020. That's not too bad, but it's fair to say the end of the cash runway is in sight, unless cash burn reduces drastically. You can see how its cash balance has changed over time in the image below.

How Well Is Myomo Growing?

Myomo reduced its cash burn by 13% during the last year, which points to some degree of discipline. And arguably the operating revenue growth of 98% was even more impressive. It seems to be growing nicely. While the past is always worth studying, it is the future that matters most of all. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Myomo To Raise More Cash For Growth?

Myomo seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Myomo has a market capitalisation of US$73m and burnt through US$9.1m last year, which is 12% of the company's market value. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

So, Should We Worry About Myomo's Cash Burn?

Myomo appears to be in pretty good health when it comes to its cash burn situation. Not only was its cash burn relative to its market cap quite good, but its revenue growth was a real positive. Cash burning companies are always on the riskier side of things, but after considering all of the factors discussed in this short piece, we're not too worried about its rate of cash burn. Taking a deeper dive, we've spotted 4 warning signs for Myomo you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

When trading Myomo or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSEAM:MYO

Myomo

A wearable medical robotics company, designs, develops, and produces myoelectric orthotics for people with neuromuscular disorders in the United States, China, Germany, and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives