- United States

- /

- Medical Equipment

- /

- NYSEAM:ELMD

Announcing: Electromed (NYSEMKT:ELMD) Stock Soared An Exciting 405% In The Last Five Years

It hasn't been the best quarter for Electromed, Inc. (NYSEMKT:ELMD) shareholders, since the share price has fallen 11% in that time. But that doesn't undermine the fantastic longer term performance (measured over five years). To be precise, the stock price is 405% higher than it was five years ago, a wonderful performance by any measure. Arguably, the recent fall is to be expected after such a strong rise. But the real question is whether the business fundamentals can improve over the long term.

Check out our latest analysis for Electromed

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

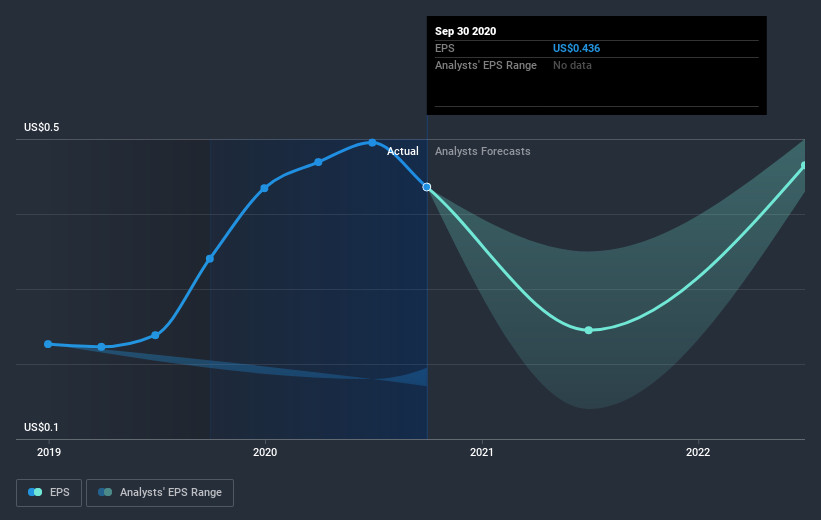

During five years of share price growth, Electromed achieved compound earnings per share (EPS) growth of 27% per year. This EPS growth is slower than the share price growth of 38% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Electromed has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Electromed will grow revenue in the future.

A Different Perspective

Investors in Electromed had a tough year, with a total loss of 1.0%, against a market gain of about 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 38%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Electromed is showing 3 warning signs in our investment analysis , you should know about...

Of course Electromed may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

When trading Electromed or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Electromed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSEAM:ELMD

Electromed

Develops, manufactures, markets, and sells airway clearance therapy and related products that apply high frequency chest wall oscillation (HFCWO) therapy in pulmonary care for patients of various ages in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives