- United States

- /

- Medical Equipment

- /

- NYSE:ZBH

Zimmer Biomet Holdings (NYSE:ZBH) Expands with NeuroOne Alliance and Z1 Hip System Launch

Reviewed by Simply Wall St

Zimmer Biomet Holdings (NYSE:ZBH) is navigating a dynamic phase with its recent strategic alliance with NeuroOne and the launch of the Z1™ Femoral Hip System, which are poised to enhance its market offerings and revenue potential. However, the company faces challenges such as lowered revenue growth expectations and a high debt-to-equity ratio, which could impact its financial stability. Readers should anticipate a detailed discussion on how Zimmer Biomet plans to leverage its innovative product portfolio while addressing these financial constraints.

Get an in-depth perspective on Zimmer Biomet Holdings's performance by reading our analysis here.

Key Assets Propelling Zimmer Biomet Holdings Forward

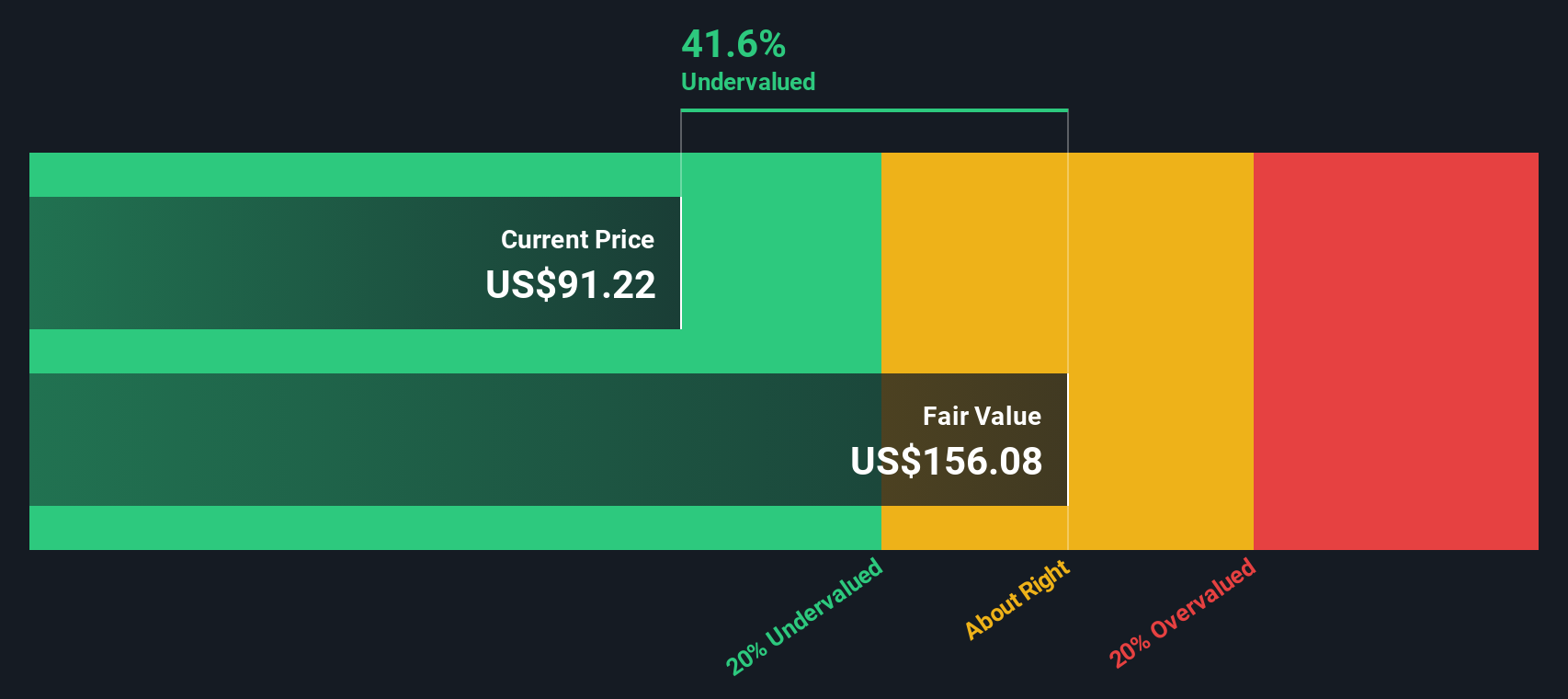

Zimmer Biomet's financial health is underscored by a remarkable profit growth of 128.4% over the past year, with consistent earnings growth of 24.1% annually over five years. The company has maintained a stable net profit margin of 14.3%, up from 6.5% the previous year. Its dividends, supported by a low payout ratio of 18.2%, have been reliable for a decade. The seasoned management team, with an average tenure of 6.3 years, plays a crucial role in strategic decision-making, enhancing corporate stability. Trading at a P/E ratio of 19.7x, significantly below the industry average, Zimmer Biomet appears undervalued, indicating potential for market appreciation.

To dive deeper into how Zimmer Biomet Holdings's valuation metrics are shaping its market position, check out our detailed analysis of Zimmer Biomet Holdings's Valuation.Strategic Gaps That Could Affect Zimmer Biomet Holdings

Despite its profitability, Zimmer Biomet faces challenges with slower forecasted earnings and revenue growth compared to the US market averages. The company's Return on Equity remains low at 8.8%, with a high net debt to equity ratio of 49%. These financial constraints highlight potential vulnerabilities. Furthermore, the recent lowering of corporate guidance, with expected revenue growth reduced to 3.5%-4.0%, reflects these strategic gaps.

Explore the current health of Zimmer Biomet Holdings and how it reflects on its financial stability and growth potential.Future Prospects for Zimmer Biomet Holdings in the Market

The company has opportunities for expansion through strategic alliances, such as the exclusive distribution agreement with NeuroOne for the OneRF™ Ablation System, promising additional revenue streams. The launch of the Z1™ Femoral Hip System, alongside the acquisition of OrthoGrid Systems, positions Zimmer Biomet to capitalize on innovative product offerings. These initiatives could bolster its market presence and attract value-focused investors.

See what the latest analyst reports say about Zimmer Biomet Holdings's future prospects and potential market movements.External Factors Threatening Zimmer Biomet Holdings

Zimmer Biomet's financial results are susceptible to large one-off losses, impacting profitability. The high debt level poses risks to financial stability, especially in adverse market conditions. Moreover, the company faces competitive pressures, necessitating strategic adjustments to maintain its market share. Regulatory hurdles and economic headwinds, such as inflation, further complicate its operational landscape.

To gain deeper insights into Zimmer Biomet Holdings's historical performance, explore our detailed analysis of past performance.Conclusion

Zimmer Biomet's impressive profit growth and stable net profit margins, coupled with a reliable dividend history, underscore its solid financial foundation. The company must address strategic gaps, such as its lower forecasted earnings and high debt levels, which could hinder its growth relative to the market. However, its strategic initiatives, like partnerships and innovative product launches, offer promising avenues for expansion and could enhance its market position. Trading at a Price-To-Earnings Ratio of 19.7x, significantly below industry peers, suggests potential for market appreciation, provided the company effectively navigates its financial and competitive challenges.

Key Takeaways

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Zimmer Biomet Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About NYSE:ZBH

Zimmer Biomet Holdings

Operates as a medical technology company worldwide.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives