- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (VEEV): Valuation Spotlight as Leading Biopharma Clients Adopt Vault CRM and Investor Day Approaches

Reviewed by Kshitija Bhandaru

Veeva Systems (VEEV) has been drawing attention lately, thanks to recent moves by leading biopharma companies like Bristol Myers Squibb and Merck adopting its Vault CRM platform. Investors are also watching for upcoming updates at the Virtual Investor Day on October 16.

See our latest analysis for Veeva Systems.

The recent wave of high-profile biopharma clients embracing Veeva’s Vault CRM adds further momentum to the company, especially with anticipation building around the upcoming Virtual Investor Day. While the share price has seen a gradual gain so far this year, Veeva’s one-year total shareholder return of nearly 47% indicates durable performance and ongoing optimism about its growth outlook.

If you’re interested in seeing how other innovators in the healthcare space are making their mark, check out the full range of companies with our See the full list for free..

But with shares up nearly 47% over the past year and excitement building around major milestones, are investors overlooking hidden value, or has the future growth story already been fully priced in?

Most Popular Narrative: 5% Undervalued

Veeva Systems’ fair value according to the leading narrative stands above its last close, hinting at potential upside that the current share price does not yet fully reflect. The debate now centers not just on future growth, but on what is propelling those optimistic projections.

The resolution of the long-standing dispute with IQVIA removes critical data interoperability barriers, enabling Veeva to fully integrate industry-leading datasets into its Commercial Cloud. This should materially expand its addressable market, improve product adoption across multiple commercial applications, and accelerate top-line revenue growth over the next several years. Veeva's rapid progress embedding advanced AI agents directly within its Vault platform, across both R&D and Commercial suites, positions it as an essential workflow and automation partner amid the rising complexity of personalized medicine, genomics, and data-driven trials. This potentially supports higher pricing power, platform stickiness, and net margin expansion in the medium to long term.

Want to know what’s hidden behind this ambitious price target? Hint: ground-breaking earnings forecasts, rising profit margins and bold calls about how much customers will spend. Discover which powerful combination of financial drivers and market catalysts gets analysts to this fair value.

Result: Fair Value of $316.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer resistance to change or aggressive competition from tech giants could slow Veeva’s growth and test analyst optimism in the future.

Find out about the key risks to this Veeva Systems narrative.

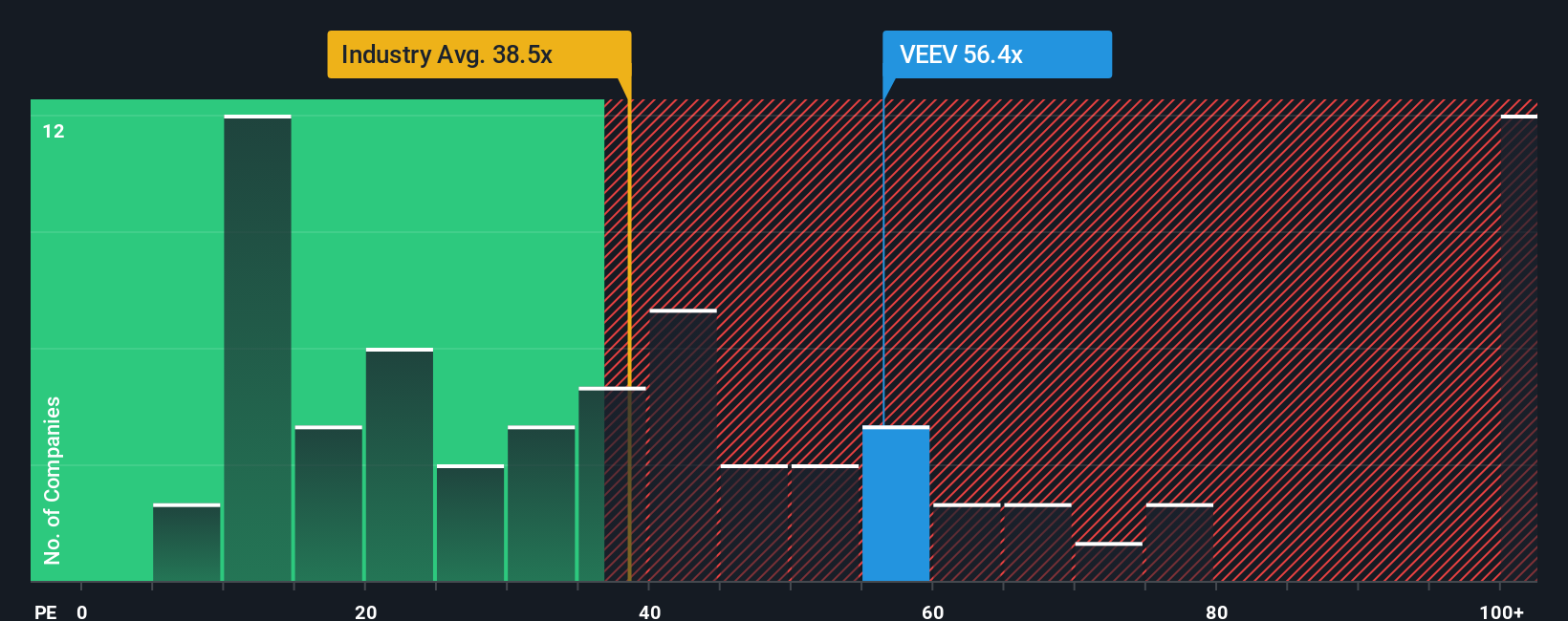

Another View: Multiples Paint a Pricier Picture

Looking from a different angle, Veeva’s current price-to-earnings ratio of 60.9x stands well above both the global healthcare services industry average of 38.4x and its peer average of 56.9x. When compared to the fair ratio of 32.3x, this sizable gap signals a potentially elevated valuation risk. Could the market be a little too optimistic, or does future growth justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Veeva Systems Narrative

If you see things differently or are curious to dig deeper on your own terms, you can easily shape your own view in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Veeva Systems.

Looking for More Investment Ideas?

Smart investors never stop at just one opportunity. Tap into new themes and smart strategies with these unique stock picks that could help you stay ahead of the curve.

- Catalyze your portfolio with these 24 AI penny stocks by harnessing the explosive potential of artificial intelligence across industries from healthcare to finance.

- Unlock cash flow opportunities by seeking out these 900 undervalued stocks based on cash flows that the market may have overlooked despite strong fundamentals and growth potential.

- Maximize your income by targeting these 19 dividend stocks with yields > 3% designed to deliver consistent returns even in uncertain conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives