- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (VEEV) Secures Merck Commitment To Enhance Global CRM Capabilities

Reviewed by Simply Wall St

Veeva Systems (VEEV) recently experienced a 31% increase in share price over the last quarter, a period marked by significant developments for the company. Key to this movement was Merck's commitment to implement Veeva Vault CRM, enhancing commercial execution during Merck's critical launch phase. Additionally, Veeva's expanded collaboration with Amazon Web Services and the adoption of its applications by major medtech firms emphasized its industry footprint. This was set against a backdrop of a strong market performance, with record highs in major indexes, which supported Veeva's rise in tandem with broader positive market trends.

Buy, Hold or Sell Veeva Systems? View our complete analysis and fair value estimate and you decide.

The recent surge in Veeva Systems' share price can significantly influence its future narrative. The strategic partnership with Merck and the expanded collaboration with Amazon Web Services could enhance Veeva's position in the life sciences industry, bolstering its revenue. Additionally, the adoption of Veeva's application by major medtech firms highlights its growing footprint, potentially elevating its revenue and earnings forecasts. Over the past year, the company achieved a total return of 50.96%, indicative of strong performance. Comparatively, its one-year earnings and revenue growth exceeded both the broader U.S. market and the Healthcare Services industry.

The recent 31% increase in share price is noteworthy when juxtaposed against the analysts’ price target of US$295.45, which suggests a 5.5% potential upside from the current share price of approximately US$282.29. This relatively small discount to the target indicates that much of the positive momentum stemming from the partnerships and expansions may already be priced in. While analysts forecast Veeva's earnings to grow by 15.24% annually, these strategic moves with Merck and other partners could support achieving or even surpassing such estimates in the future.

Examine Veeva Systems' past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

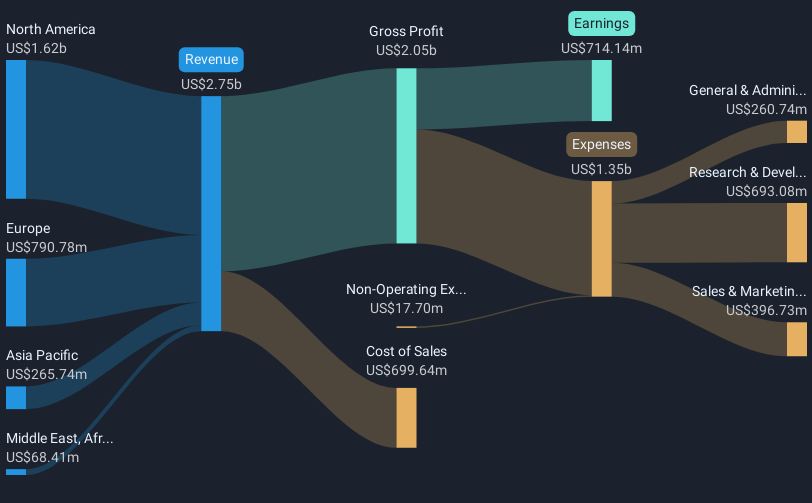

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives