- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (VEEV): Assessing Valuation After Winning Gilead Sciences as a Vault CRM Client

Reviewed by Kshitija Bhandaru

If you’ve been following Veeva Systems (VEEV), the announcement that Gilead Sciences is adopting Veeva Vault CRM likely caught your attention. Gilead’s decision to go with Veeva’s platform isn’t just another client addition; it puts a spotlight on Veeva’s growing reputation among major players in the life sciences industry. With Vault CRM offering features like AI-driven pre-call planning and voice control, this latest partnership signals stronger traction for Veeva’s cloud offerings in a competitive market.

This news arrives at a time when Veeva’s stock performance has been a bit of a mixed bag. Shares have climbed roughly 32% since the start of the year, outpacing the market, though there have been some dips in the past month. Still, the longer-term trend remains solid, with nearly 71% growth over three years. Other recent updates, like positive earnings estimates, suggest momentum could be building; though investors have also noticed the premium valuation that comes with it.

Now comes the big question: after gains this year and a high-profile client win, is Veeva Systems undervalued, or is Wall Street already factoring in all its future growth?

Most Popular Narrative: 12.3% Undervalued

The most widely followed narrative suggests Veeva Systems is currently trading at a notable discount to its estimated fair value, indicating potential upside if projections materialize.

The resolution of the long-standing dispute with IQVIA removes critical data interoperability barriers. This enables Veeva to fully integrate industry-leading datasets into its Commercial Cloud, which should materially expand its addressable market, improve product adoption across multiple commercial applications, and accelerate top-line revenue growth over the next several years.

Just how ambitious are the financial targets behind this optimism? This narrative builds its outlook on an aggressive set of assumptions for future sales, profits, and margins. Want to peek behind the curtain and see which bold projections power that double-digit discount? The equation here is more surprising than you think.

Result: Fair Value of $316.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent competition from larger tech firms and slow customer adoption of AI-driven solutions could dampen Veeva’s long-term growth story.

Find out about the key risks to this Veeva Systems narrative.Another View: Not So Cheap by Traditional Metrics

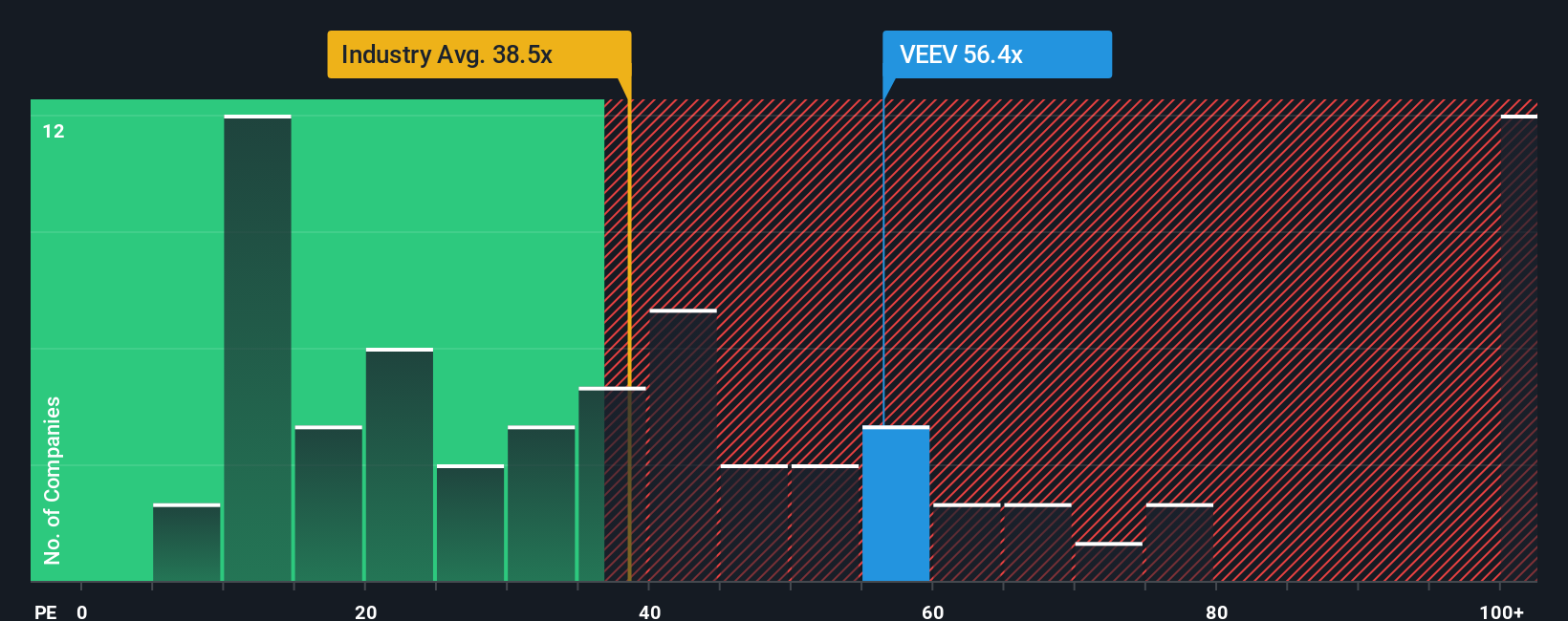

While analyst forecasts highlight potential undervaluation, a more conventional measure offers a challenge. Looking at standard valuation multiples compared to the broader healthcare industry, Veeva appears expensive by this yardstick. Which method tells the truer story?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Veeva Systems to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Veeva Systems Narrative

If these views aren’t quite what you see in the data, or if you’re the type to dig deeper, shaping your own perspective takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Veeva Systems.

Looking for More Smart Investing Ideas?

Don’t let the best stock opportunities pass you by. Take a fresh look at the market with three proven strategies and find your next winning investment today.

- Tap into income potential by checking out companies offering dividend stocks with yields > 3%. These can boost your portfolio with reliable yields.

- Catch tomorrow’s technology leaders early by searching for breakthrough innovators among the top picks in AI penny stocks.

- Seize value now with access to a handpicked selection of undervalued stocks based on cash flows. These are trading at a discount based on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives