- United States

- /

- Healthtech

- /

- NYSE:VEEV

Veeva Systems (NYSE:VEEV) Unveils Veeva AI To Boost Productivity In Life Sciences

Reviewed by Simply Wall St

Veeva Systems (NYSE:VEEV) recently announced the integration of Veeva AI into its Vault Platform to enhance productivity within the life sciences sector. This product initiative may have contributed some weight to the company's 7% stock price increase over the past week. However, given that the broader market rose by 5%, with major indexes remaining largely positive despite some notable corporate earnings misses and macroeconomic concerns, Veeva's price move aligns with these trends. The company's AI-driven innovations likely provided an additional positive sentiment, even as the market navigated economic uncertainties.

Buy, Hold or Sell Veeva Systems? View our complete analysis and fair value estimate and you decide.

The recent integration of Veeva AI into the Vault Platform could significantly enhance Veeva Systems' operational efficiencies and strengthen its position in the life sciences sector. This development aligns with the broader narrative of leveraging AI-enhanced productivity, which could translate into improved revenue streams and margin enhancements. Despite this potential, Veeva's stock price, although having risen 7% recently, mirrors general market trends influenced by a 5% market uptick. Over a longer horizon, Veeva's total shareholder return, including dividends and share price gains, was 26.10% over the past three years.

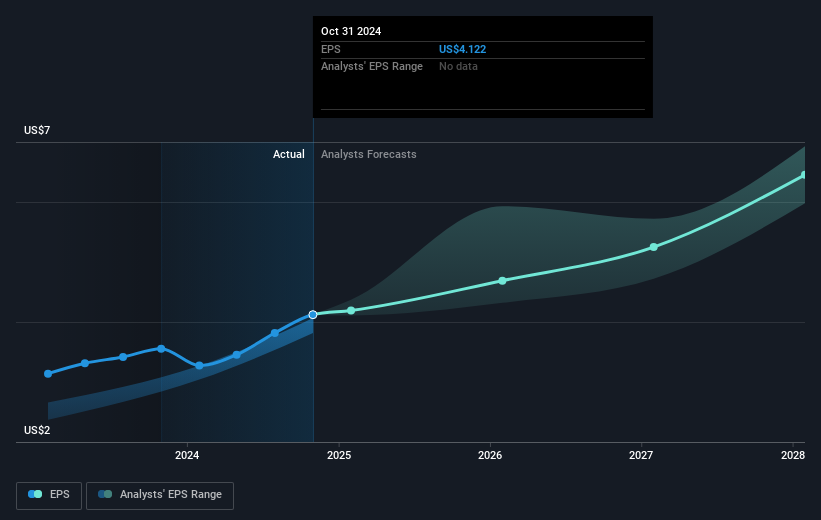

Comparatively, the company's one-year performance surpassed the US market, which returned 9.9%. This suggests Veeva's resilience in industry-specific and market conditions. The announcement may contribute positively to revenue forecasts, potentially accelerating annual growth rates as interest in AI solutions grows. With earnings expected to rise from US$714.14 million to US$1.1 billion by April 2028, AI enhancements could support these projections. The current price of US$215.78 remains somewhat below the consensus price target of US$263.14, indicating room for appreciation if growth assumptions align with analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VEEV

Veeva Systems

Provides cloud-based software for the life sciences industry in North America, Europe, the Asia Pacific, the Middle East, Africa, and Latin America.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives