- United States

- /

- Healthcare Services

- /

- NYSE:UNH

Will UnitedHealth (UNH) Guidance Reaffirmation Reveal More About Its Approach to Medicare Advantage Stability?

Reviewed by Simply Wall St

- UnitedHealth Group recently held shareholder and analyst calls to reaffirm its adjusted 2025 earnings per share guidance and discuss preliminary Centers for Medicare & Medicaid Services (CMS) Medicare Advantage star ratings for Star Year 2026 and Payment Year 2027.

- This communication addressed key regulatory and performance topics, signaling continued operational visibility and management’s focus on stabilizing Medicare Advantage program outcomes.

- Next, we'll examine how reaffirming 2025 earnings guidance may influence UnitedHealth Group's investment narrative and future business outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

UnitedHealth Group Investment Narrative Recap

To own shares in UnitedHealth Group, an investor needs to believe in the company’s ability to manage regulatory changes in Medicare Advantage and maintain stable long-term earnings despite near-term volatility. The company’s decision to reaffirm its 2025 adjusted earnings per share guidance during its recent calls does not meaningfully alter the core short-term catalyst, restoring stability in Medicare Advantage performance, nor does it address the largest immediate risk: unexpected changes in care utilization and member profiles that could impact projected earnings. Of the company’s recent announcements, the affirmation of its quarterly cash dividend stands out as most relevant here. It highlights UnitedHealth’s ongoing commitment to returning capital to shareholders, which remains a key pillar of value for investors even as the business addresses operational challenges around Medicare program transitions and short-term earnings headwinds. However, it’s important to also consider the potential effects of ongoing funding pressures on Medicare Advantage reimbursement schedules, as these could represent...

Read the full narrative on UnitedHealth Group (it's free!)

UnitedHealth Group is projected to achieve $501.1 billion in revenue and $20.0 billion in earnings by 2028. This outlook implies a 5.8% annual revenue growth rate, but a decrease in earnings of $1.3 billion from current earnings of $21.3 billion.

Uncover how UnitedHealth Group's forecasts yield a $333.42 fair value, in line with its current price.

Exploring Other Perspectives

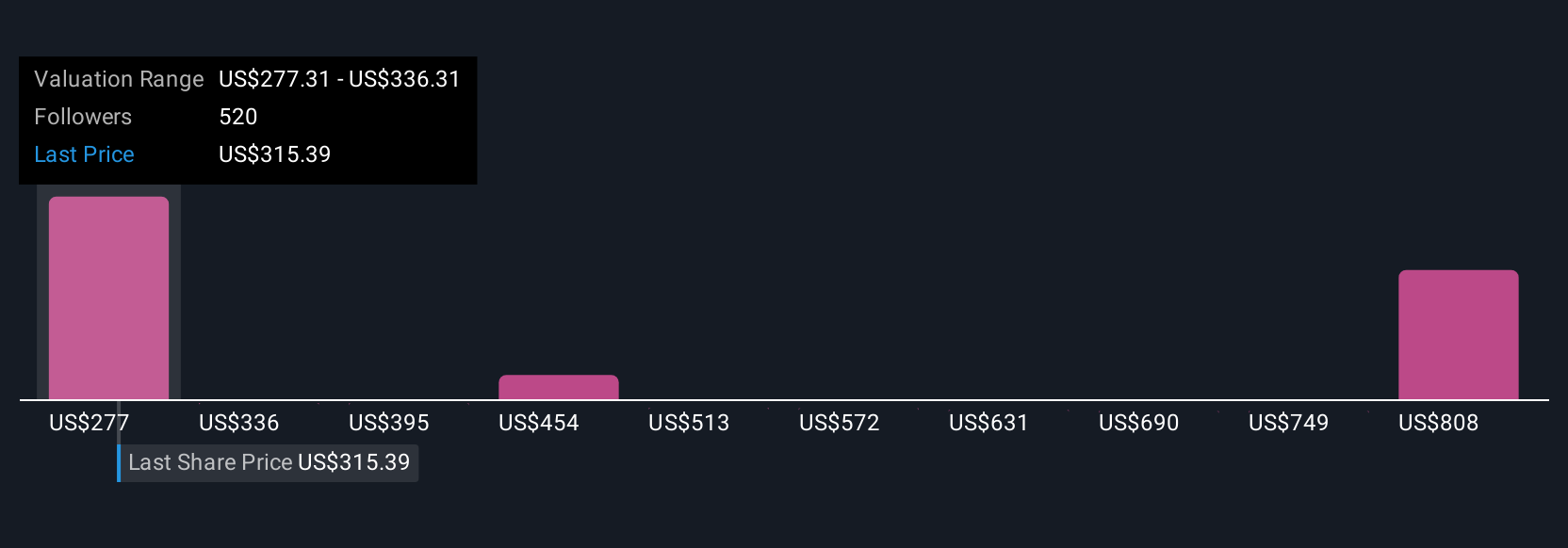

Eighty-three private investors in the Simply Wall St Community estimate UnitedHealth’s fair value between US$306 and US$867 per share. With reimbursement and funding changes in focus, these wide-ranging views offer you a chance to explore several alternative perspectives and assess how policy shifts may influence future business results.

Explore 83 other fair value estimates on UnitedHealth Group - why the stock might be worth over 2x more than the current price!

Build Your Own UnitedHealth Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your UnitedHealth Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free UnitedHealth Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate UnitedHealth Group's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives