- United States

- /

- Healthcare Services

- /

- NYSE:UNH

Where Does UnitedHealth Go Next After a 34% Drop and Recent Rebound?

Reviewed by Bailey Pemberton

If you’re holding shares of UnitedHealth Group or just thinking about jumping in, it’s easy to wonder where the stock is headed next. After a turbulent stretch, UnitedHealth has recently picked up some steam, climbing 1.5% in the last week and 8.5% across the past month. Still, looking at the chart over the past year tells a more dramatic story: the stock is down over 34% in the last 12 months and almost 28% in the last three years, reflecting a mix of changing investor sentiment and the occasional headline that rattled confidence.

Much of that nervousness can be traced back to evolving government healthcare regulations and, more recently, news around potential increases in medical costs that could challenge profit margins for large insurers. These developments have left some investors questioning whether UnitedHealth’s recent uptick is a sign of a longer-term rebound or just a brief pause in the downward trend.

From a pure numbers perspective, there’s some cause for optimism. UnitedHealth currently holds a value score of 4 out of 6, which means it checks the box for being undervalued in the majority of the criteria that analysts look at. In other words, according to several traditional measures, the company could be a bargain after all that selling pressure.

So what exactly do these valuation numbers mean, and which methods are the most reliable? Let’s run through the most widely used approaches to valuing UnitedHealth Group, and stick around to see why the best way to really size up its value might not be what you expect.

Why UnitedHealth Group is lagging behind its peers

Approach 1: UnitedHealth Group Discounted Cash Flow (DCF) Analysis

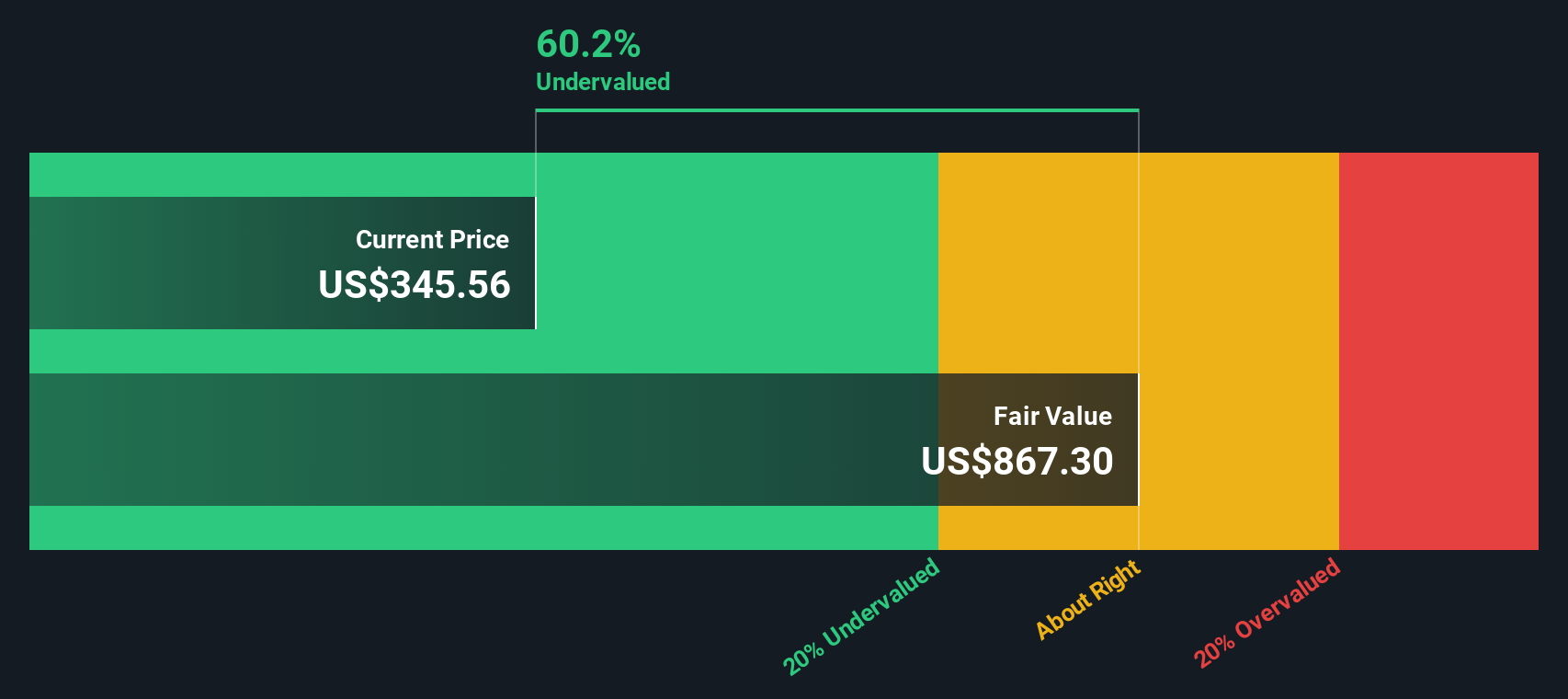

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today using a required rate of return. Essentially, it asks: what are all the future dollars UnitedHealth is expected to generate, and what are those dollars worth right now?

For UnitedHealth Group, the latest reported Free Cash Flow stands at $25.2 Billion. Analysts supply estimates for the next few years, projecting steady growth. By 2029, annual Free Cash Flow is forecast to reach about $27.1 Billion. Beyond 2029, projections are extrapolated, but the growth rate slows, reflecting a mature stage for the business.

Taking all these cash flows and discounting them to the present, the DCF model calculates an intrinsic value of $853.86 per share. This figure is notably higher than UnitedHealth’s recent share price, implying the stock trades at a 57.2% discount to its intrinsic value.

For investors, this DCF analysis signals that UnitedHealth shares are significantly undervalued based on cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UnitedHealth Group is undervalued by 57.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

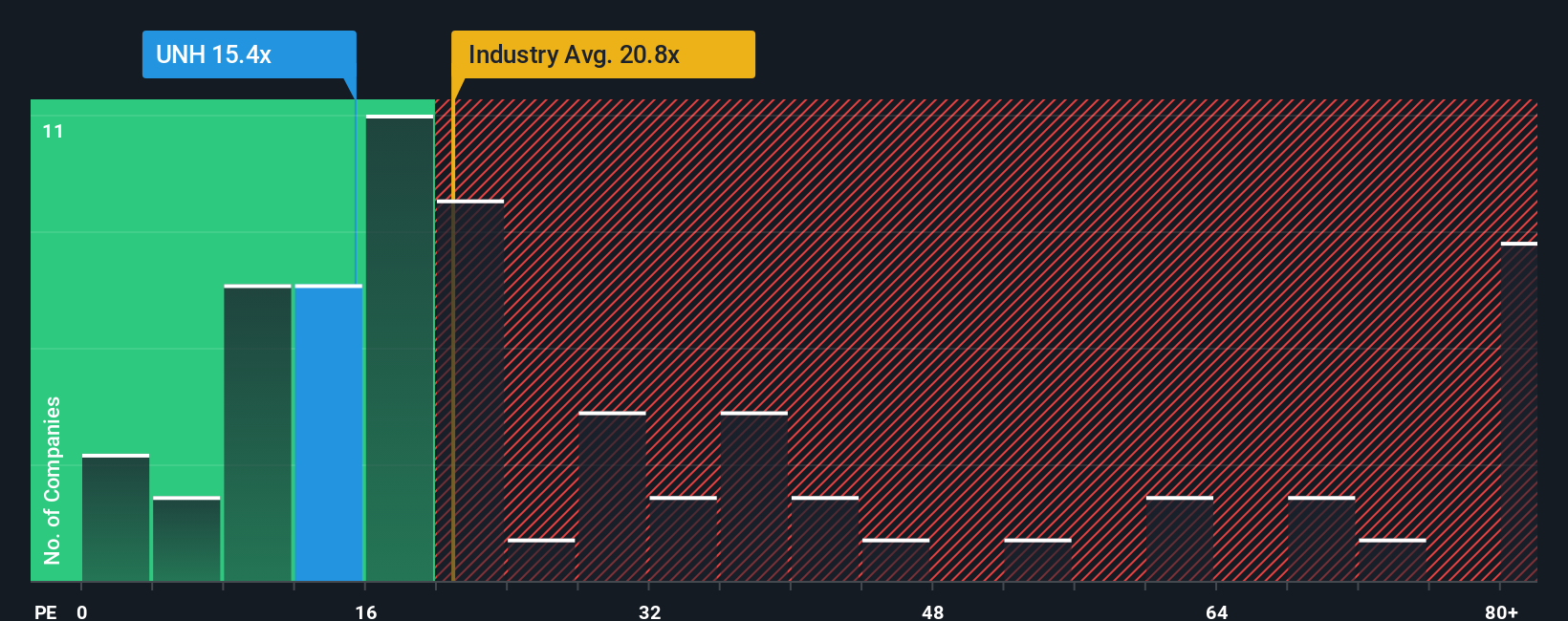

Approach 2: UnitedHealth Group Price vs Earnings (PE)

For strong, profitable companies like UnitedHealth Group, the Price-to-Earnings (PE) ratio is often the most trusted measure for valuation. Investors favor this multiple because it puts the current share price in context with earnings power, offering a direct way to gauge how much the market is willing to pay for one dollar of net income.

The PE ratio can seem straightforward, but it is heavily influenced by expectations for future growth and perceived risk. Higher growth prospects or lower risk typically justify a higher “normal” PE, while uncertainty or sluggish growth can push it lower.

Currently, UnitedHealth Group trades at a PE of 15.54x. This is below both the healthcare industry average of 21.51x and the peer group average of 13.71x. At first glance, this might suggest the stock is attractively priced relative to the broader sector and its closest rivals.

However, Simply Wall St’s proprietary “Fair Ratio” offers an upgraded lens for valuation. Unlike blanket peer or industry averages, the Fair Ratio customizes the PE benchmark for UnitedHealth by factoring in the company’s unique growth outlook, profit margins, risk profile, industry dynamics, and even its market size. This tailored approach aims to give a far more accurate sense of what UnitedHealth “should” be worth, taking all factors into account.

For UnitedHealth, the Fair Ratio stands at 39.21x, which is substantially higher than the company’s current PE. This suggests the market is pricing UnitedHealth well below what would be expected given its financial strengths and opportunities.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UnitedHealth Group Narrative

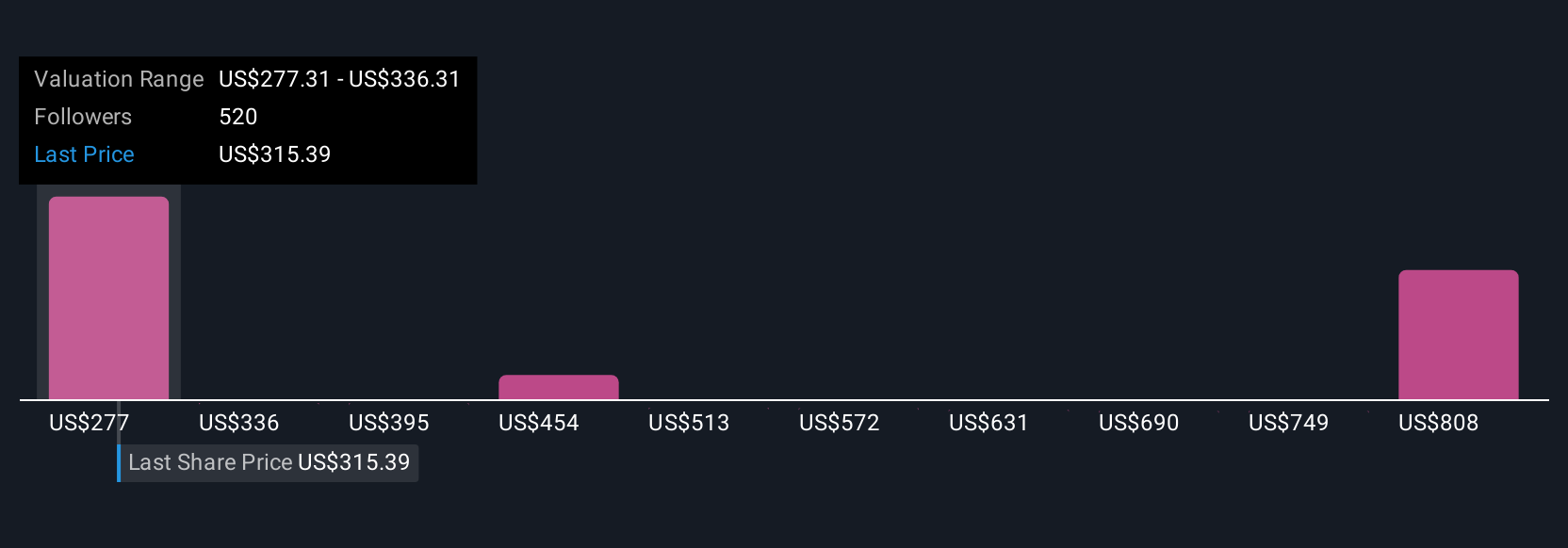

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a clear, easy-to-use tool that lets you define your story about a company—your perspective on its future revenue, earnings, and margins—instead of simply accepting the consensus or basic data.

Instead of focusing only on a single number, Narratives help you build a bridge from a company’s unique journey to a detailed financial forecast, and finally to a fair value estimate. On Simply Wall St’s platform, millions of investors use the Community page to create and compare Narratives quickly, making it accessible regardless of your experience.

By comparing a Narrative’s Fair Value with the current share price, you can decide whether it’s the right time to buy or sell. And because these Narratives update automatically when key news, earnings, or sector shifts happen, you always have a living, relevant view of where UnitedHealth might go next.

For example, the most optimistic Narrative for UnitedHealth Group currently values the shares at $626, while the most cautious puts it at only $198, showing just how much your interpretation of UnitedHealth’s story and numbers can drive your own investment decision.

Do you think there's more to the story for UnitedHealth Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives