- United States

- /

- Healthcare Services

- /

- NYSE:UNH

UnitedHealth Group (UNH): Evaluating Valuation After Recent Share Price Swings

Reviewed by Kshitija Bhandaru

UnitedHealth Group (UNH) shares ticked slightly lower this week, continuing a stretch of mixed returns for the US-based health insurer. Despite modest swings, investors are closely watching for signs of broader shifts in sentiment or performance.

See our latest analysis for UnitedHealth Group.

UnitedHealth Group’s share price movement has been a rollercoaster this year, with a sharp 26.19% gain in the past 90 days. This stands out against a backdrop of longer-term underperformance. While momentum has returned in recent months, the company’s total shareholder return over the past year remains down 35.62%. This reflects ongoing uncertainty around the sector and some recent industry headwinds.

If this shift in momentum has you interested in what’s happening across healthcare, take the next step and discover See the full list for free.

With such dramatic swings in recent performance and still uncertain sector outlooks, it is worth asking whether UnitedHealth Group might now be genuinely undervalued, or if the company’s future growth has already been fully priced in.

Most Popular Narrative: Fairly Valued

UnitedHealth Group’s fair value, as determined by the most popular analyst narrative, aligns closely with its recent share price. This highlights a debate over future prospects. The current narrative is built around key strategic moves that could shift the earnings outlook.

“The company is addressing unanticipated changes in Medicare membership profiles which impacted 2025 revenue. They are taking measures to ensure complex patients engage in clinical and value-based programs, which should help stabilize and potentially increase future revenue.”

Want to know what makes this valuation tick? Analysts are betting on a decisive turnaround driven by operational strategy and shifting care models. However, the forecast relies on a few critical assumptions that may not be immediately obvious. Find out which future milestones could move the numbers further.

Result: Fair Value of $352 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected Medicare policy changes or heightened regulatory scrutiny could quickly undermine this fair value narrative and challenge UnitedHealth Group’s positive momentum.

Find out about the key risks to this UnitedHealth Group narrative.

Another View: Discounted Cash Flow Offers a Different Angle

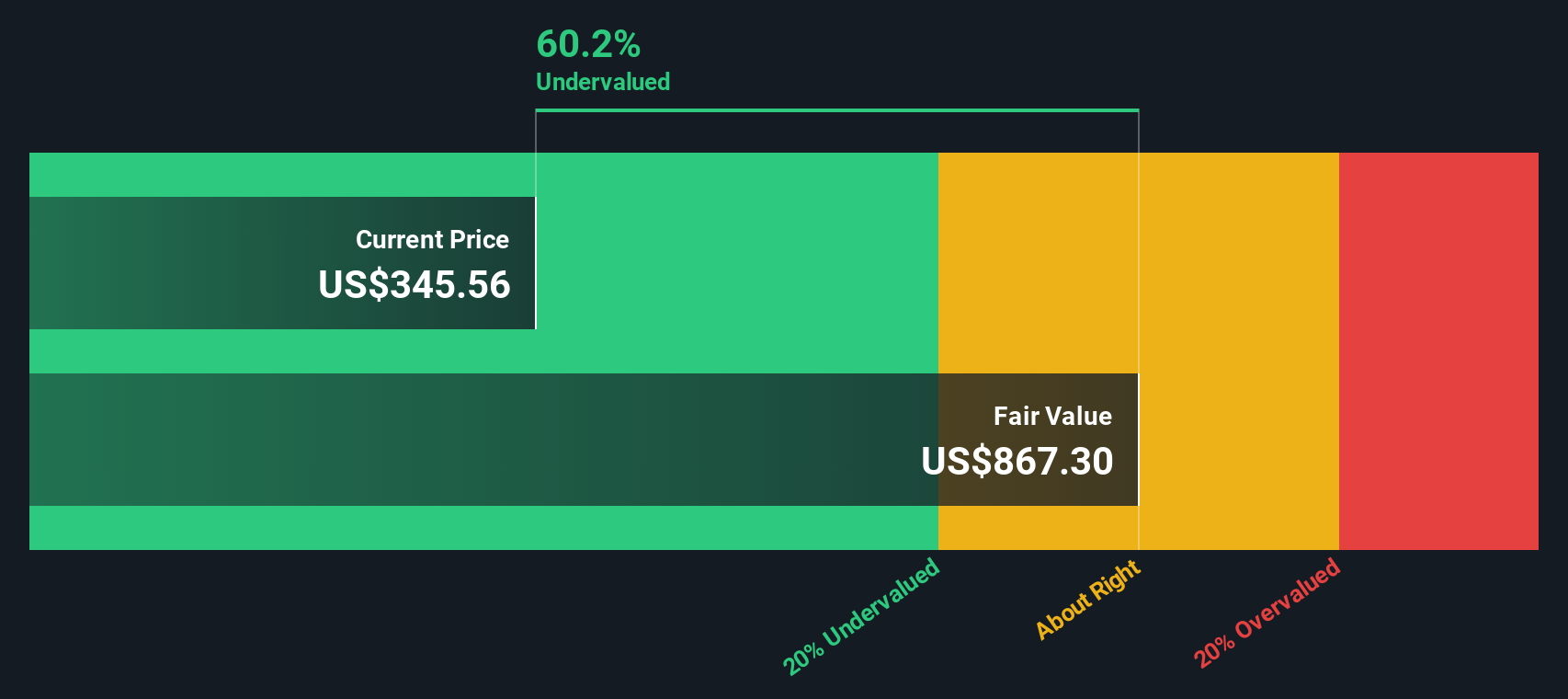

While analysts suggest UnitedHealth Group is fairly valued based on earnings and peer comparisons, our DCF model presents a much more optimistic picture. According to the SWS DCF approach, UNH is trading well below its estimated fair value. Could the market be missing hidden value, or is the DCF model too bullish?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out UnitedHealth Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own UnitedHealth Group Narrative

If you want to dig into the data and map out your own perspective, you can easily build a personalized narrative in just a few minutes. Do it your way

A great starting point for your UnitedHealth Group research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors seize every opportunity to get ahead. Open the door to fresh possibilities and make sure you're not missing the next big winner.

- Start building wealth with high-yield options by checking out these 20 dividend stocks with yields > 3%, featuring consistent performers offering attractive payouts.

- Unlock the future of artificial intelligence growth by accessing these 24 AI penny stocks that are driving tomorrow’s biggest tech breakthroughs.

- Capture potential market upside by reviewing these 873 undervalued stocks based on cash flows, featuring investments that trade below their true worth so you never leave value on the table.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Outstanding track record established dividend payer.

Similar Companies

Market Insights

Community Narratives