- United States

- /

- Healthcare Services

- /

- NYSE:UNH

Is There Now an Opportunity in UnitedHealth Group After Regulatory Scrutiny Hits Shares?

Reviewed by Bailey Pemberton

- Curious if UnitedHealth Group's current price tag is a bargain, or if there's still room to drop before true value shows itself? You are not alone, as many investors are asking the same question given the stock’s history and stature.

- UnitedHealth Group’s shares saw a 3.0% recovery over the past week, but longer-term moves show deeper struggles. The stock dropped 7.2% this month and remains down 44.8% over the last year.

- Recent headlines have highlighted new regulatory pressures and increased scrutiny around healthcare reimbursements, shaking investor confidence and fueling volatility in the share price. Broader sector jitters and shifting policy debates are amplifying the effects and keeping traders on their toes.

- Based on Simply Wall St’s six-point valuation framework, UnitedHealth Group currently scores 5 out of 6 on undervaluation checks. This is a strong result, but how does each valuation approach stack up here? Stick around as we dig into the different methods, and watch for an even smarter way to size up value by the end of this article.

Find out why UnitedHealth Group's -44.8% return over the last year is lagging behind its peers.

Approach 1: UnitedHealth Group Discounted Cash Flow (DCF) Analysis

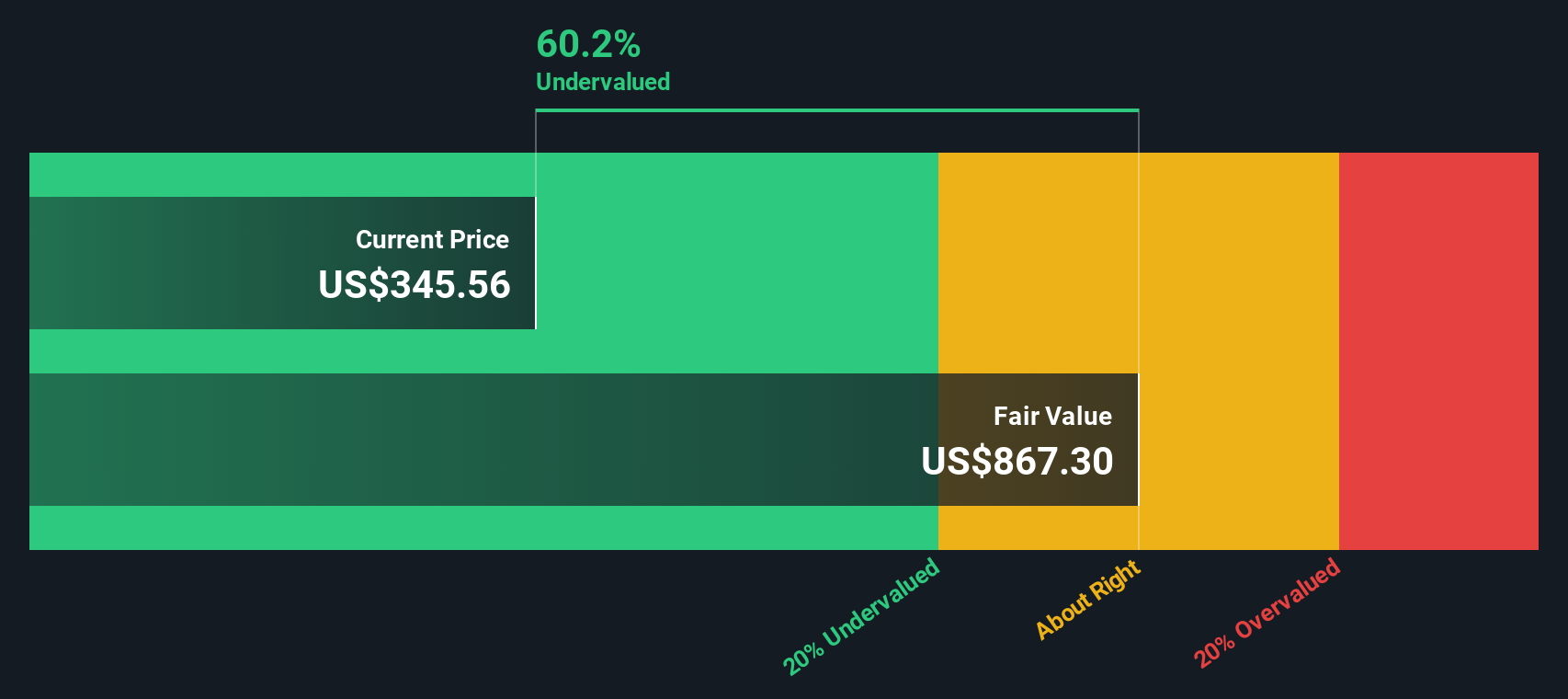

A Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This approach aims to determine what the business is truly worth in today's dollars, based on how much cash it is expected to generate.

For UnitedHealth Group, the model starts with a current free cash flow of $17.1 Billion. Analyst forecasts extend for the next five years, and then projections are extrapolated, culminating in an estimated free cash flow of $39.7 Billion by 2035. These numbers, all in USD, reflect healthy cash generation and an anticipated steady climb year after year.

According to this analysis, UnitedHealth Group's intrinsic value is estimated at $847.44 per share. Compared to recent market prices, the DCF suggests the stock is undervalued by 61.1%.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests UnitedHealth Group is undervalued by 61.1%. Track this in your watchlist or portfolio, or discover 926 more undervalued stocks based on cash flows.

Approach 2: UnitedHealth Group Price vs Earnings

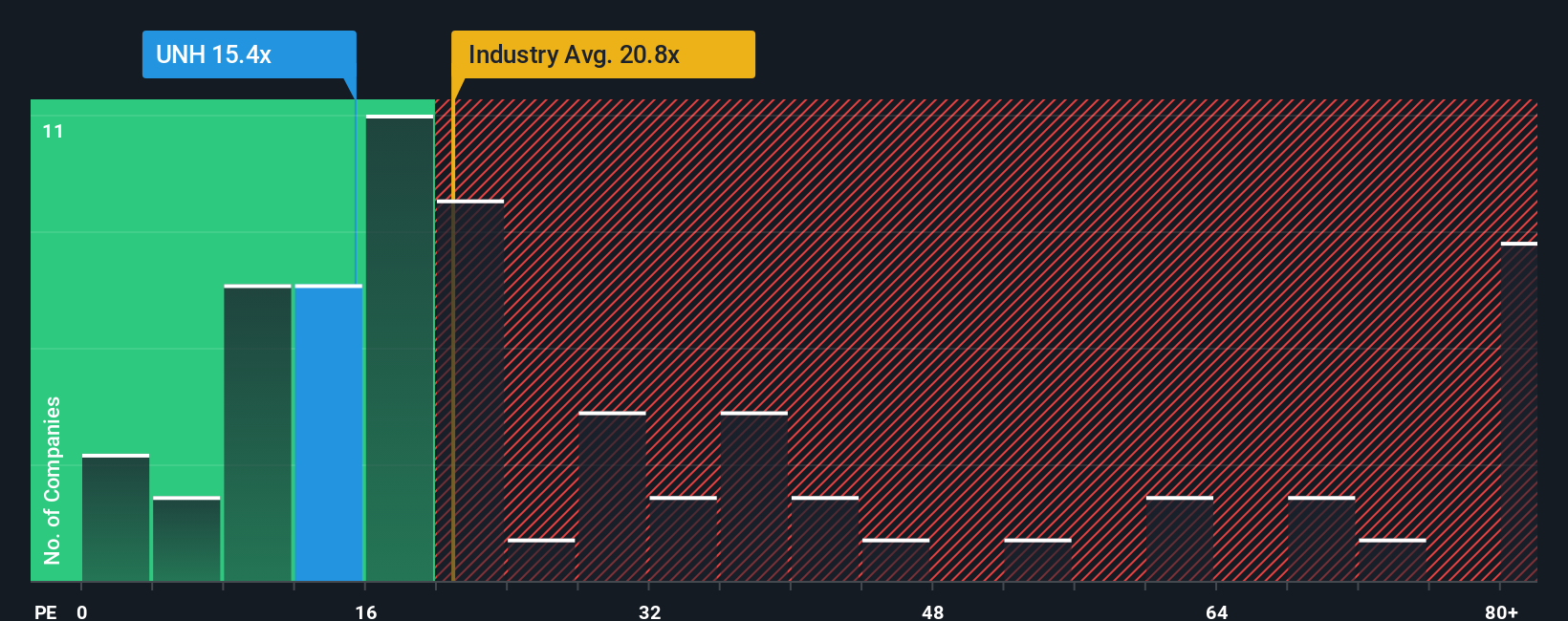

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing established and profitable companies like UnitedHealth Group. By comparing a company's current share price to its recent earnings, investors gain a quick sense of how much the market is willing to pay for each dollar of profit. For businesses with a consistent earnings track record, the PE ratio can offer meaningful insights into expectations for growth and perceived risk.

Growth prospects and market risks both play a big role in influencing what is considered a “normal” or “fair” PE ratio. Fast-growing and lower-risk companies tend to command higher multiples. In contrast, slower growth or elevated uncertainty typically push these ratios down. For UnitedHealth Group, the current PE ratio stands at 17x, which is notably below the healthcare industry average of 22.8x and the average of close peers at 26.8x.

Simply Wall St’s Fair Ratio provides a more nuanced benchmark by factoring in UnitedHealth Group’s specific earnings growth outlook, profit margins, size, and potential risks. Instead of just comparing with industry averages or peers, this approach offers a tailored perspective. For UnitedHealth, the proprietary Fair Ratio lands at 41.4x, suggesting that, even after accounting for these company specifics, the market is currently pricing the stock at a steep discount relative to its expected performance.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your UnitedHealth Group Narrative

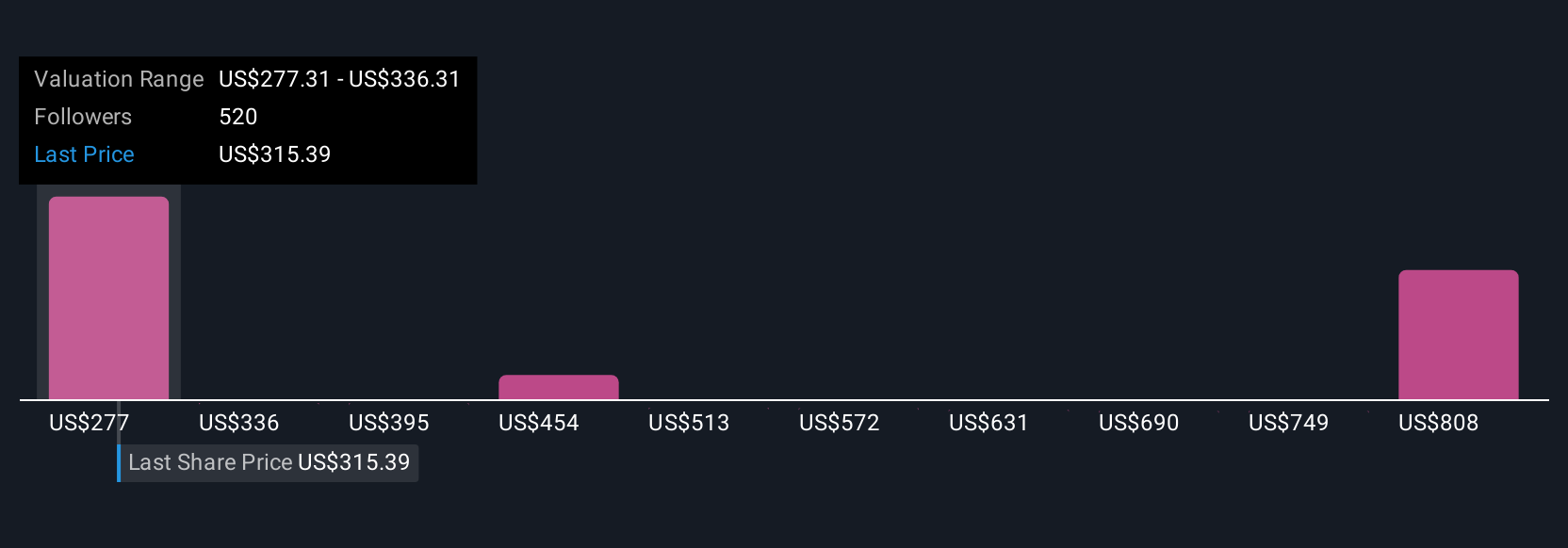

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that lets investors tell the story behind a company by connecting their own outlook for future revenues, earnings, and margins to an estimated fair value. Rather than just relying on numbers or ratios alone, Narratives allow you to combine your perspective of UnitedHealth Group’s future with a financial forecast, instantly showing what that means for the stock’s fair value today.

On Simply Wall St’s Community page, millions of investors already use Narratives to make their buy, hold, or sell decisions more transparent and dynamic. Narratives update as soon as new information, such as earnings reports or major news, becomes available, keeping every estimate fresh and relevant. For example, some UnitedHealth Group Narratives anticipate robust margin recovery and set a bullish fair value as high as $626 per share, while more cautious outlooks, reflecting tougher regulatory or operational challenges, arrive at a fair value as low as $198. This diversity of perspectives empowers you to compare your story to others and make smarter, more informed investment choices.

Do you think there's more to the story for UnitedHealth Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:UNH

UnitedHealth Group

Operates as a health care company in the United States and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.