- United States

- /

- Medical Equipment

- /

- NYSE:TFX

Getting In Cheap On Teleflex Incorporated (NYSE:TFX) Might Be Difficult

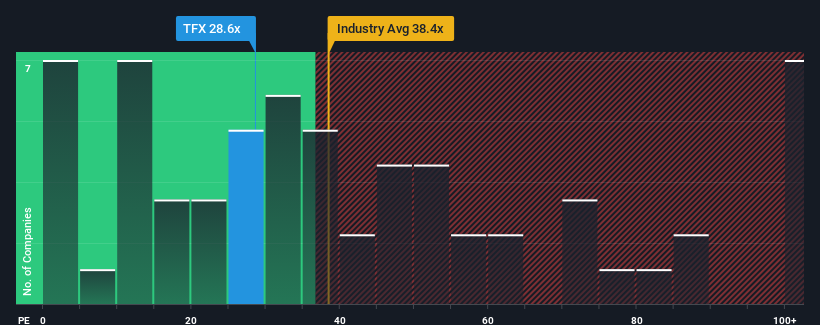

With a price-to-earnings (or "P/E") ratio of 28.6x Teleflex Incorporated (NYSE:TFX) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 16x and even P/E's lower than 8x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

While the market has experienced earnings growth lately, Teleflex's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Teleflex

Is There Enough Growth For Teleflex?

In order to justify its P/E ratio, Teleflex would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 1.3% decrease to the company's bottom line. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 8.9% in total. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the analysts watching the company. With the market only predicted to deliver 13% each year, the company is positioned for a stronger earnings result.

In light of this, it's understandable that Teleflex's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Teleflex's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Teleflex maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Teleflex with six simple checks will allow you to discover any risks that could be an issue.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Teleflex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TFX

Teleflex

Designs, develops, manufactures, and supplies single-use medical devices for common diagnostic and therapeutic procedures in critical care and surgical applications worldwide.

Excellent balance sheet with moderate growth potential.