- United States

- /

- Medical Equipment

- /

- NYSE:SOLV

A Fresh Look at Solventum (SOLV) Valuation Following Recent Share Price Cooling

Reviewed by Kshitija Bhandaru

Solventum (SOLV) has seen shares fluctuate over the past month, moving down around 3%. Investors are watching for signals about its growth plans, especially as market sentiment remains mixed in the broader healthcare sector.

See our latest analysis for Solventum.

After a steady run earlier in the year, Solventum’s share price has cooled off slightly with a 3.4% dip over the past month, reflecting cautious sentiment in healthcare stocks recently. Still, the stock remains up 7.5% year-to-date, and its 2.2% total shareholder return over the past year suggests growth potential is possible if confidence builds.

If you’re watching healthcare stocks for promising movers, now is the perfect time to explore See the full list for free.

With Solventum now trading at a noticeable discount to analyst price targets and solid gains year-to-date, the big question remains: Is the stock undervalued in today’s market, or has future growth already been priced in?

Most Popular Narrative: 16.7% Undervalued

With Solventum closing at $70.88 and the most popular narrative estimating a fair value above $85, there is clear separation between current price and what analysts anticipate. This gap is driven by expectations of strategic gains and operational improvements.

The company's new product innovation pipeline (notably in Negative Pressure Wound Therapy, advanced wound care, sterilization, and digital health solutions such as autonomous coding) is gaining traction, positioning Solventum to benefit from rising global demand for technologically advanced healthcare equipment, ultimately supporting future topline and earnings growth.

Curious about the bold projections fueling this valuation? The most popular narrative banks on accelerating profit margins, a disciplined approach to earnings growth, and a forward-looking earnings multiple that even outpaces some sector leaders. See which of these assumptions could reshape the outlook for Solventum. Dive into the full story driving this eye-catching fair value estimate.

Result: Fair Value of $85.11 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing 3M separation risks and slowing underlying demand could quickly challenge the bullish case for Solventum’s long-term growth and valuation.

Find out about the key risks to this Solventum narrative.

Another View: What Do Earnings Multiples Say?

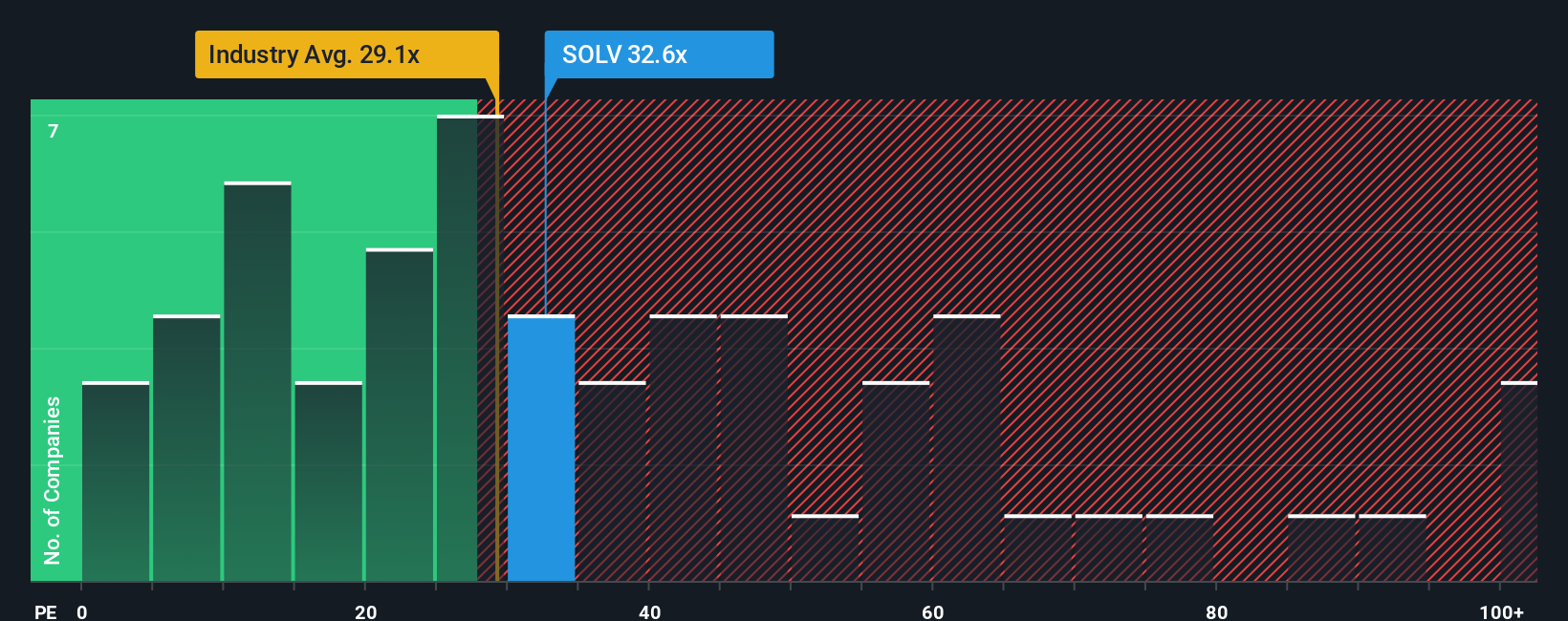

Looking beyond fair value models, Solventum’s price-to-earnings ratio stands at 32.3x, which is higher than both the industry average of 29.5x and the peer average of 27.1x. This means the stock is pricing in more growth or stronger profitability than many rivals, raising the stakes for future performance. Is this premium a signal of real opportunity or a potential risk if results disappoint?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Solventum Narrative

If you want your own perspective reflected or prefer to dig into the numbers independently, you can craft a personal narrative in just minutes with Do it your way.

A great starting point for your Solventum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh investment opportunities pass you by; the right screen could help you spot the next big winner before others catch on.

- Uncover strong dividends and stable payouts with these 18 dividend stocks with yields > 3%, connecting you to companies offering reliable income streams in any market.

- Tap into breakthroughs transforming healthcare by searching these 33 healthcare AI stocks. Here, medical innovation meets advanced artificial intelligence for high-growth potential.

- Seize rare undervalued gems when you check these 880 undervalued stocks based on cash flows. This screen highlights stocks trading below their estimated cash flow value for smarter buying decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOLV

Solventum

A healthcare company, develops, manufactures, and commercializes a portfolio of solutions to address critical customer and patient needs in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026