- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Will ResMed’s (RMD) Design Accolades Reveal a Lasting Edge in Sleep Tech Innovation?

Reviewed by Simply Wall St

- ResMed recently announced the election of Nicole Mowad-Nassar, President of Specialty and U.S. Therapeutics Operations at AbbVie, to its board of directors, effective August 15, 2025, while long-serving board member Rich Sulpizio will retire following the 2025 Annual Meeting of Stockholders in November.

- In addition, ResMed received two Red Dot Awards for its AirTouch N30i mask and reached a milestone of 10,000 patents and designs, underscoring its recognized leadership in sleep and respiratory care technology.

- We'll now explore how ResMed's global recognition for design innovation may reinforce its long-term investment thesis and competitive strengths.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

ResMed Investment Narrative Recap

To own ResMed, an investor generally needs conviction in its ability to drive adoption of sleep and respiratory solutions globally, supported by clinical leadership and continuous innovation. The recent board changes, including the addition of Nicole Mowad-Nassar, bring experienced healthcare oversight but are unlikely to materially affect the key near-term catalyst: expanding home-based digital therapy. At the same time, heightened competition and potential regulatory risks remain the biggest watch points; this executive update does not fundamentally change those dynamics.

Of the recent headlines, ResMed winning two Red Dot Awards for the AirTouch N30i mask stands out as most closely tied to its investment thesis. Global recognition in product design reinforces ResMed’s innovation narrative and supports its drive for premium pricing, which is central to maintaining its market share and margin profile amid reimbursement and competitive pressures.

By contrast, investors should still pay close attention to one risk in particular: possible regulatory moves that could reshape pricing power and reimbursement for ResMed’s devices...

Read the full narrative on ResMed (it's free!)

ResMed's narrative projects $6.4 billion revenue and $1.9 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $0.5 billion earnings increase from $1.4 billion.

Uncover how ResMed's forecasts yield a $291.86 fair value, in line with its current price.

Exploring Other Perspectives

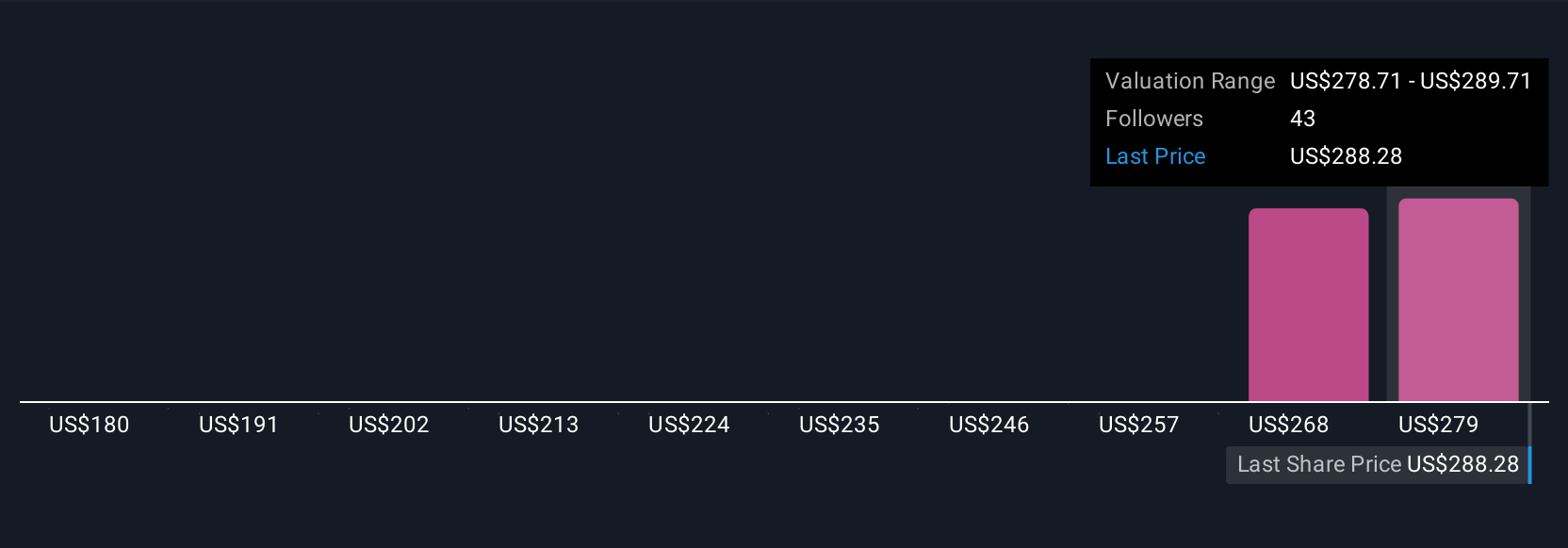

Seven fair value estimates from the Simply Wall St Community range from US$179.72 to US$291.86, revealing wide opinion dispersion. With strong recent product innovation as a catalyst, consider how different views factor in emerging competitive and regulatory risks to future performance.

Explore 7 other fair value estimates on ResMed - why the stock might be worth 39% less than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 23 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives