- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Should You Consider ResMed After Its 18% Surge and Recent Earnings Pullback?

Reviewed by Bailey Pemberton

If you’re watching ResMed and trying to decide whether now is the right moment to get in, you’re not alone. The stock has been making steady waves, and investors are paying extra attention after seeing solid gains earlier this year with an 18.2% jump year-to-date and a strong 54.0% rise over five years. Of course, no price chart is a straight line, and recent weeks brought a mild pullback, with shares slipping 1.0% over the past month and 2.8% in the last week. That short-term dip stands out against the backdrop of impressive long-term growth, and it has many people weighing whether this is a temporary breather or a potential inflection point.

There’s a lot to consider: changing market sentiment, developments in the broader healthcare sector, and how investors are reassessing risk across medical device companies. But one of the most important questions for any stock is whether it’s currently undervalued or if the recent climb means you’re paying too much. When we run ResMed through six classic valuation checks, it scores a 3, suggesting it’s undervalued in half the ways analysts typically measure a stock’s price.

So how does ResMed stack up on those classic valuation methods? And could there be a smarter way still to decide if the stock is worth your money? Let’s break it down method by method, and then explore the big picture at the end.

Approach 1: ResMed Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular approach for determining a stock's intrinsic value by projecting the company's future cash flows and discounting them back to their present value. Essentially, it helps estimate what ResMed is truly worth today based on the cash it’s expected to generate in the years ahead.

For ResMed, the most recent reported Free Cash Flow stands at $1.62 billion, with analysts forecasting consistent growth over the next several years. By 2028, projections put Free Cash Flow at $1.86 billion. Further extrapolation suggests this figure could approach $2.39 billion by 2035. The DCF model used here combines analyst estimates for the next five years and extends them using well-established growth assumptions, all measured in $.

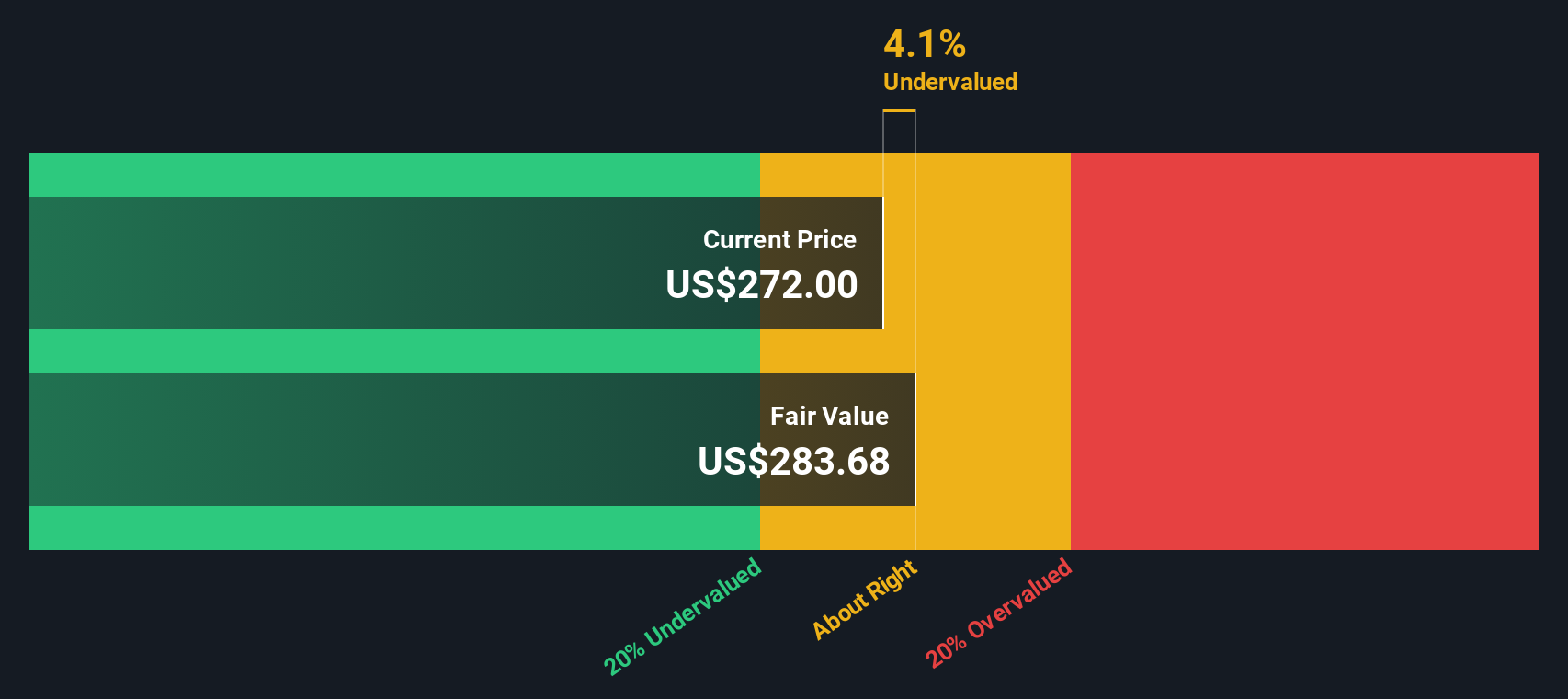

After running these numbers, the intrinsic fair value for ResMed is estimated at $283.96 per share. This valuation implies the current share price trades at about a 4.9% discount to fair value. In other words, based on DCF analysis, the stock is valued pretty close to its true worth.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out ResMed's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: ResMed Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is one of the most widely used metrics for valuing profitable companies like ResMed. It reflects how much investors are willing to pay for each dollar of the company’s earnings. A PE ratio works well when analyzing companies with steady profitability because it captures both the market’s expectations for future growth and its perception of risk.

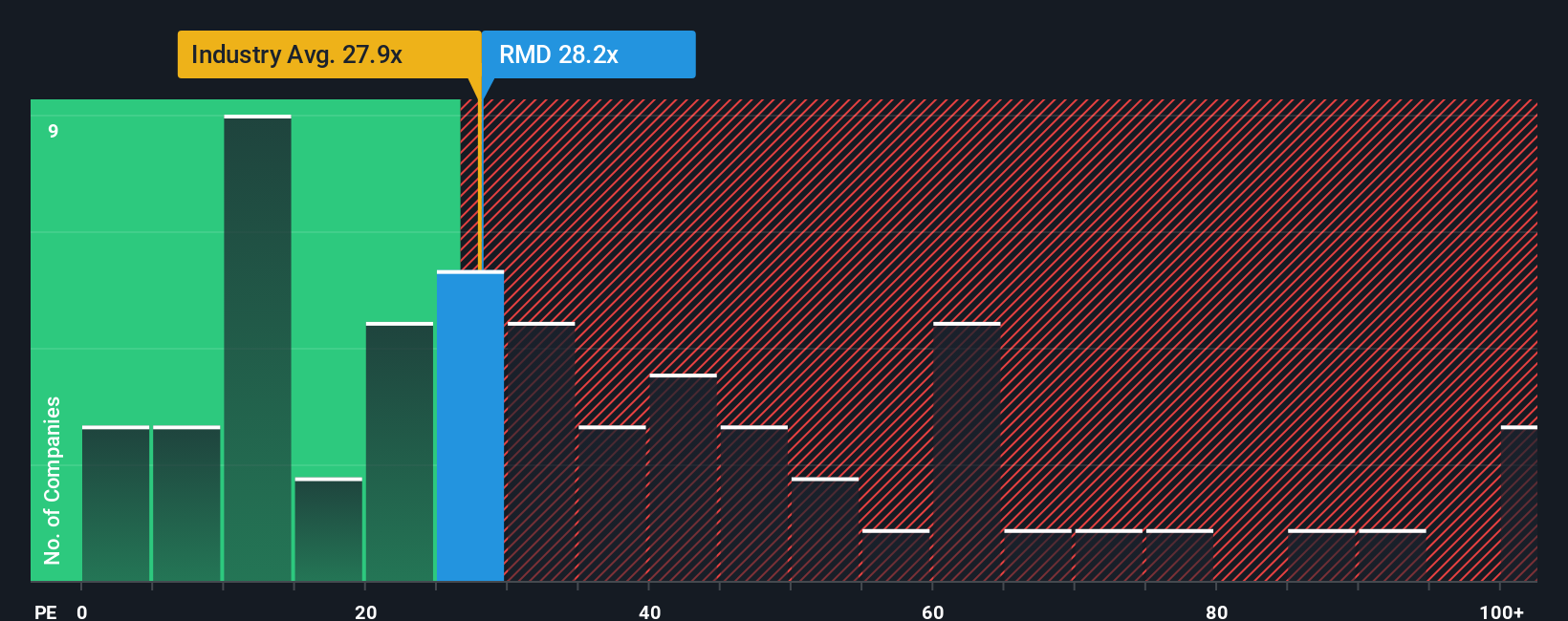

A higher PE often signals that investors expect robust growth ahead, while a lower PE may reflect uncertainty or slower expected gains. What is considered “normal” depends on multiple factors such as the company’s sector, its recent growth trends, and risk profile. For instance, ResMed currently trades on a PE of 28x. In comparison, the average for the Medical Equipment industry is about 28x, and the peer group average is a bit higher at nearly 33x.

Simply Wall St also calculates a Fair Ratio for each stock, representing the PE you might expect based on unique factors like ResMed’s forecasted earnings growth, profit margins, industry conditions, company size, and its particular risks. This approach goes beyond simple peer or sector comparisons by adjusting for the metrics that actually drive investor returns. ResMed’s Fair Ratio is 25x, just below its current PE, indicating that the market’s current pricing is closely aligned with its fundamentals and outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ResMed Narrative

Earlier we mentioned there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers—an accessible tool that lets you connect your own view of ResMed’s business and growth drivers to specific financial forecasts, such as assumed fair value, future revenue, and margin estimates. Instead of only comparing ratios or relying on static price targets, Narratives map out how a company’s unique situation and industry drivers connect directly to its future performance and fair value. This approach helps you decide exactly when ResMed may be attractively priced by revealing the gap between fair value and current price.

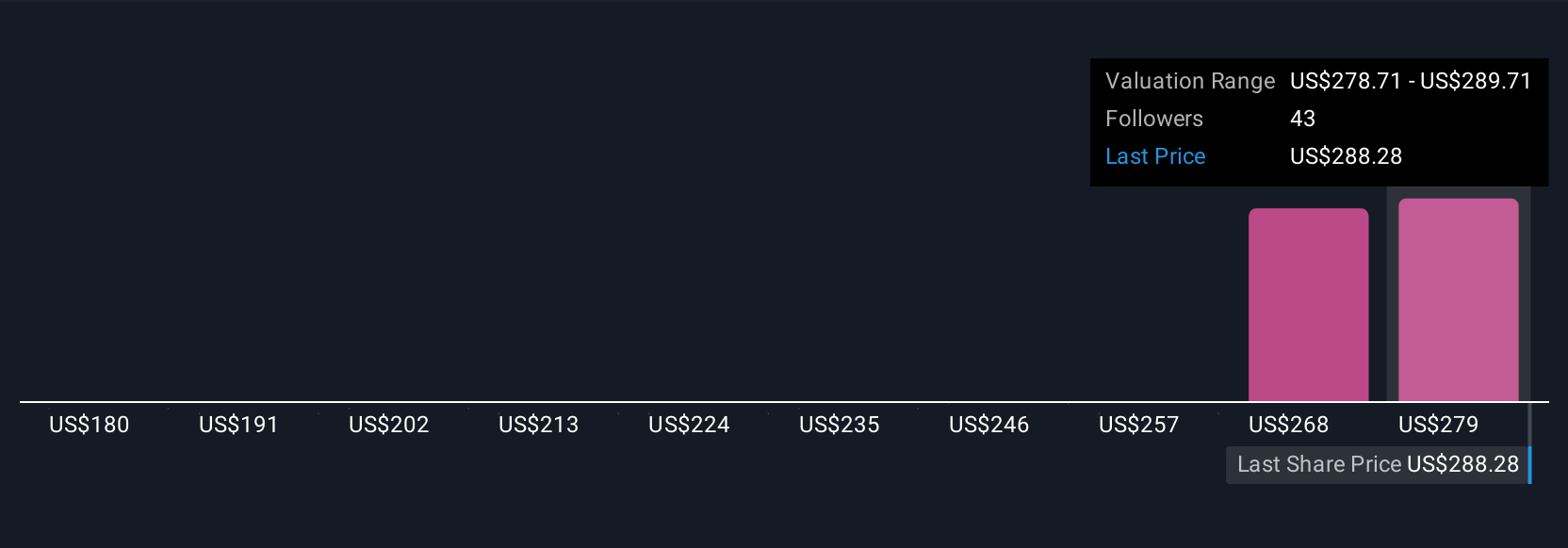

On Simply Wall St’s Community page, millions of investors are already using Narratives to sharpen their decisions, as these are updated in real time with fresh news and results, ensuring your outlook always reflects the latest data. For instance, some ResMed investors may believe its digital health innovation and global sleep apnea growth make $325 a fair target, while others take a more cautious view, seeing risks from new competitors and stricter regulations, supporting a fair value closer to $215. By crafting your own Narrative, you can make investment moves that fit your understanding and goals rather than simply following the crowd.

Do you think there's more to the story for ResMed? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives