- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Shareholders May Find It Hard To Justify Increasing ResMed Inc.'s (NYSE:RMD) CEO Compensation For Now

Key Insights

- ResMed will host its Annual General Meeting on 16th of November

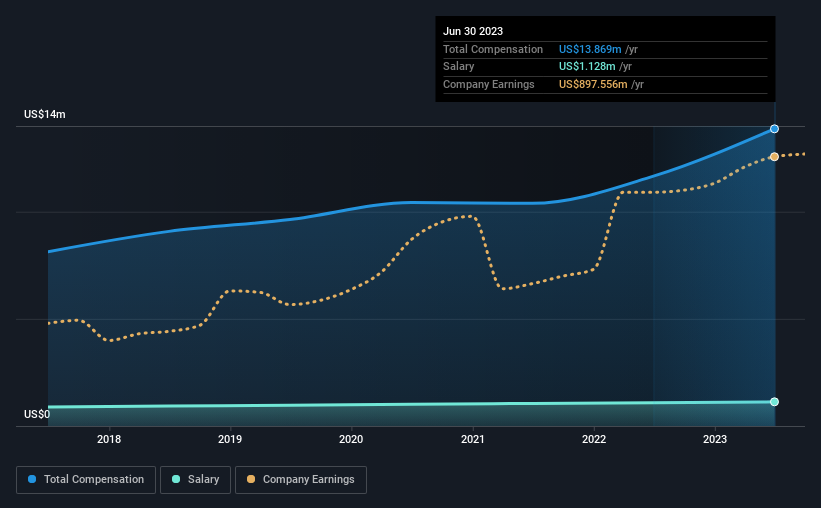

- Total pay for CEO Mick Farrell includes US$1.13m salary

- Total compensation is similar to the industry average

- ResMed's EPS grew by 9.4% over the past three years while total shareholder loss over the past three years was 31%

The underwhelming share price performance of ResMed Inc. (NYSE:RMD) in the past three years would have disappointed many shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. These are some of the concerns that shareholders may want to bring up at the next AGM held on 16th of November. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for ResMed

Comparing ResMed Inc.'s CEO Compensation With The Industry

At the time of writing, our data shows that ResMed Inc. has a market capitalization of US$22b, and reported total annual CEO compensation of US$14m for the year to June 2023. We note that's an increase of 19% above last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$1.1m.

In comparison with other companies in the American Medical Equipment industry with market capitalizations over US$8.0b, the reported median total CEO compensation was US$13m. This suggests that ResMed remunerates its CEO largely in line with the industry average. Furthermore, Mick Farrell directly owns US$65m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.1m | US$1.1m | 8% |

| Other | US$13m | US$11m | 92% |

| Total Compensation | US$14m | US$12m | 100% |

Speaking on an industry level, nearly 25% of total compensation represents salary, while the remainder of 75% is other remuneration. ResMed pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at ResMed Inc.'s Growth Numbers

ResMed Inc.'s earnings per share (EPS) grew 9.4% per year over the last three years. Its revenue is up 21% over the last year.

This revenue growth could really point to a brighter future. And the improvement in EPSis modest but respectable. So while performance isn't amazing, we think it really does seem quite respectable. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has ResMed Inc. Been A Good Investment?

The return of -31% over three years would not have pleased ResMed Inc. shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

Whatever your view on compensation, you might want to check if insiders are buying or selling ResMed shares (free trial).

Important note: ResMed is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion