- United States

- /

- Medical Equipment

- /

- NYSE:RMD

How Investors Are Reacting To ResMed (RMD) Facing Patent Lawsuit Over Device Antenna Technology

Reviewed by Sasha Jovanovic

- Fractus has filed a patent infringement lawsuit against ResMed in the United States District Court for the Southern District of California, alleging that several of ResMed’s sleep apnea devices and related connected therapy solutions infringe patents covering miniaturized, high-performance multi-band antenna technology.

- The involvement of high-profile intellectual property trial lawyers suggests that the dispute could have significant implications for ResMed’s product portfolio and technology strategy.

- We'll assess how the newly filed patent lawsuit introduces legal risks that could influence ResMed’s established investment narrative and business outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ResMed Investment Narrative Recap

To invest in ResMed, one usually needs to believe in the company's ability to strengthen its position in digital health and home-based sleep therapy, capturing long-term growth in the underdiagnosed sleep apnea market. The recently announced Fractus patent infringement lawsuit introduces new short-term legal uncertainty, but at this stage, it does not materially overshadow the most immediate catalyst: sustained revenue and earnings growth driven by the adoption of connected products and recurring software services.

Among recent company updates, ResMed reported robust earnings growth for Q4 FY2025, with sales of US$1,347.99 million and net income of US$379.71 million. While this positive financial momentum supports confidence in execution, investors will be watching if the legal developments impact progress on expanding digital and device solutions.

However, with the risk of increased compliance and litigation costs now added to the mix, investors need to be mindful that...

Read the full narrative on ResMed (it's free!)

ResMed's outlook anticipates $6.4 billion in revenue and $1.9 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 7.8% and an increase in earnings of $0.5 billion from the current $1.4 billion.

Uncover how ResMed's forecasts yield a $291.86 fair value, a 8% upside to its current price.

Exploring Other Perspectives

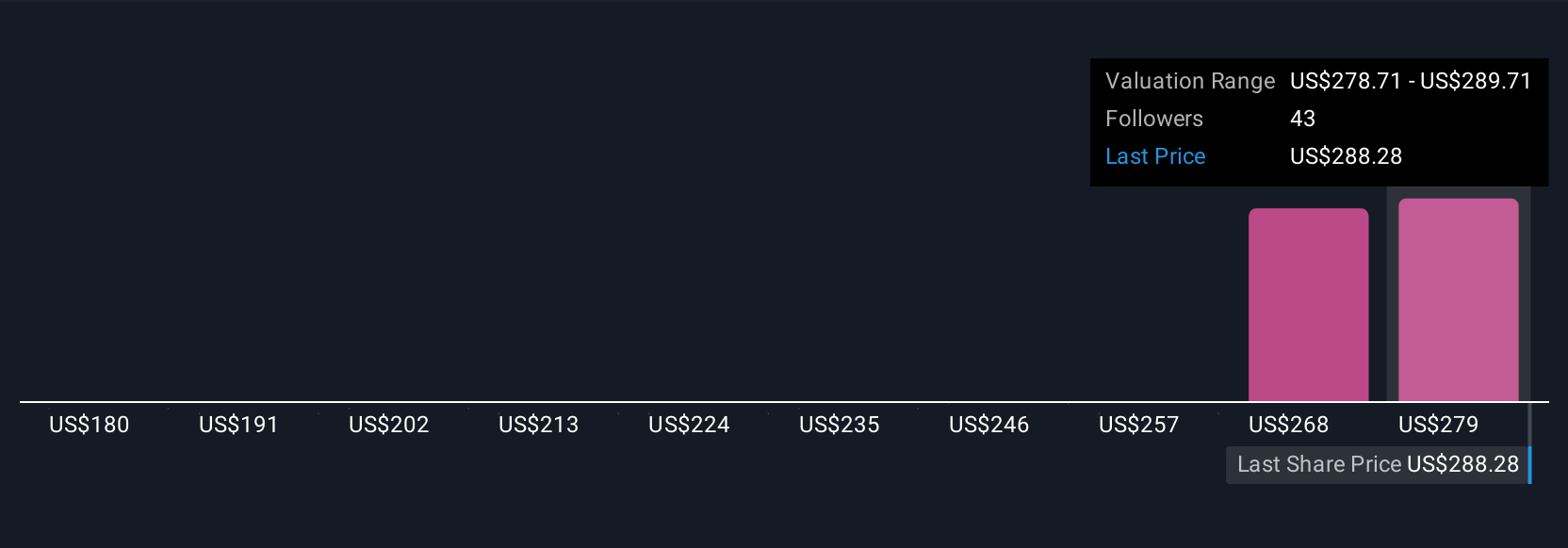

Seven private investors in the Simply Wall St Community assessed ResMed's fair value between US$179.72 and US$291.86, showing a wide spread in expectations. Against this varied backdrop, the emergence of new legal risks illustrates why investor views on ResMed's future can differ so widely.

Explore 7 other fair value estimates on ResMed - why the stock might be worth 34% less than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives