- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Does US Security Probe of Device Imports Alter the Bull Case for ResMed (RMD)?

Reviewed by Sasha Jovanovic

- Earlier this month, the U.S. Commerce Department initiated a national security investigation into medical device imports, including products from major manufacturers such as ResMed, raising the prospect of tariffs and new regulatory requirements for the industry.

- This development introduces ongoing uncertainty for companies with significant U.S. market presence and extensive global manufacturing, yet ResMed's recent launch of the NightOwl™ home sleep apnea test highlights a continued push to broaden patient access even amid tighter scrutiny.

- We'll explore how regulatory pressures and new product innovation may alter ResMed's outlook following the recent news event.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

ResMed Investment Narrative Recap

To believe in ResMed as a shareholder, you have to trust in persistently high global demand for sleep health solutions, strong recurring revenues, and resilience to regulatory shifts. The recent U.S. Commerce Department investigation into medical device imports brings potential near-term challenges, especially if tariffs or regulations arise, but it does not appear to materially alter the company’s most important catalyst, expanding patient access through innovation. The critical risk remains tightening U.S. reimbursement or regulatory headwinds impacting profits and margins.

Among the latest announcements, ResMed’s launch of the FDA-cleared NightOwl™ home sleep apnea test is directly relevant, aiming to accelerate adoption in an underdiagnosed market. Increased accessibility to home diagnosis tools could help offset some pressure from regulatory uncertainty, keeping growth prospects intact if reimbursement conditions remain favorable.

However, as global regulation tightens, investors should pay particular attention to how potential rule changes could quickly affect...

Read the full narrative on ResMed (it's free!)

ResMed's outlook anticipates $6.4 billion in revenue and $1.9 billion in earnings by 2028. This scenario is based on a 7.8% annual revenue growth rate and a $0.5 billion increase in earnings from the current level of $1.4 billion.

Uncover how ResMed's forecasts yield a $291.86 fair value, a 6% upside to its current price.

Exploring Other Perspectives

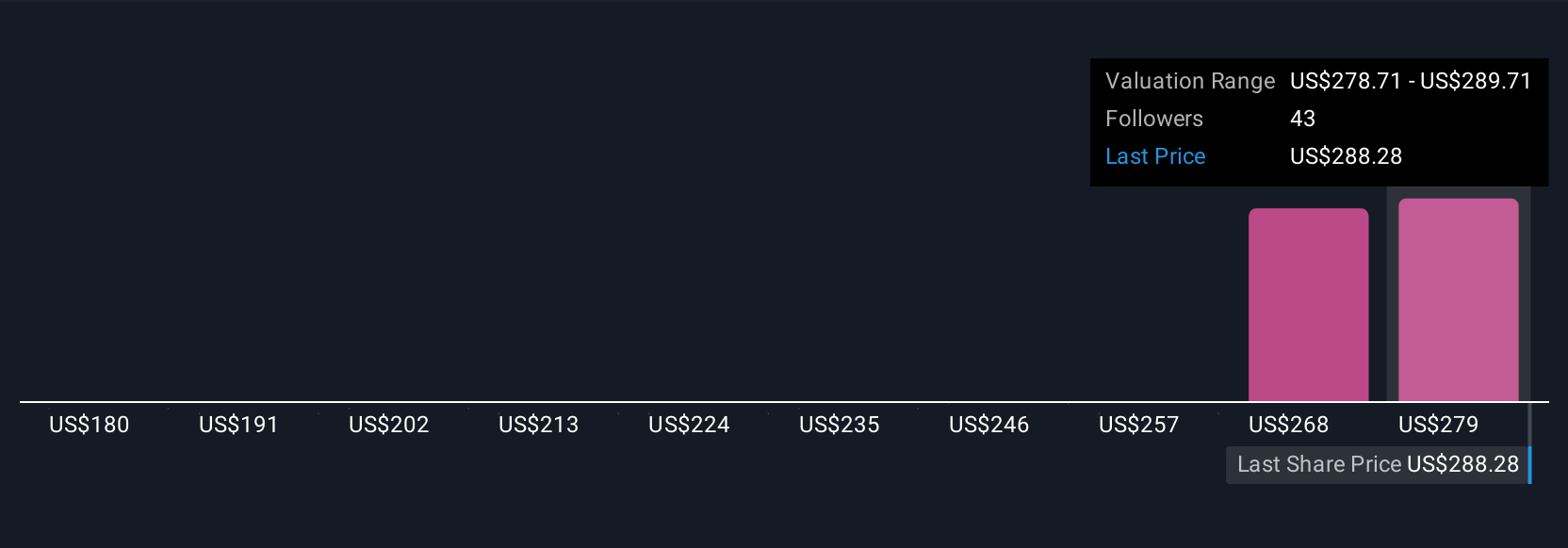

Eight Simply Wall St Community members see fair value for ResMed between US$179.72 and US$291.86, reflecting wide-ranging outlooks. With reimbursement and regulatory changes now a growing concern, you can see how opinions across the market may shift, take a look at multiple views to understand what could influence returns.

Explore 8 other fair value estimates on ResMed - why the stock might be worth as much as 6% more than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives