- United States

- /

- Medical Equipment

- /

- NYSE:RMD

Citigroup's Digital Health Vote Could Be a Game Changer for ResMed (RMD)

Reviewed by Simply Wall St

- Earlier this week, Citigroup initiated coverage on ResMed with a 'Buy' rating, reflecting strong analyst confidence in the company’s growth potential in digital health and clinical data services for out-of-hospital care.

- An interesting insight is that institutional investors, led by The Vanguard Group holding 15%, control 74% of ResMed's shares, potentially giving them significant influence over corporate decisions.

- Let’s explore how Citigroup’s positive initiation, centered on digital health momentum, may impact ResMed’s broader investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

ResMed Investment Narrative Recap

Shareholders in ResMed need to trust in the long-term shift toward digital health solutions and the company’s ability to grow its data and software services within out-of-hospital care. While Citigroup’s positive rating underlines growing industry optimism around these digital capabilities, it does not materially alter the key near-term catalysts, adoption of cloud-connected therapy platforms, and the ongoing risk from potential tightening of US reimbursement policies or pricing pressure from CMS programs.

The recent board appointment of Nicole Mowad-Nassar is worth noting given her background in commercial strategy and digital health innovation. This move is aligned with the growing industry emphasis on digital transformation and data-driven care, a trend at the heart of both Citigroup’s report and ResMed’s growth narrative.

On the other hand, investors should also be aware of the possibility that US reimbursement or competitive bidding changes could pressure core device pricing and...

Read the full narrative on ResMed (it's free!)

ResMed's narrative projects $6.4 billion revenue and $1.9 billion earnings by 2028. This requires 7.8% yearly revenue growth and a $0.5 billion earnings increase from $1.4 billion.

Uncover how ResMed's forecasts yield a $291.86 fair value, a 7% upside to its current price.

Exploring Other Perspectives

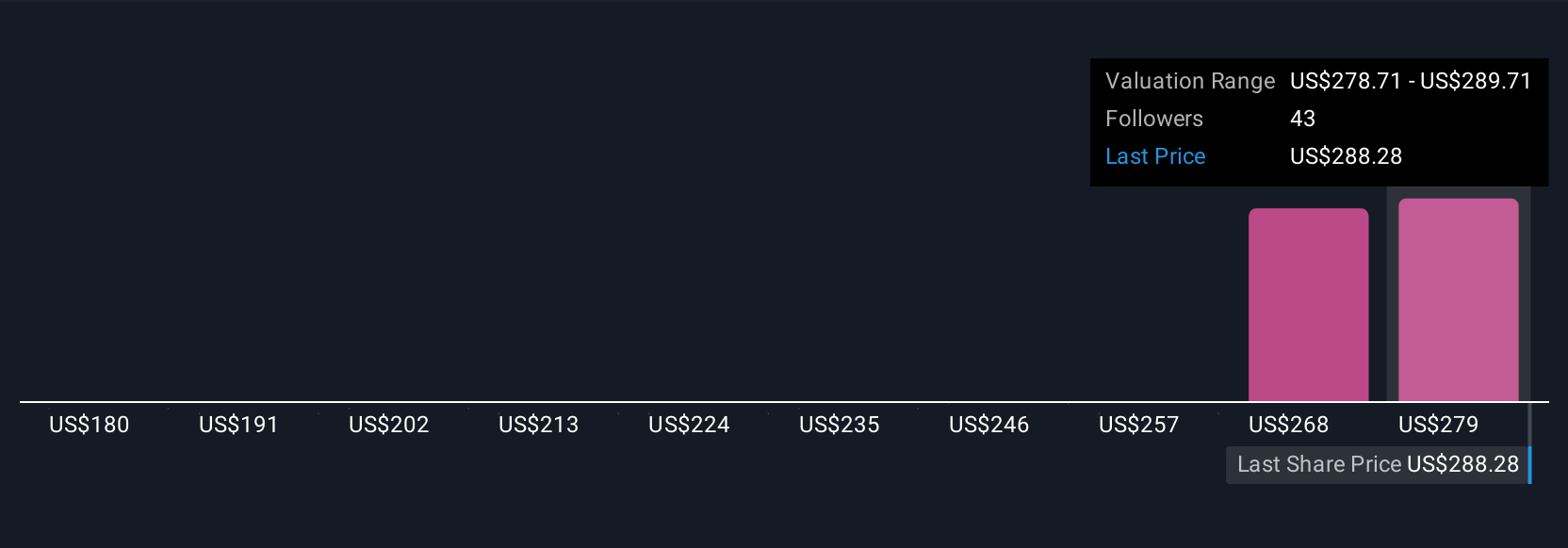

Simply Wall St Community members provided 8 unique fair value estimates for ResMed ranging from US$179.72 to US$291.86 per share. With adoption of cloud-connected platforms a central catalyst, this diversity highlights how investor opinions about ResMed’s future growth can widely differ, inviting you to compare multiple viewpoints.

Explore 8 other fair value estimates on ResMed - why the stock might be worth as much as 7% more than the current price!

Build Your Own ResMed Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ResMed research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free ResMed research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ResMed's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RMD

ResMed

Develops, manufactures, distributes, and markets medical devices and cloud-based software applications to diagnose, treat, and manage respiratory disorders in the United States and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives