- United States

- /

- Healthtech

- /

- NYSE:PHR

Phreesia (PHR) Is Down 14.0% After Swinging to Profit and Launching VoiceAI Is the Growth Story at a Turning Point?

Reviewed by Simply Wall St

- Earlier this month, Phreesia reported second-quarter earnings with revenue rising to US$117.26 million from US$102.12 million a year ago, alongside the launch of its new AI-driven healthcare solution, VoiceAI.

- Notably, this period also marked a turnaround to positive net income for the quarter, underscoring operational progress in parallel with product innovation.

- We’ll examine how Phreesia’s improved profitability and the debut of VoiceAI may influence its long-term investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Phreesia Investment Narrative Recap

To own a stake in Phreesia, an investor needs confidence in the company’s ability to expand its healthcare platform, grow recurring revenues, and consistently innovate. The latest earnings report, showing a return to positive net income and rising revenues, provides a boost to sentiment; however, the biggest risk remains the company’s dependence on new product adoption to drive higher revenue per client, while the short-term catalyst continues to be the rollout and uptake of new value-added modules. These results are directionally supportive of the underlying narrative, but adoption rates will remain front of mind for investors evaluating near-term momentum.

Phreesia’s introduction of VoiceAI, its AI-powered patient phone solution, is especially relevant as it aligns with ongoing efforts to integrate AI across products, providing differentiation and potential operating leverage. As these innovations unfold, investors are likely to keep a close watch on whether they translate into meaningful recurring revenue growth and improved client retention.

However, in contrast, investors should remain mindful of the ongoing risk that slow adoption of new modules could...

Read the full narrative on Phreesia (it's free!)

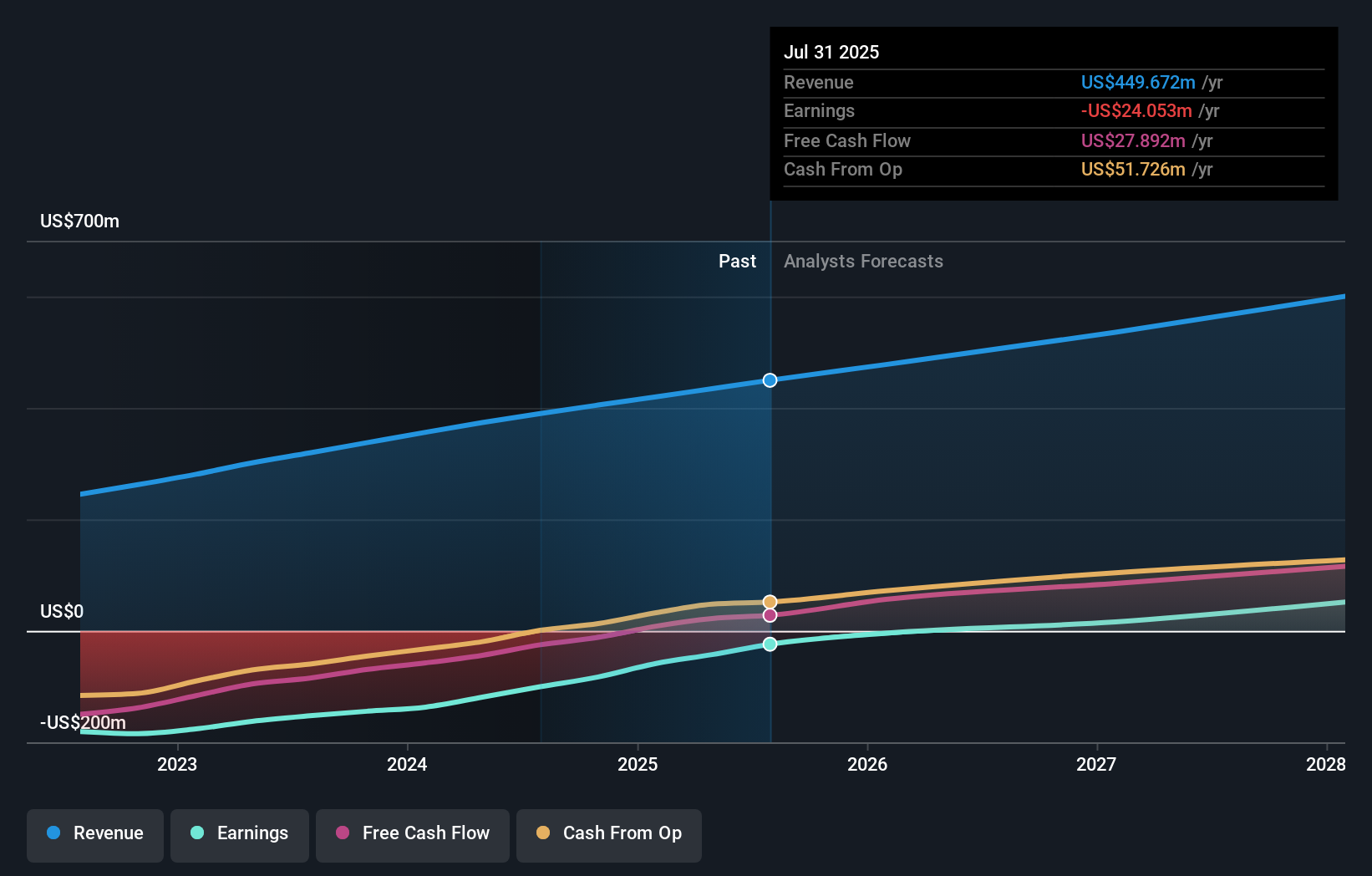

Phreesia's outlook anticipates $611.2 million in revenue and $52.6 million in earnings by 2028. This implies a 12.0% annual revenue growth rate and a $95.3 million earnings increase from current earnings of -$42.7 million.

Uncover how Phreesia's forecasts yield a $33.73 fair value, a 39% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community has contributed 1 fair value estimate for Phreesia, all clustering at US$33.73 per share. With product adoption crucial for recurring revenue gains, you may want to examine how differing strategies could influence future outcomes.

Explore another fair value estimate on Phreesia - why the stock might be worth just $33.73!

Build Your Own Phreesia Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Phreesia research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Phreesia research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Phreesia's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 29 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PHR

Phreesia

Provides an integrated SaaS-based software and payment platform for the healthcare industry in the United States and Canada.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives