- United States

- /

- Medical Equipment

- /

- NYSE:PEN

Penumbra (NYSE:PEN) Shares Surge 26% After US$1.2B Sales Growth

Reviewed by Simply Wall St

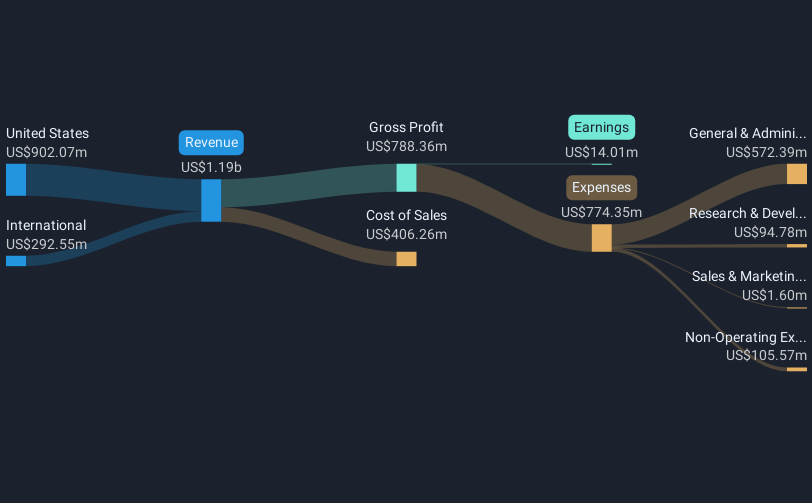

Penumbra (NYSE:PEN) reported strong sales growth for 2024 with total sales of $1,195 million, up from $1,059 million in the prior year, although net income dropped significantly from $91 million to $14 million. Earnings per share also saw a decrease. Despite this mixed performance, the company's share price surged 26% over the last quarter. This increase might be attributed to positive corporate guidance, where Penumbra projected revenue growth of 12% to 14% for 2025. During the same period, despite broader market turbulence with a 1.5% decline in the Dow Jones and slight decreases in the S&P 500 and Nasdaq, Penumbra distinguished itself against mega-cap technology and retail sector challenges, such as declines in Walmart and Palantir shares. The robust sales figure amid broader market declines likely gave investors confidence in Penumbra's potential, setting it apart in a volatile landscape.

Take a closer look at Penumbra's potential here.

Over the past five years, Penumbra's total shareholder return was 76.92%, reflecting a period of strong growth, despite some recent earnings challenges. Throughout this time, the company has seen a consistent 22.5% annual earnings growth, which has been a significant driving force behind its long-term performance. This growth has been accompanied by proactive steps like announcing a substantial share repurchase program, including a recent US$100 million buyback, aimed at providing value to shareholders.

Conversely, Penumbra's share's recent annual return has underperformed the broader US market but exceeded the US Medical Equipment industry. While the company ended 2024 with noticeably lower net income due to a very large one-off loss, the solid performance over five years highlights investor confidence. Forward-looking growth estimates, including a projected revenue increase of 12% to 14% for 2025, have also influenced investor sentiment favorably, despite these short-term challenges.

- Discover whether Penumbra is fairly priced, undervalued, or overvalued in our comprehensive valuation breakdown.

- Gain insight into the risks facing Penumbra and how they might influence its performance—click here to read more.

- Already own Penumbra? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PEN

Penumbra

Designs, develops, manufactures, and markets medical devices in the United States and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives