- United States

- /

- Healthcare Services

- /

- NYSE:PACS

Will PACS Group's (PACS) CFO Change Test Investor Confidence in Its Governance Practices?

Reviewed by Simply Wall St

- PACS Group announced that Chief Financial Officer Derick Apt resigned earlier this month after an internal investigation found he violated company policies by accepting high-value items from external parties associated with business partners.

- The company has appointed Executive Vice Chairman and co-founder Mark Hancock as interim CFO while expanding its finance and accounting team, highlighting a swift leadership response during a time of internal scrutiny.

- We'll explore how changes in executive leadership and internal controls may influence PACS Group's investment narrative in the aftermath of these events.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is PACS Group's Investment Narrative?

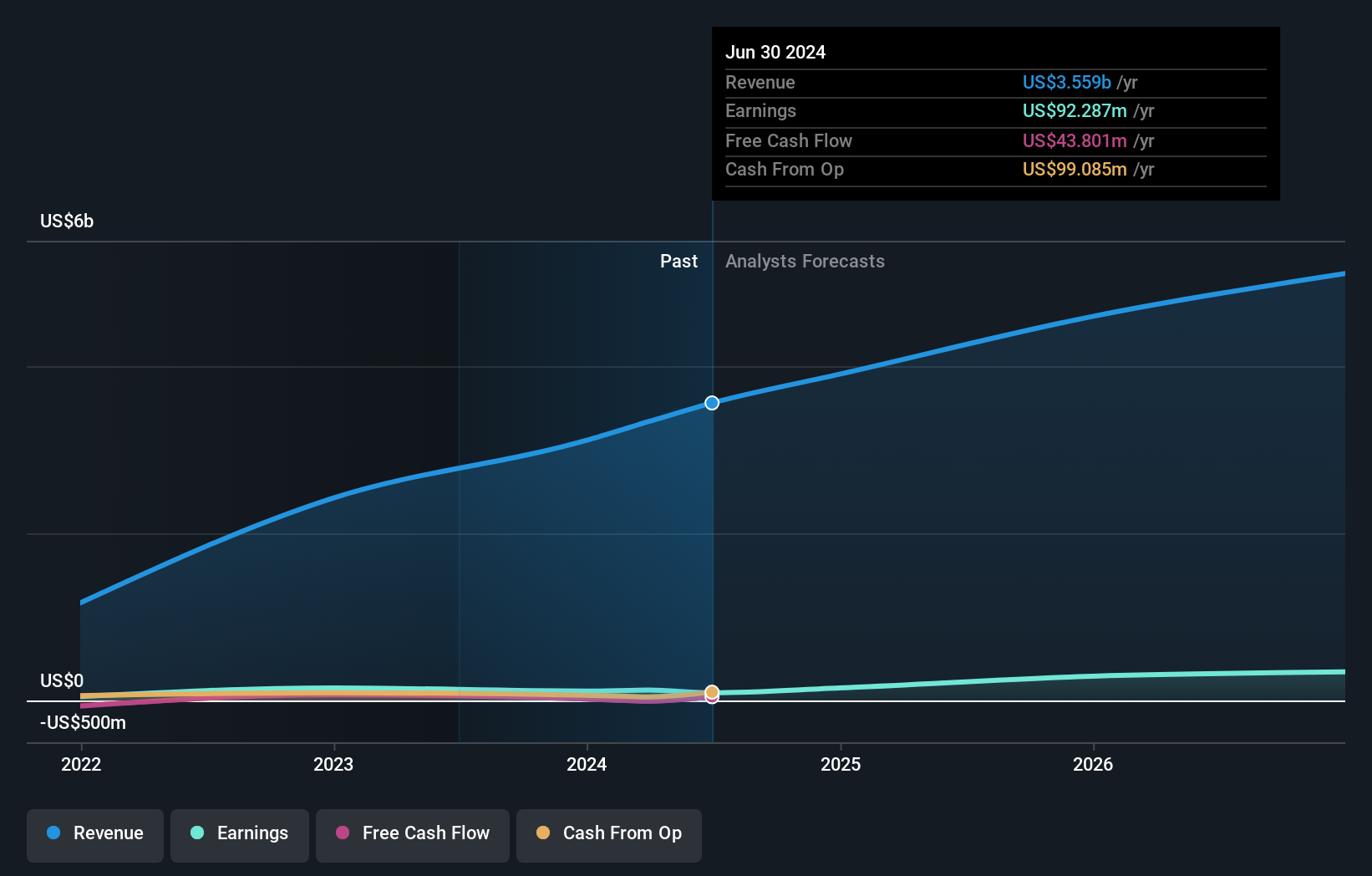

For anyone considering PACS Group as a long-term holding, belief centers around the company's ability to turn operational stability and disciplined expansion into improved profitability and shareholder returns. The investment case has hinged on the group’s significant facility acquisitions, recent index inclusions, and forecasts for robust earnings growth, all at a modest valuation compared to peers. However, in the short term, attention has quickly shifted to internal controls and management integrity after the CFO’s resignation due to a policy breach. While the appointment of co-founder Mark Hancock as interim CFO lends institutional continuity, the timing of this leadership shakeup, on the back of delayed SEC filings, forbearance agreements with lenders, and ongoing legal concerns, adds extra uncertainty to what was already a complex period. Any changes in internal controls or delays in securing a permanent finance chief could impact the most important upcoming catalysts, such as transparent financial reporting and restoring lender confidence. Based on recent price moves, the impact of these events appears material, with near-term risk perception heightened further as leadership stability and governance take center stage.

But with this much management turnover, there’s a key risk some investors may not have considered. PACS Group's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore another fair value estimate on PACS Group - why the stock might be worth over 3x more than the current price!

Build Your Own PACS Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACS Group research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PACS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACS Group's overall financial health at a glance.

Interested In Other Possibilities?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 25 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PACS

PACS Group

Through its subsidiaries, operates skilled nursing facilities and assisted living facilities in the United States.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives