- United States

- /

- Healthcare Services

- /

- NYSE:PACS

How Financing Defaults and Delayed SEC Filings at PACS Group (PACS) Have Changed Its Investment Story

Reviewed by Simply Wall St

- On August 13, 2025, PACS Group, Inc. entered into a forbearance agreement with its lenders after reporting multiple events of default tied to compliance certificate representations and warranty issues, alongside a related event of default under a key lease agreement.

- PACS Group further announced it would be unable to file its next quarterly 10-Q report with the SEC on time, highlighting heightened uncertainties around both its financial stability and reporting controls.

- We’ll now examine how the combination of financing default forbearance and delayed public filings impacts PACS Group’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is PACS Group's Investment Narrative?

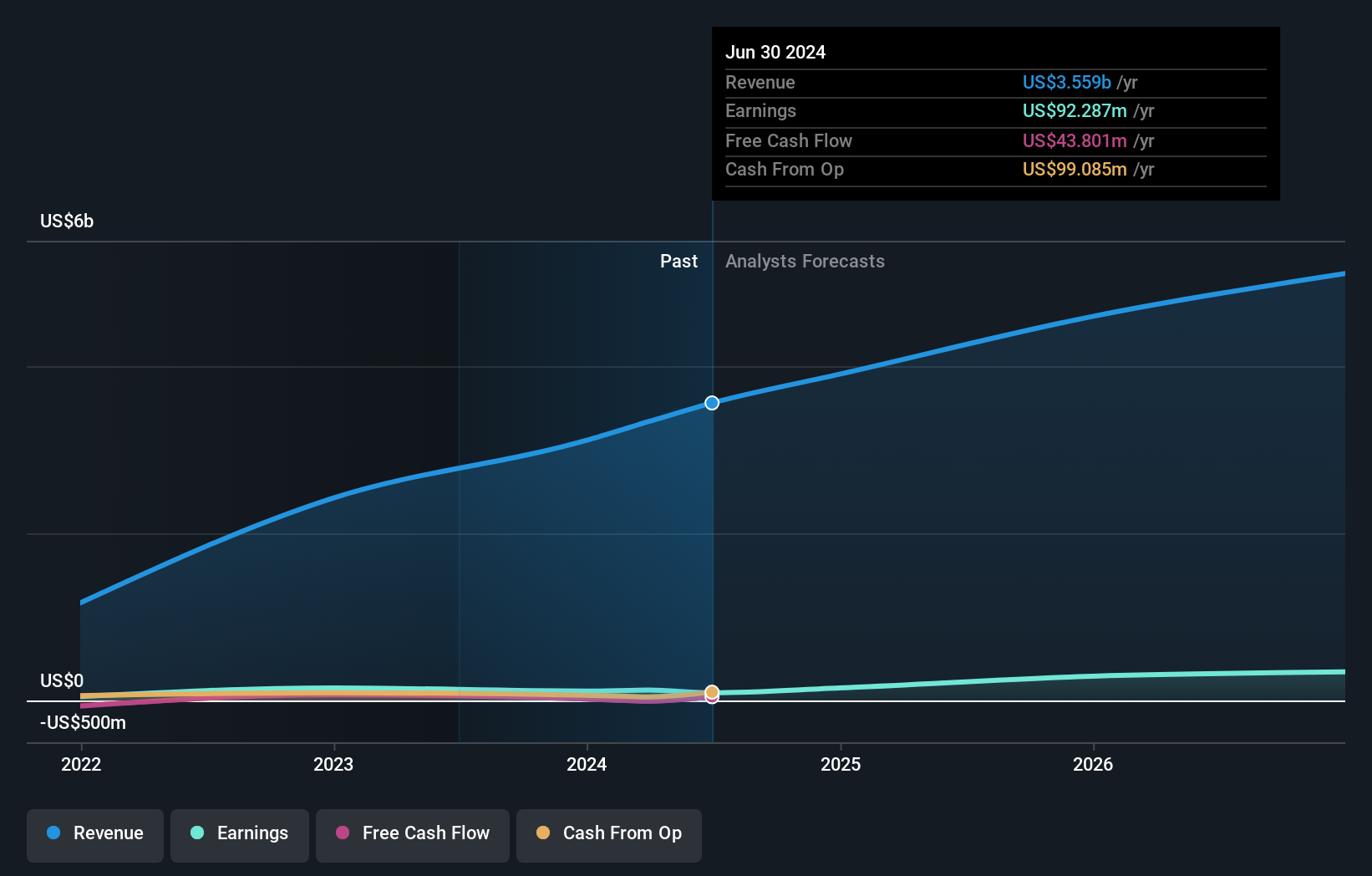

The PACS Group story has always revolved around balancing robust growth ambitions with the reality of high debt and tightening financial discipline. Before the recent forbearance agreement and delayed 10-Q filing, the catalysts most investors cared about included expected rapid earnings growth, the impact of new acquisitions, and improved operational scale from index additions. However, the latest news around technical defaults and repeated filing delays make financial and legal risks unavoidable in the near term. Questions about internal controls and credit relationships now take priority over expansion headlines or valuation gaps. While past analyst forecasts suggested significant upside, this uncertainty puts those expectations into question, shifting the spotlight to how quickly PACS can restore lender and market confidence. For anyone considering the stock now, the focus should shift from growth alone to a clear timeline for resolving these risks.

Yet, financial discipline matters more than ever when technical defaults are in play.

Exploring Other Perspectives

Explore another fair value estimate on PACS Group - why the stock might be worth just $30.50!

Build Your Own PACS Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACS Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PACS Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACS Group's overall financial health at a glance.

No Opportunity In PACS Group?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 27 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PACS

PACS Group

Through its subsidiaries, operates skilled nursing facilities and assisted living facilities in the United States.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives