- United States

- /

- Medical Equipment

- /

- NYSE:NVST

Will Declining Earnings and Profit Pressures Change Envista Holdings' (NVST) Investment Narrative?

Reviewed by Sasha Jovanovic

- Recent reports indicate that Envista Holdings is facing declining earnings and underwhelming operational performance, with a 12% drop in EBIT over the past year and concerns about negative returns on invested capital.

- Despite managing debt with a net debt to EBITDA ratio of 1.1, ongoing profit pressures and weak revenue growth have prompted caution over the sustainability of Envista's current debt levels.

- With management effectiveness now in question, we'll explore how concerns about declining earnings impact Envista Holdings' investment narrative.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Envista Holdings Investment Narrative Recap

For investors to remain confident in Envista Holdings, there needs to be belief in the company’s ability to restore earnings momentum and maintain operational discipline as it balances innovation in dental care with ongoing margin pressures. The recent news of a 12% drop in EBIT and stagnant returns on invested capital raises new concerns, especially as the sustainability of current debt levels becomes more uncertain, even though the impact on near-term catalysts, such as digital dentistry growth and broader international expansion, remains limited for now.

Among the latest announcements, Envista’s upward revision of its 2025 core sales guidance to 3%-4%, following Q2 results, stands out for its relevance. This signals some ongoing confidence in topline trends, but the new financial headwinds prompt closer scrutiny of whether operational gains can outweigh margin risks in the year ahead.

Yet, even with apparent progress, investors should pay attention to the risk that ongoing negative returns on capital pose to Envista’s…

Read the full narrative on Envista Holdings (it's free!)

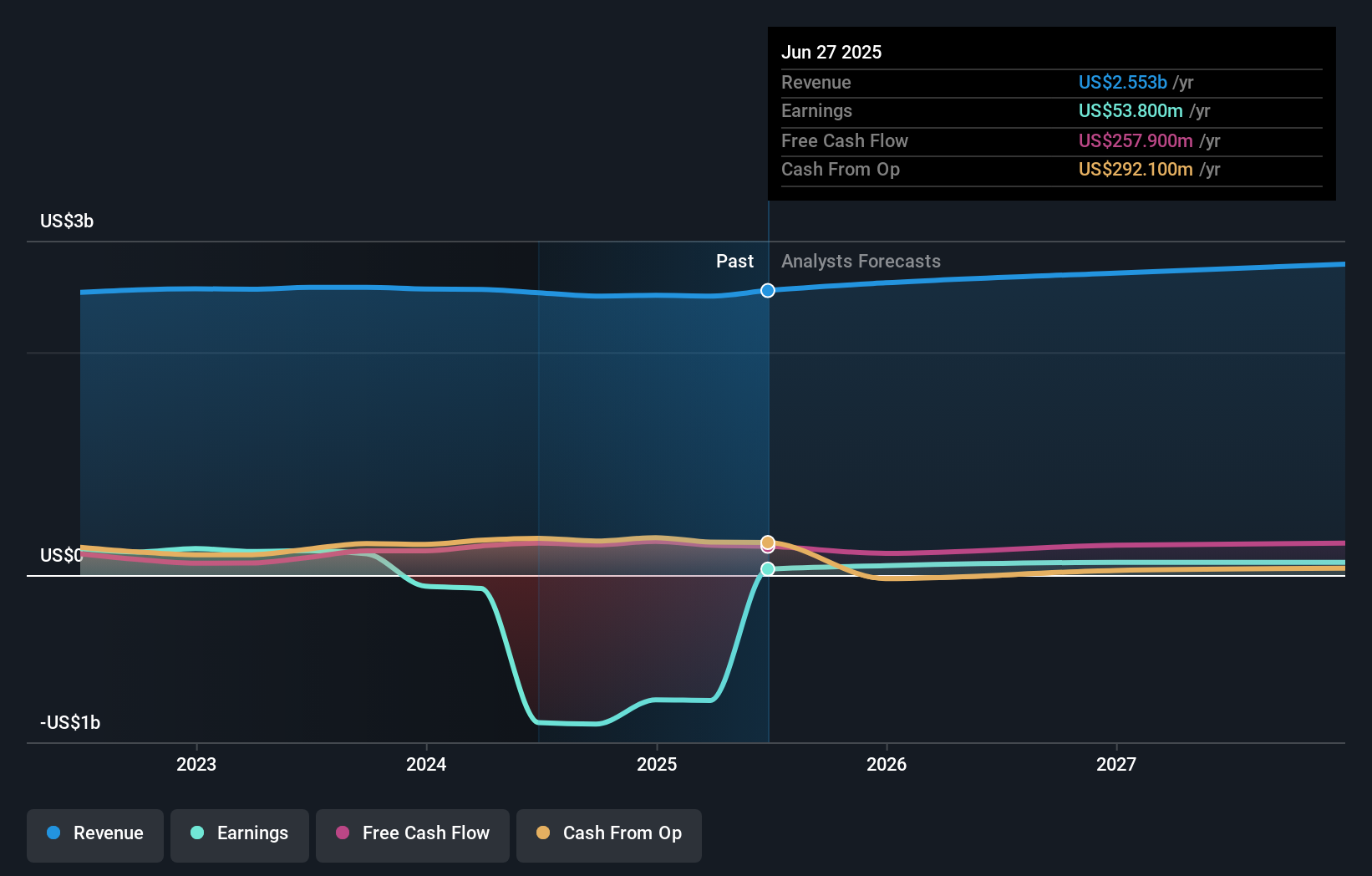

Envista Holdings is forecast to reach $2.8 billion in revenue and $144.7 million in earnings by 2028. This outlook assumes annual revenue growth of 3.6% and a $90.9 million increase in earnings from the current $53.8 million.

Uncover how Envista Holdings' forecasts yield a $21.42 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members arrived at fair value estimates for Envista ranging from US$21.42 to US$25.51, based on just two unique analyses. With recent earnings pressure and returns on capital under question, be aware opinions on the business outlook can diverge widely.

Explore 2 other fair value estimates on Envista Holdings - why the stock might be worth as much as 25% more than the current price!

Build Your Own Envista Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Envista Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Envista Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Envista Holdings' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envista Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVST

Envista Holdings

Develops, manufactures, markets, and sells dental products in the United States, China, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives