- United States

- /

- Medical Equipment

- /

- OTCPK:IVCR.Q

Increases to CEO Compensation Might Be Put On Hold For Now at Invacare Corporation (NYSE:IVC)

In the past three years, the share price of Invacare Corporation (NYSE:IVC) has struggled to grow and now shareholders are sitting on a loss. What is concerning is that despite positive EPS growth, the share price has not tracked the trend in fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 20 May 2021. They could also try to influence management and firm direction through voting on resolutions such as executive remuneration and other company matters. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

Check out our latest analysis for Invacare

Comparing Invacare Corporation's CEO Compensation With the industry

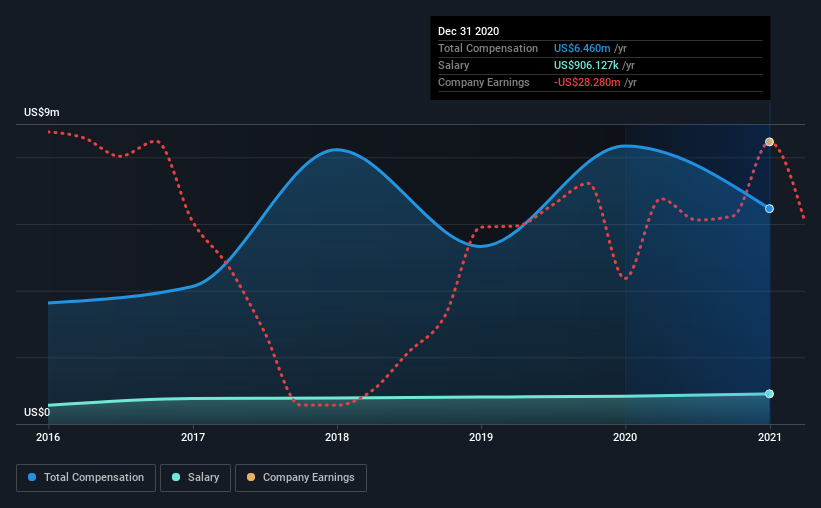

Our data indicates that Invacare Corporation has a market capitalization of US$298m, and total annual CEO compensation was reported as US$6.5m for the year to December 2020. We note that's a decrease of 23% compared to last year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at US$906k.

On comparing similar companies from the same industry with market caps ranging from US$100m to US$400m, we found that the median CEO total compensation was US$1.0m. This suggests that Matt Monaghan is paid more than the median for the industry. Moreover, Matt Monaghan also holds US$9.3m worth of Invacare stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$906k | US$835k | 14% |

| Other | US$5.6m | US$7.5m | 86% |

| Total Compensation | US$6.5m | US$8.3m | 100% |

Speaking on an industry level, nearly 20% of total compensation represents salary, while the remainder of 80% is other remuneration. Invacare sets aside a smaller share of compensation for salary, in comparison to the overall industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Invacare Corporation's Growth Numbers

Over the past three years, Invacare Corporation has seen its earnings per share (EPS) grow by 23% per year. Its revenue is down 10% over the previous year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. While it would be good to see revenue growth, profits matter more in the end. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Invacare Corporation Been A Good Investment?

With a total shareholder return of -50% over three years, Invacare Corporation shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for Invacare that investors should be aware of in a dynamic business environment.

Important note: Invacare is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you’re looking to trade Invacare, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About OTCPK:IVCR.Q

Invacare

Invacare Corporation, together with its subsidiaries, designs, manufactures, distributes, and exports medical equipment for use in home health care, retail, and extended care markets worldwide.

Slightly overvalued with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives