- United States

- /

- Medical Equipment

- /

- NYSE:ITGR

Integer Holdings (ITGR): A Fresh Look at Valuation After Subtle Share Price Uptick

Reviewed by Kshitija Bhandaru

Integer Holdings (ITGR) recently caught the attention of investors after its shares moved up by nearly 2% in a single session, drawing interest in the company’s latest performance and ongoing business trajectory.

See our latest analysis for Integer Holdings.

After a steady day, Integer Holdings’ 1-year total shareholder return is just about flat, reflecting muted momentum despite a few notable business updates this year. While the latest session saw a slight share price uptick, overall performance remains fairly range-bound for now as the market looks for stronger growth signals or shifts in risk perception.

If today’s subtle move has you curious about what else is out there, it might be a good time to broaden your search and discover See the full list for free.

With shares still trading well below analyst targets, investors may wonder if Integer Holdings is currently undervalued or if the stock’s muted run means markets have already priced in all the future growth. Could this be a buying opportunity?

Most Popular Narrative: 25% Undervalued

With Integer Holdings trading at $105.04, but the most widely followed narrative setting a fair value near $141, the story is all about future expectations overtaking current reality. The sizable price gap hints at confidence in the company’s ability to deliver on bold growth forecasts. Let's see what’s driving that optimism below.

Ongoing investments in manufacturing automation and operational excellence initiatives are yielding sequential gross and operating margin improvements, with expectations for further quarterly expansion through the year, underpinning continued net margin and earnings growth. Enhanced strategic partnerships and long-term contracts with leading OEMs, covering approximately 70% of business, provide stable, visible demand and improved pricing power, supporting consistent earnings and reducing revenue volatility.

What’s the story behind this high valuation? The core of the narrative is a sharp transformation in profit margins and locked-in demand, all projected to fuel a multi-year earnings surge. Want to know which bold assumptions could push Integer’s future profits far beyond today’s levels, or if this optimism hides big surprises? Only the full narrative reveals how these quantitative projections shape the fair value.

Result: Fair Value of $140.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sudden changes in customer demand or losses of major contracts could quickly challenge these positive growth projections and shake confidence in Integer’s outlook.

Find out about the key risks to this Integer Holdings narrative.

Another View: Is the Market Paying Too Much?

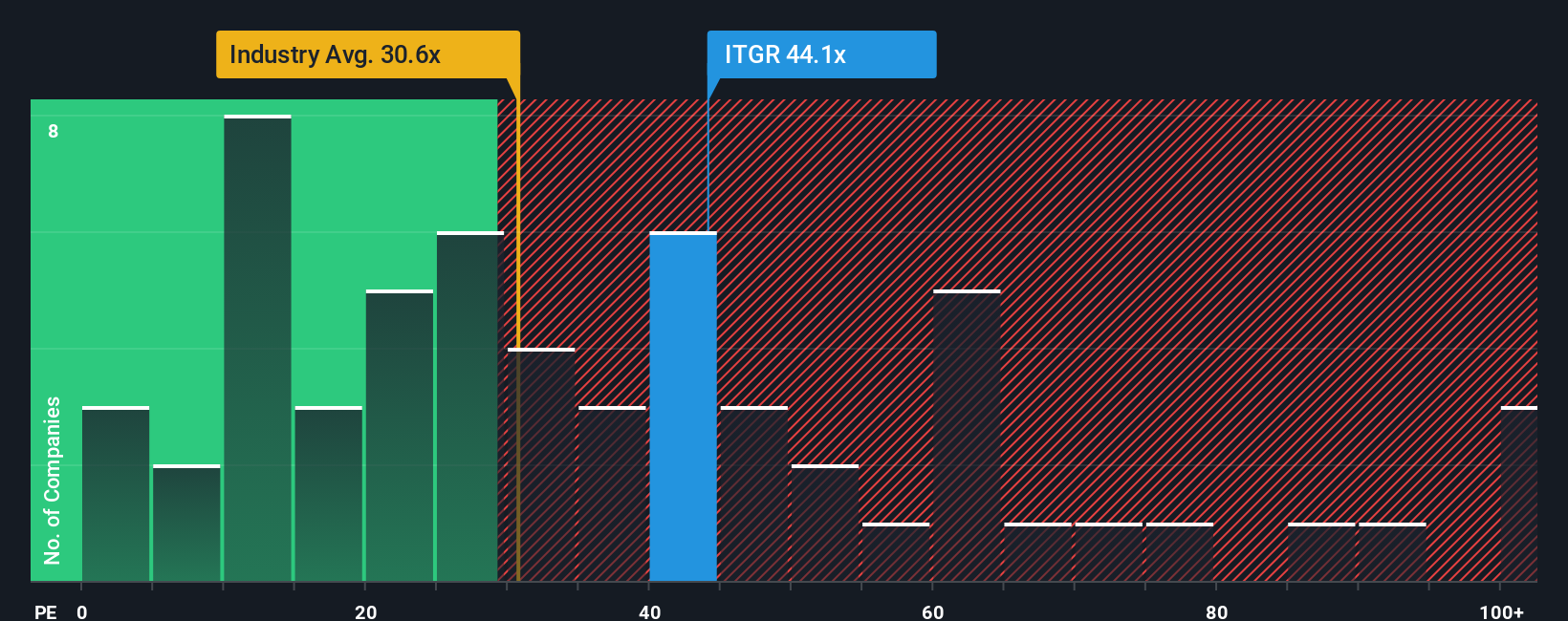

Switching the lens from future profits to current prices, Integer Holdings looks expensive. Its price-to-earnings ratio is at 43.9 times, much higher than both the US Medical Equipment industry average of 31.1 and the peer average of 37.6. The fair ratio stands at just 35.7. This gap signals investors are paying a steep premium for growth that has not shown up yet. Does this raise the risk that expectations are outpacing reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Integer Holdings Narrative

If you see the numbers differently or want to develop your own perspective, it only takes a few minutes to shape your own Integer Holdings outlook. Why not Do it your way?

A great starting point for your Integer Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want more opportunities on your radar, don’t wait for the next headline. Make smarter moves by checking out screens packed with market standouts below.

- Power up your portfolio and spot gains with these 896 undervalued stocks based on cash flows based on strong cash flow metrics that are often overlooked by most investors.

- Tap into the potential of tomorrow’s tech leaders by running through these 24 AI penny stocks featuring companies at the forefront of artificial intelligence innovation.

- Secure recurring income streams by checking out these 19 dividend stocks with yields > 3% offering yields above 3% for cash flow-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ITGR

Integer Holdings

Operates as a medical device contract development and manufacturing company in the United States, Puerto Rico, Costa Rica, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives