- United States

- /

- Pharma

- /

- NasdaqGM:LGND

November 2025's Top Stocks Priced Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a challenging landscape with tech stocks under pressure and major indices experiencing significant losses, investors are keenly observing economic indicators like labor market data and Federal Reserve interest rate decisions. In this environment, identifying undervalued stocks becomes crucial as they may offer potential opportunities for growth amidst broader market volatility.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Super Group (SGHC) (SGHC) | $11.75 | $22.95 | 48.8% |

| Old National Bancorp (ONB) | $20.59 | $40.90 | 49.7% |

| Oddity Tech (ODD) | $39.96 | $79.51 | 49.7% |

| MoneyHero (MNY) | $1.23 | $2.42 | 49.1% |

| Huntington Bancshares (HBAN) | $15.42 | $30.83 | 50% |

| Genius Sports (GENI) | $10.21 | $20.14 | 49.3% |

| First Busey (BUSE) | $22.76 | $45.34 | 49.8% |

| Corpay (CPAY) | $278.00 | $544.18 | 48.9% |

| Caris Life Sciences (CAI) | $24.61 | $48.22 | 49% |

| AbbVie (ABBV) | $219.04 | $434.82 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

Ligand Pharmaceuticals (LGND)

Overview: Ligand Pharmaceuticals Incorporated is a biopharmaceutical company that develops and licenses biopharmaceutical assets globally, with a market cap of approximately $4.06 billion.

Operations: Unfortunately, the provided text does not contain specific information about Ligand Pharmaceuticals' revenue segments. Therefore, I am unable to summarize them without additional data.

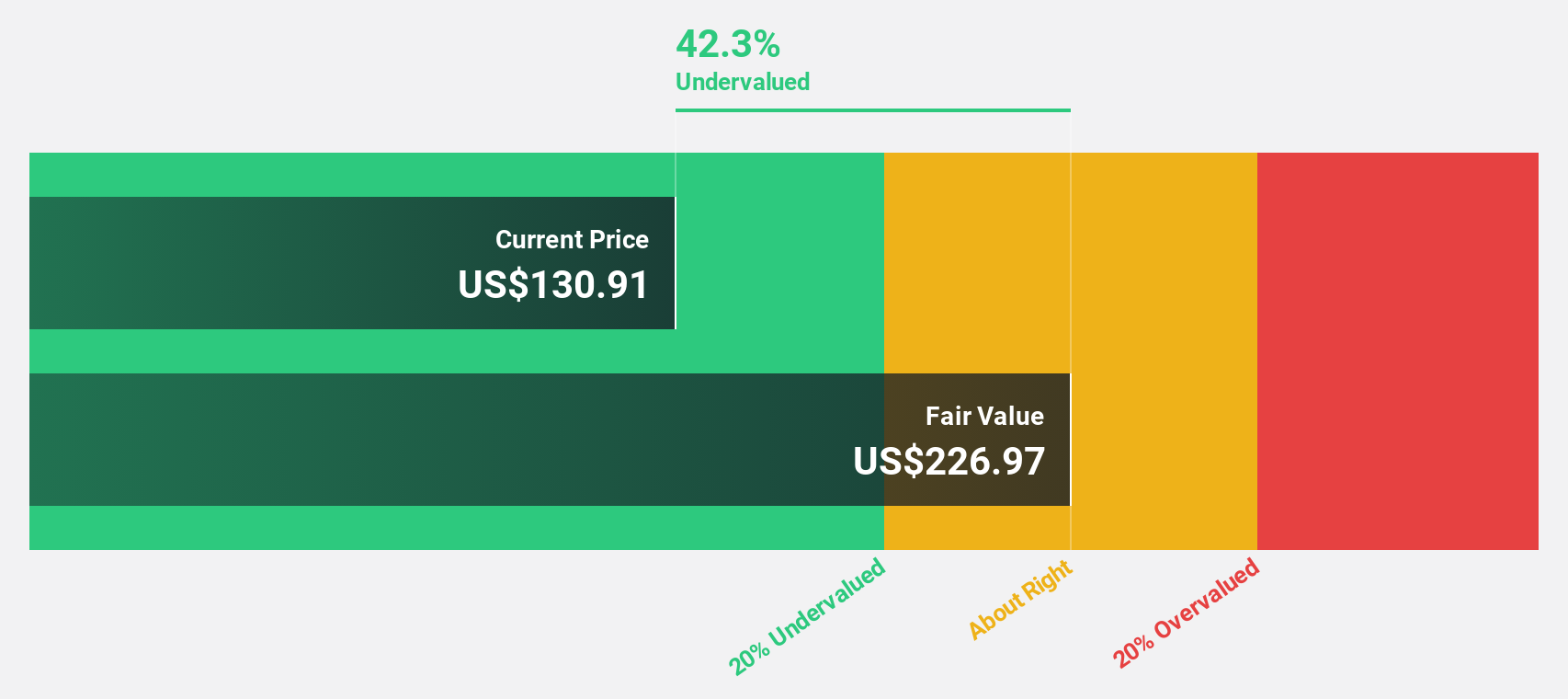

Estimated Discount To Fair Value: 28.6%

Ligand Pharmaceuticals is trading at US$208.22, significantly below its estimated fair value of US$291.45, presenting a potential undervaluation based on discounted cash flow analysis. The company's recent earnings report shows substantial revenue growth to US$115.46 million for Q3 2025, up from US$51.81 million a year ago, with net income reaching US$117.27 million compared to a prior net loss. Additionally, Ligand has raised its full-year revenue guidance, indicating strong financial momentum.

- Our comprehensive growth report raises the possibility that Ligand Pharmaceuticals is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Ligand Pharmaceuticals.

SolarEdge Technologies (SEDG)

Overview: SolarEdge Technologies, Inc. designs, develops, manufactures, and sells DC optimized inverter systems for solar PV installations globally and has a market cap of approximately $2.44 billion.

Operations: SolarEdge Technologies generates revenue from the design, development, manufacture, and sale of DC optimized inverter systems for solar photovoltaic installations across various international markets including the United States and Europe.

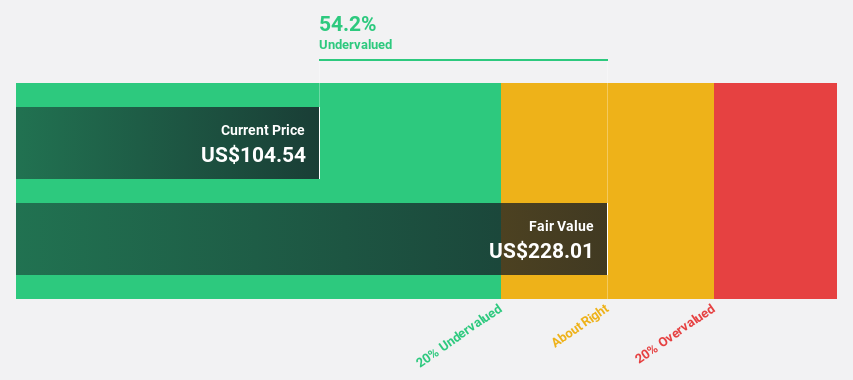

Estimated Discount To Fair Value: 47.3%

SolarEdge Technologies is trading at US$38.88, well below its estimated fair value of US$73.76, indicating a potential undervaluation based on discounted cash flow analysis. Despite recent net losses, the company reported significant revenue growth to US$340.18 million in Q3 2025 from US$235.44 million a year ago and continues to expand its Virtual Power Plant programs across multiple states and territories. Recent collaborations aim to enhance efficiency in AI data centers, supporting future profitability prospects.

- According our earnings growth report, there's an indication that SolarEdge Technologies might be ready to expand.

- Navigate through the intricacies of SolarEdge Technologies with our comprehensive financial health report here.

Inspire Medical Systems (INSP)

Overview: Inspire Medical Systems, Inc. is a medical technology company that develops and commercializes minimally invasive solutions for obstructive sleep apnea (OSA) patients globally, with a market cap of approximately $2.41 billion.

Operations: The company's revenue segment consists of Patient Monitoring Equipment, generating $882.62 million.

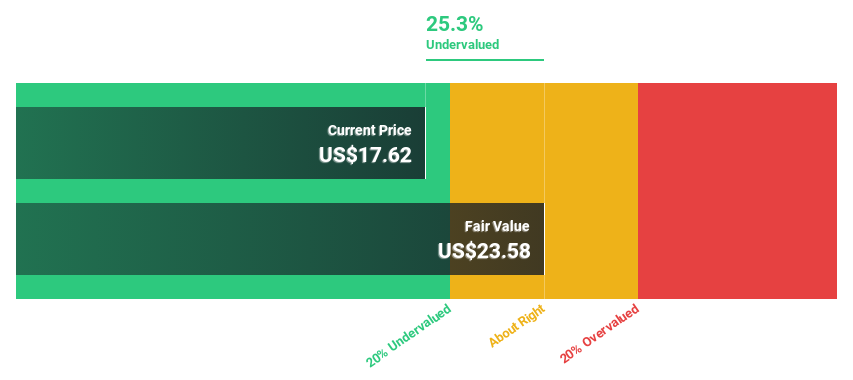

Estimated Discount To Fair Value: 35.3%

Inspire Medical Systems, trading at US$83.81, is significantly undervalued compared to its estimated fair value of US$129.62, based on discounted cash flow analysis. Despite a forecasted earnings growth of 25.67% annually, recent legal challenges and insider selling may affect investor sentiment. The company's Q3 2025 revenue increased to US$224.5 million from the previous year but net income fell sharply due to issues with their new Inspire V device launch, impacting market confidence and reducing earnings guidance by over 80%.

- The growth report we've compiled suggests that Inspire Medical Systems' future prospects could be on the up.

- Dive into the specifics of Inspire Medical Systems here with our thorough financial health report.

Key Takeaways

- Dive into all 180 of the Undervalued US Stocks Based On Cash Flows we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:LGND

Ligand Pharmaceuticals

A biopharmaceutical company, develops and licenses biopharmaceutical assets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives